As the summer’s peak demand period winds down, the live lobster market faces an unexpected dynamic. Maine’s landings have been slow to gain momentum, resulting in supply that is tighter than anticipated. At the same time, both domestic and international demand have remained subdued. The absence of strong buyer interest—despite limited availability—has prompted market participants to question whether elevated price points, broader economic pressures, or shifting consumption patterns are dampening demand, a sharp departure from the robust activity typically seen during the height of the season.

Lobster Supply

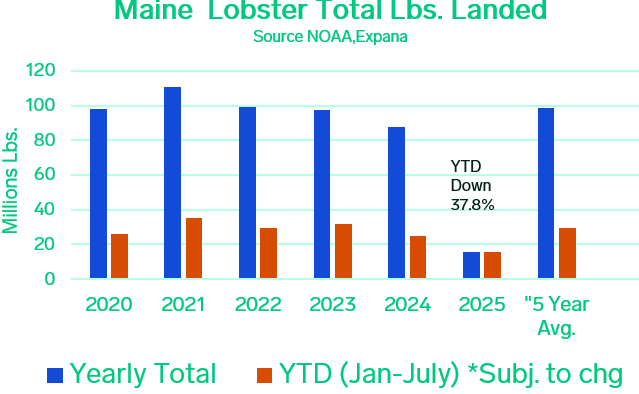

According to NOAA, year-to-date (January–July) Maine landings totaled 15.5 million pounds—down 37.8% from the same period in 2024 and marking the lowest YTD volume since at least 2012. The slow start is especially evident in June and July, where landings trailed last year’s volumes by 50.21%, highlighting a sluggish early summer harvest.

However, market participants report that catch levels have been gradually improving as the season progresses. With the industry now nearing the end of the peak summer demand window, attention is turning toward the potential for a stronger late-fall harvest. A well-timed uptick in landings could open the door for increased processing activity at more favorable price points, particularly if raw material becomes more readily available. Processors remain eager to replenish inventories of smaller tails and lobster meat—both of which continue to see steady demand—but have struggled to do so amid the earlier season’s limited supply.

Year-to-date, live lobster imports from Canada totaled 30 million pounds—down 5.4% from the same period last year. The bulk of the shortfall occurred in Q1, while imports surged in July, coinciding with peak Canadian production. This seasonal influx not only supported the live trade but also enabled processors to begin replenishing depleted inventory positions. Market sources indicate that many “tubbers” were able to secure substantial volumes during this window and are now holding relatively large inventories heading into the fall.

Lobster Demand

On the demand side, U.S. summer consumption has been softer than in past years, with slower foodservice traffic—particularly in coastal markets—keeping overall movement subdued. International demand has also underperformed, as buyers in China and Europe remain highly price-sensitive, cutting volumes or delaying shipments in response to elevated costs and weaker end-user pull. Year-to-date, live lobster exports are running 3% behind last year’s pace. This muted domestic and global appetite has added to market stagnation, leaving participants uncertain about near-term direction as the industry transitions out of the peak summer window.

