FAQs

How can procurement teams reduce price and supply risks now?

By leveraging IOSCO-assured price benchmarks, comprehensive historical pricing data, and Expana’s predictive forecasting tools to negotiate contracts and time purchases strategically.

Which commodity markets are most vulnerable?

Energy and LNG markets, soybean oil, grains, feed additives, skim milk powder, and energy-intensive manufacturing sectors like plastics and glass.

How long will commodity prices be affected by the Middle East conflict?

The duration depends on how long the Middle East conflict persists and the extended logistics impacts. Even after resolution, supply chain disruptions can last several months.

What is the IOSCO compliant methodology?

IOSCO compliance requires an independent, third-party audit, a comprehensive assurance report and ongoing, consistent compliance. You can find our IOSCO Assurance Report, available here covering:

- Our methodology, systems, and policies

- How we engage with the industry, handle complaints and defend our assessments

- Our rigorous and secure record-keeping

- Expana’s application of its assessment methodology in every assessment it prepares

What does IOSCO assurance mean?

IOSCO assurance refers to the independent verification of financial information against global standards. Assurance aims to boost investor confidence by ensuring the reliability and transparency of information provided to the market.

What is the purpose of IOSCO?

IOSCO regulations are designed to enhance investor protection, ensure markets are fair and efficient, and promote financial stability.

Whats is IOSCO?

The International Organization of Securities Commissions (IOSCO) is the global standard for financial markets regulations.

What are Watchlists and how can I build one?

What should I do when I first visit Expana?

When will my access to the Mintec platform be discontinued?

Mintec will soon be discontinued for all users, following a personalized timeline based on your transition date – typically within a month. You will be notified by email before your access ends. For updates, questions, or feedback, please stay in touch with your Expana account team.

Why is Mintec’s platform being retired?

We’ll be retiring the Mintec platform to give you access to a more powerful experience with Expana. Built from the ground up, Expana combines the best of our legacy platforms – Mintec, Urner Barry, Tropical Research Services, Stratégie Grains and FeedInfo – into one unified solution. It delivers broader data coverage, smarter features and advanced Dashboarding and Cost Modelling tools that simply weren’t possible on the older platforms. You will be given a few weeks’ notice before we turn off the Mintec platform.

How do I get access to the Expana platform?

Mintec users will be migrated to the new Expana platform with notice provided to the user/s via email and on calls with your usual contact in advance. Once notified, go to the platform login page. If you have any problems, get in touch with your usual contact (Key Account Manager or Client Success Executive), or alternatively contact us [email protected].

I’m looking for Market Data > China Exports – where is it?

In Expana platform the same information that was available in FeedInfo platform can be found under Prices & forecasts, however in a different format; the data is available as individual time series which can be charted and exported to Excel (if required).

What will happen to my FeedInfo daily newsletter email?

You will still receive this email, and it will contain the same insightful news content in the new Expana style and branding. Upon migration to the Expana platform users will be switched over to the new-look Expana newsletter. When you click on an article to read more, you’ll be directed to the article in the Expana platform.

