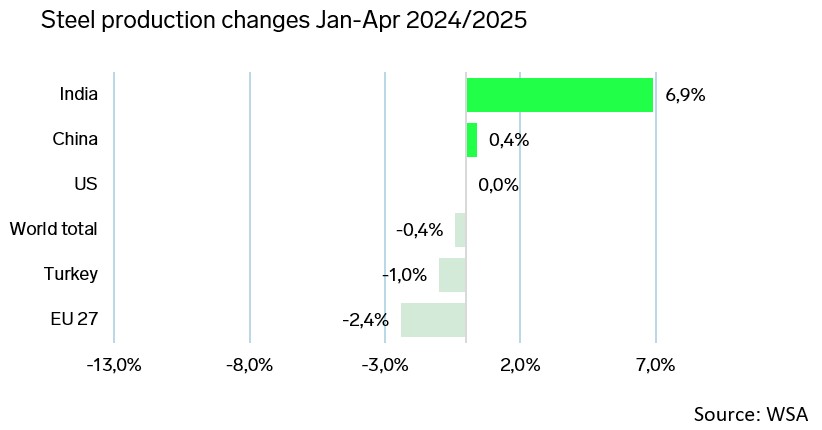

Despite the easing of tariff tensions in April, steel market prices in May show no recovery. In the US and Europe, hot rolled coil (HRC) prices have started to slowly decline m-o-m; in China, domestic prices have shown weak growth but remain at low levels, while export prices from China have declined by mid-May. This is due to oversupply, led by China, and to stagnation in key consuming sectors in the US and Europe.

In China, the situation in the steel market remains volatile. In March, steel production was 92.84 million tonnes, up 4.6% y-o-y, but this surge only resulted in a steel glut in the market. As a result, volumes in April were down 7% m-o-m, remaining at the same level as last April. At the same time, China’s surplus production is being successfully exported, and for Q1 exports reached 27.43 million tonnes, up 6.3% y-o-y. The growth in exports of construction steel and semi-finished steel is particularly notable.

In the US, for the first four months, steel production was stable y-o-y, while steel product output was growing, as the US actively imported steel semi-finished products and produced steel products from them. Thus, total steel imports in the US in Q1 grew by 3% y-o-y, and imports of semi-finished steel products grew by 10% y-o-y. However, market sources say that demand has started to weaken as buyers have built up inventories and reduced purchases, and they do not see a fundamental growth in steel consumption in the country yet.

Domestic steel producers in the EU reduced steel production for the first four months by 2.4% y-o-y to balance the market. At the same time, imports of steel products were also declining, but similar to the US, imports of semi-finished products were growing. During Q1, the uncertainty provided by the threat of US tariffs and the possibility of retaliatory measures incentivized some buyers to hold off on placing import orders which might be affected by higher tariffs by the time they arrived, nudging some towards the domestic steel market instead. However, in May, market sources realised that the risks of tariffs were no longer the most important factor driving the market, at least in the short term. As a result, buyers are once again increasing purchases of imported steel, which is reflected in weaker prices for the EU steel market.

Written by Artem Segen