Lobster Market Price

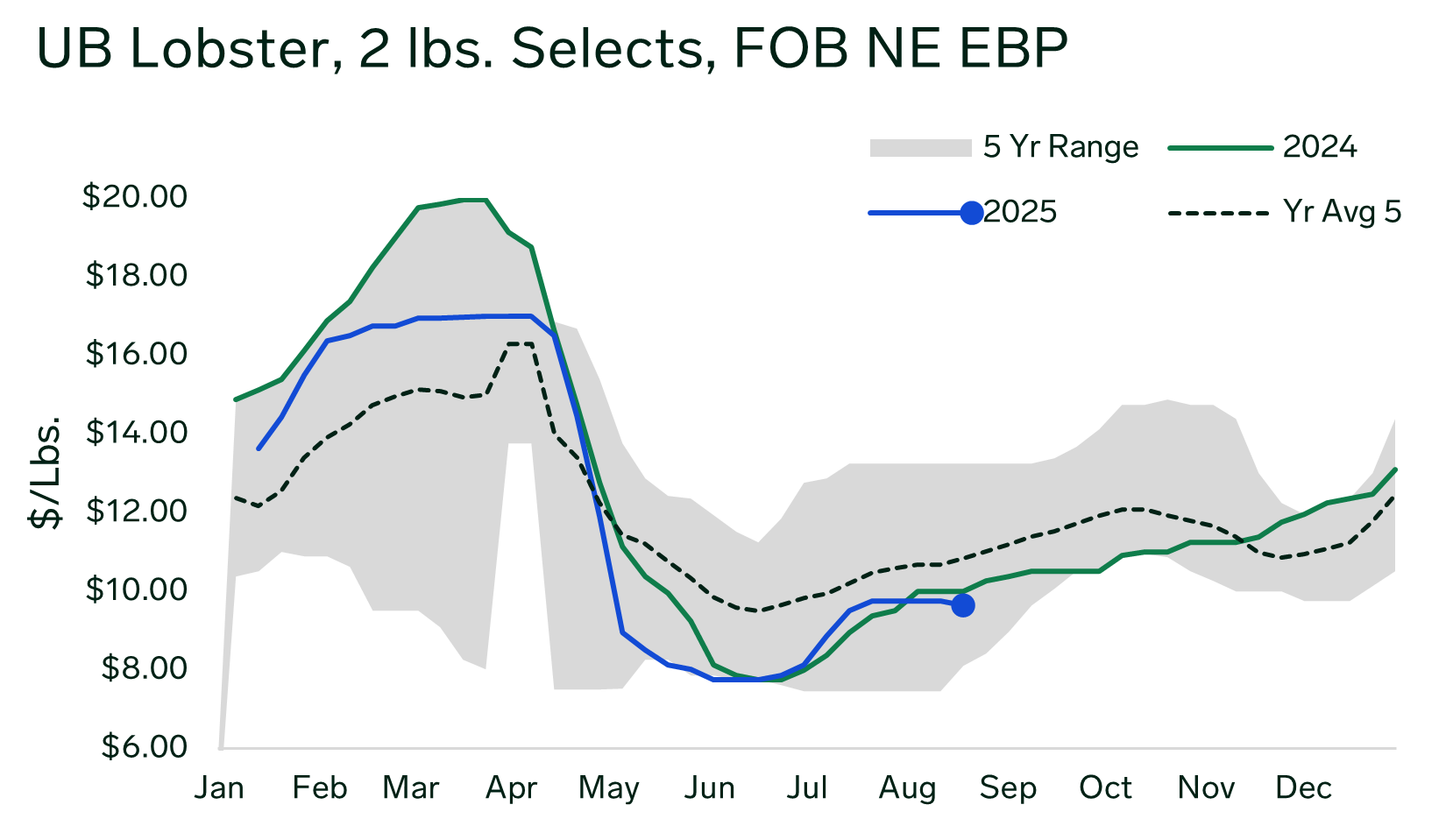

Market prices have held relatively steady but firm, supported by the perception of tight supply even as demand underperforms. Buyers who are active in the market are often purchasing cautiously, securing only what is necessary to cover near-term needs rather than building forward positions. One size category that has faced particular challenges this summer is selects. Strong offshore landings, combined with lackluster demand, have pressured sellers to move product at discounted price points. Currently, select prices are trading approximately 12% below their five-year average. In contrast, demand has remained firm for smaller sizes—chicks, quarters, and halves—helping to support more stable pricing in those segments.

Looking ahead, the focus turns to how demand will unfold through the fall and holiday period. The Chinese Mid-Autumn Festival, which falls later this year on October 6, typically supports increased movement in select lobster sizes. However, lingering concerns over China’s underperforming economy raise questions about whether sales will reach expected levels, especially with Canadian product still facing a 25% tariff. At the same time, supply will be fortified by the Canadian fall fishery, with openings beginning in October and followed by the industry’s largest producing LFA in November. The holiday season usually provides a secondary lift for exports, but if Chinese and European demand remains subdued, the market could enter Q4 with more balanced—or even softer—conditions than participants have grown accustomed to.

Image source: Shutterstock

Written by Liz Cuozzo