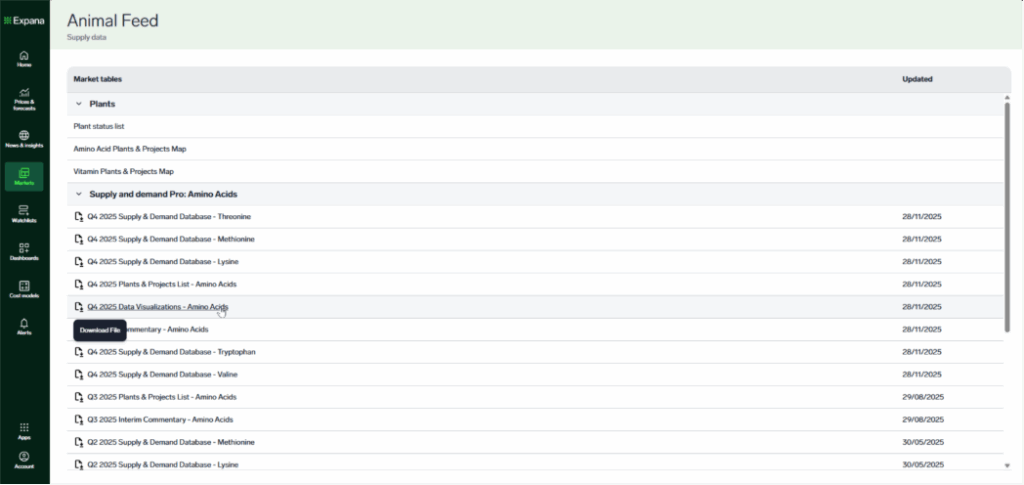

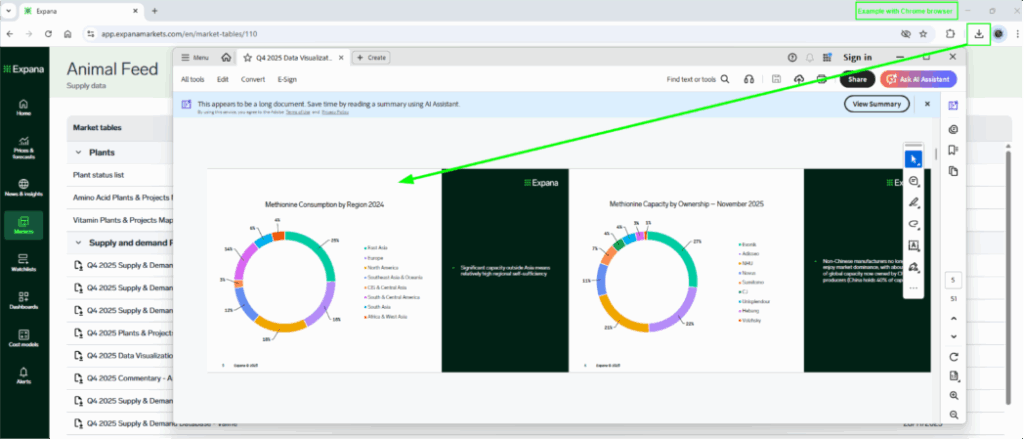

Do I have access to Supply & Demand Pro?

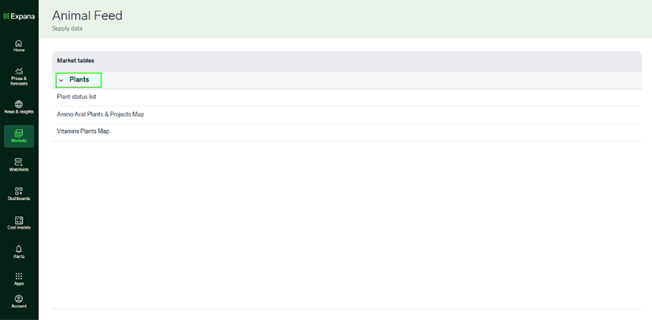

If your organisation subscribes to this service then it is included in your Expana platform access – look under Markets > Animal Feed to find the same data, summaries and data visualisations.

If your organisation does not currently subscribe to Supply & Demand Pro then, as part of your migration, you have temporary access to Supply & Demand Pro in Expana under Markets > Animal Feed. Your trial access runs until the latest version of Fundamentals becomes available. After that, you’ll have the option to upgrade.

Watch the video to learn how to navigate to Supply & Demand Pro in Expana:

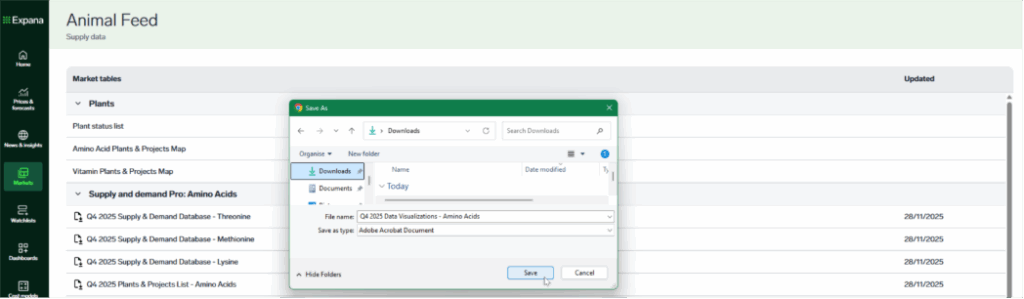

Or follow the instructions below:

- Visit Markets > Animal Feed and see all files available under either Supply and demand Pro: Amino Acids or Supply and demand Pro: Vitamins

- Select the file you wish to download

- Save it to your preferred location

- View the file as usual

What are the differences between News and Insights (under News & insights module)?

In Expana platform, FeedInfo users will be provided with access to the News & insights module, however the access to content within that module will be dependent on your organisation’s subscription.

News

Will contain short articles which relate to our benchmark price (EBP) offering. You’ll also see these alongside a price chart if you view via Prices & forecasts, e.g. for Methionine Solid DDP NW Europe:

You will note that articles are tagged with either ‘commentary’, ‘news’ or ‘analysis’.

