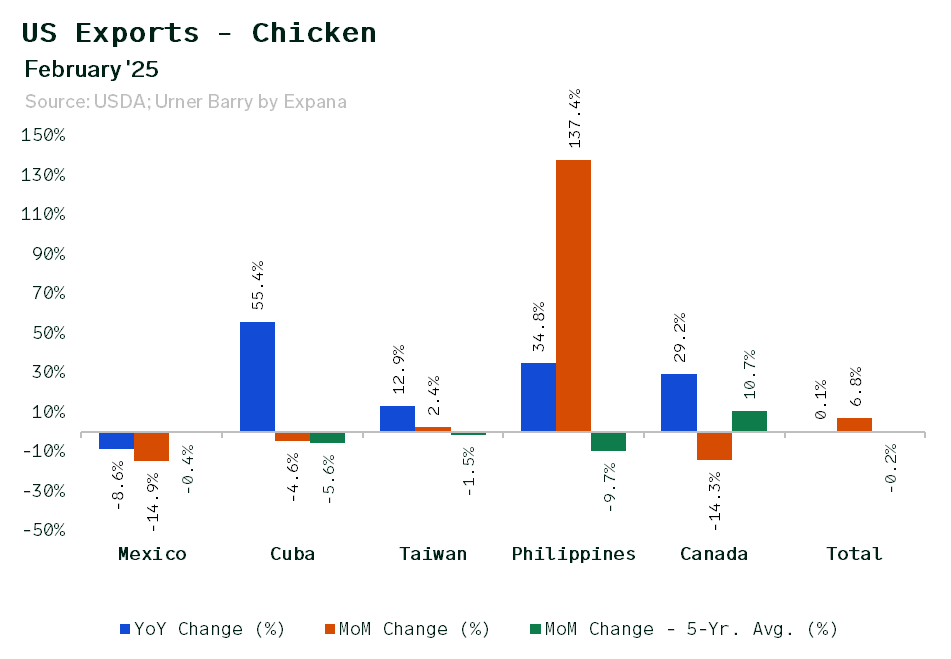

Total U.S. broiler exports were up both year-over-year (YoY) and month-over-month (MoM) in February, despite a 5-year average MoM decrease. Three of the top five export destinations purchased more MoM compared to the average or they didn’t decrease their purchasing as much as on average. These countries were Cuba, Taiwan, and the Philippines. There are a couple of different factors that may have been major influences in this shift: The fears about HPAI (Bird Flu) cases, and the uncertainty that those in the chicken market faced in the shifting political landscape.

Concerns surrounding increased HPAI may have led to preemptive trade. Spring bird migration generally starts to peak in March and with it comes concerns of increased spread of HPAI. With broiler HPAI cases at all-time high levels in January and February, it’s no surprise that fears of widespread disease heightened as we approached March. It is suggested that some participants may have tried to move out production as quickly as possible in February to help minimize the chances of losing the ability to trade certain loads due to HPAI.

On the political-economic side, shifting U.S. policies might have dramatically impacted trade. Following the inauguration of President Trump at the end of January, concerns regarding the potential for reciprocal tariffs with a number of countries heightened. This may have led destinations like Cuba, Taiwan, and the Philippines to try to get ahead of the potential for tariffs and import additional production before any announcements could be made. On the other hand, Mexico and Canada’s importation of U.S. chicken decreased significantly MoM in comparison to the 5-year averages. These two countries started facing threats of tariffs in January, the first round of which was originally set to take place on February 1st. This likely led to hesitancy on the part of exporters to schedule any production for movement within February.

As we move through the year, it will be interesting to see how export values respond to these ever-changing dynamics. For a more in-depth analysis of our 2025 poultry outlook, our recent webinar is available to view on-demand now.

Co-authored by:

Dylan Hughes

Expana

1-732-240-5330 ext 286

[email protected]

Written by Elsi Rodewald