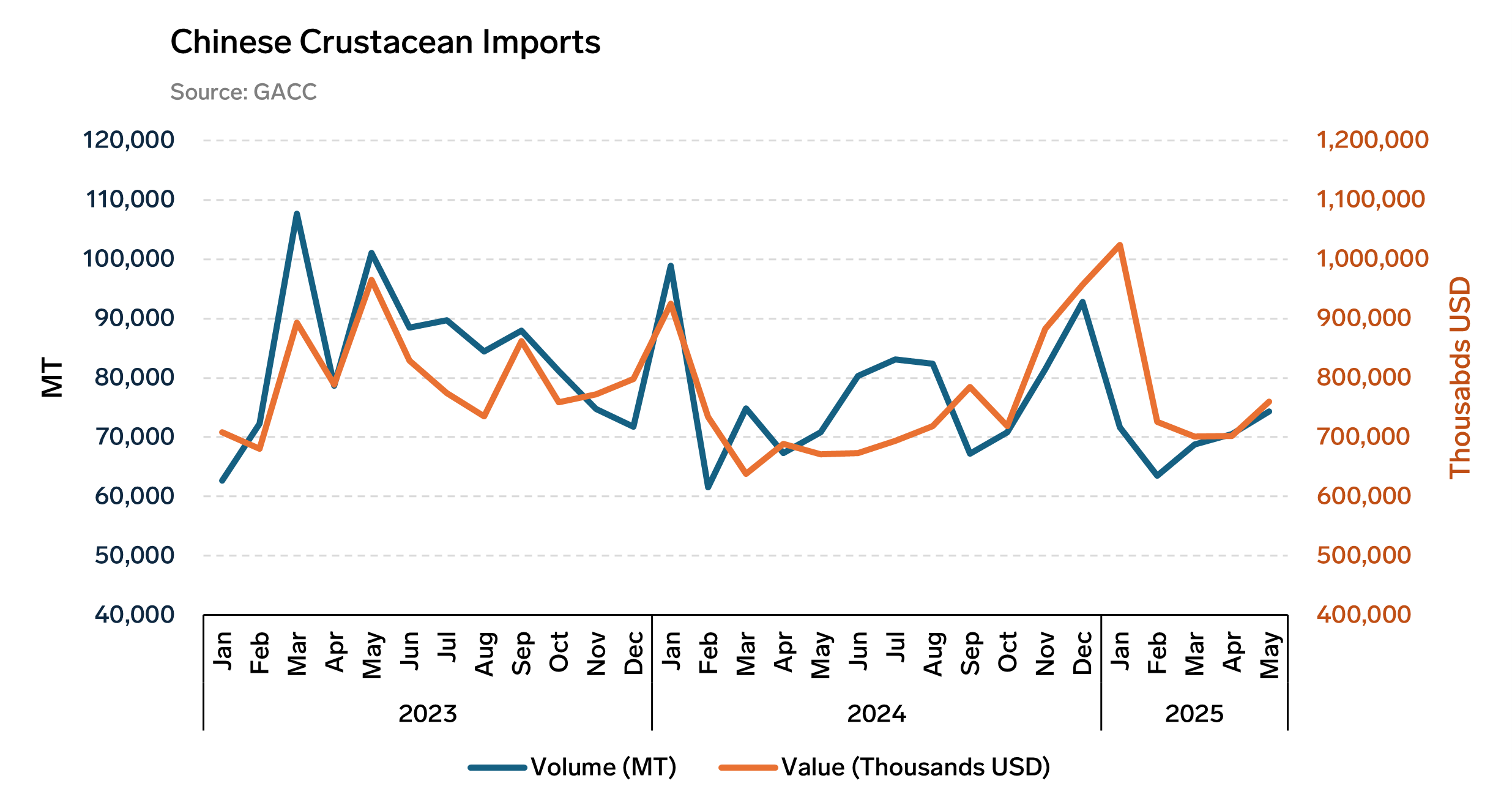

China’s General Administration of Customs (GACC) has released trade figures for May. China’s imports of crustaceans rose by 7.1% year-on-year in volume and by 13.3% in value, reaching 98,436 metric tons and 760.0 million USD. However, cumulative imports from January to May show a 2.2% decline in volume compared to the same period last year, while value increased by 7.0%.

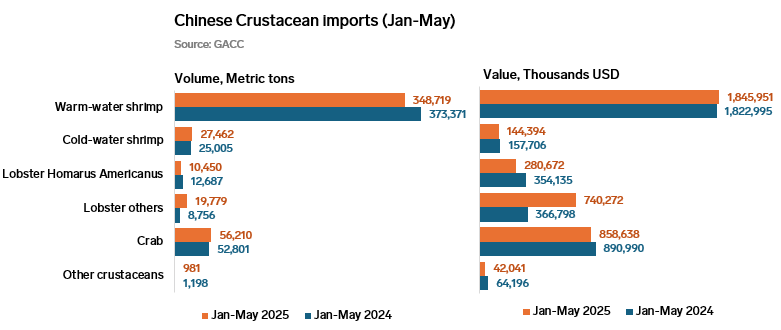

Shrimp remains by far the leading crustacean category. In May, shrimp accounted for 81% of total crustacean import volume, a share consistent with the year-to-date figure (Jan–May). This includes 76% warm-water shrimp (mainly Litopenaeus Vannamei, also called whiteleg shrimp) and 5% cold-water shrimp (mainly Pandalus borealis). In value terms, shrimp made up 53% of May’s total (50% for warm-water and 3% for cold-water shrimp) and 51% year-to-date (47% and 4%, respectively).

May imports of warm-water shrimp rose by 5.1% in volume, corresponding to a 9.6% increase in value. This follows a gradual month-on-month increase since February, resulting in a 17.2% growth in 3 months. Cold-water shrimp shows a dynamic change, with a 31.3% surge in volume and a 17.6% rise in value in May y-o-y. At 378.1 million USD according to GACC, May warm-water shrimp import value increased faster than in volume, reflecting higher unit values, while it declined for cold-water shrimp, suggesting softer pricing compared to last year. These observations are also noted in the cumulative Jan–May data.

Crab ranks second, comprising 14% of total crustacean import volume and 23% of value in May, closely aligning with year-to-date shares of 12% in volume and 22% in value. While value declined by 3.6% year-to-date, volume increased by 6.5%. May figures, however, show a strong rebound, with 14% year-on-year growth in volume and 17% in value, amounting to 13,364 metric tons imported during the month, for 177.3 million USD.

Lobster is the third major category. Year-to-date, lobster imports rose by 41.4% year-on-year. This category includes Homarus americanus (American lobster) and other species (mainly rock lobster, with smaller volumes of Norway lobster). Between January and May, China imported 10,450 MT of Homarus americanus and 19,779 MT of other lobster species, with the gap between the two categories even more pronounced in value. However, as Canada’s peak Homarus americanus fishing season falls in May and June, current proportions do not reflect the full-year balance. In May alone, imports of Homarus americanus declined by 34.3% year-on-year, while imports of other lobster species surged by 77.5%, with similar trends observed in value.

Overall, the Chinese crustacean market in May showed a rebound in demand and spending, particularly for shrimp and crab. However, persistent supply dynamics and price sensitivities—especially for premium products like Homarus americanus—are likely to influence import trends in the months ahead.

Image source: Getty

Written by Fabienne O'Donoghue