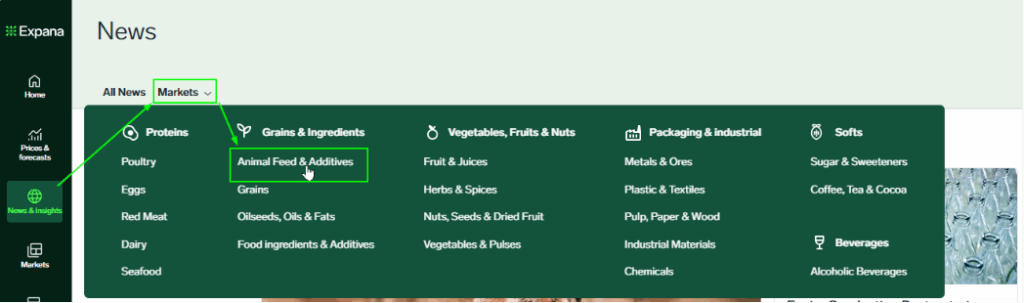

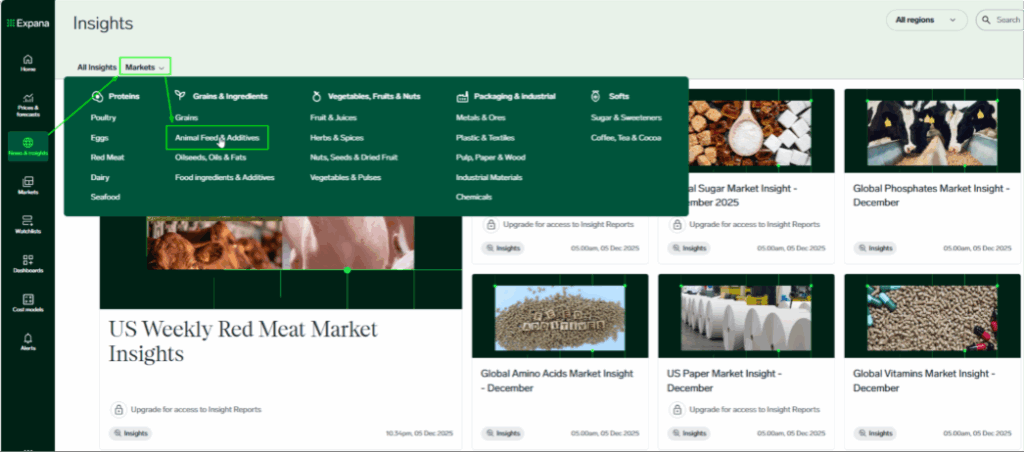

Back in the News section, you can select by category to narrow down what is shown:

Insights

Will contain something new for FeedInfo users; long-form PDF reports for the categories available to FeedInfo subscribers, including monthly market insight reports for Global Amino Acids, Global Vitamins, Global Minerals and Aquafeed.

Plus, monthly market insights for: Base metals, Steel, Sustainable Packaging Materials and Global and regional Packaging materials.

These reports will combine existing news and commentary insights together with supply and demand analysis by our expert market reporters, an indication of market sentiment for the reporting month and provide a deeper analysis to benefit platform users.

Once a user clicks into the Insights section, you can select by category to narrow down what is shown:

Anything not included in your company’s subscription will show a padlock symbol and you can speak to your Client Success Team via [email protected] to find out more.

Does the Expana Data Direct API provide data beyond pricing?

Yes. In addition to pricing, the API includes production figures, export/import statistics, economic indicators, forecasts, and proprietary market news and commentary.

Can I request pricing data in different currencies or units?

Absolutely. The Expana API includes built-in conversion features for currencies, units, and frequencies, allowing you to retrieve data in the format that best suits your needs.

How often is the data in the Expana Data Direct API updated?

Update frequency varies by series – daily, weekly, monthly, quarterly, semi-annually, or annually – so you receive the most relevant and timely information depending on the dataset.

Where can I find the Expana Data Direct API documentation?

Simply request access on this page and a member of our sales team will provide the full technical documentation, including the data model, available endpoints, and example usage.

How easy is it to integrate the Expana Data Direct API with my systems?

The Expana API is a standard RESTful API designed for seamless integration with any system that supports REST. Its simple, intuitive structure makes connecting and customizing the API to fit your data platform quick and hassle-free.

How do I build my first Watchlist?

What is the difference between Expana and Feedinfo?

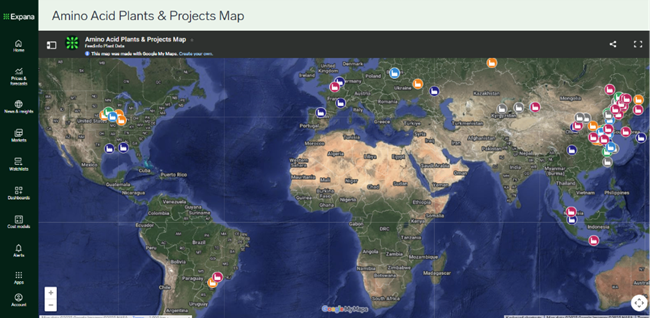

I’m looking for Market Data > Plant Maps – where is it?

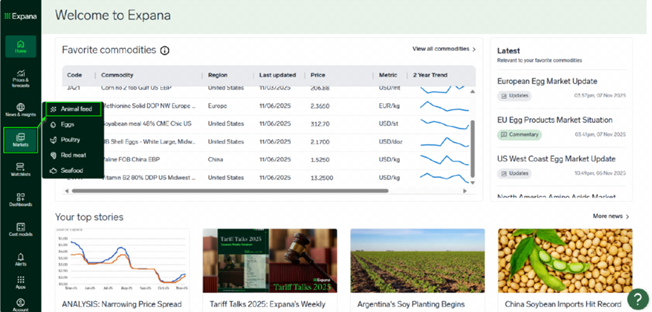

In Expana platform this information can be found under Markets > Animal Feed. You’ll see information presented as a list with collapsible sections, and can click into e.g. Plants > Amino Acid Plants & Projects Map to find the same information as is available in FeedInfo platform.

1.

2.

3.