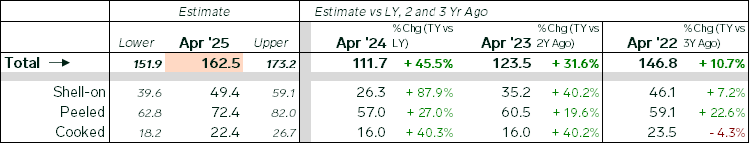

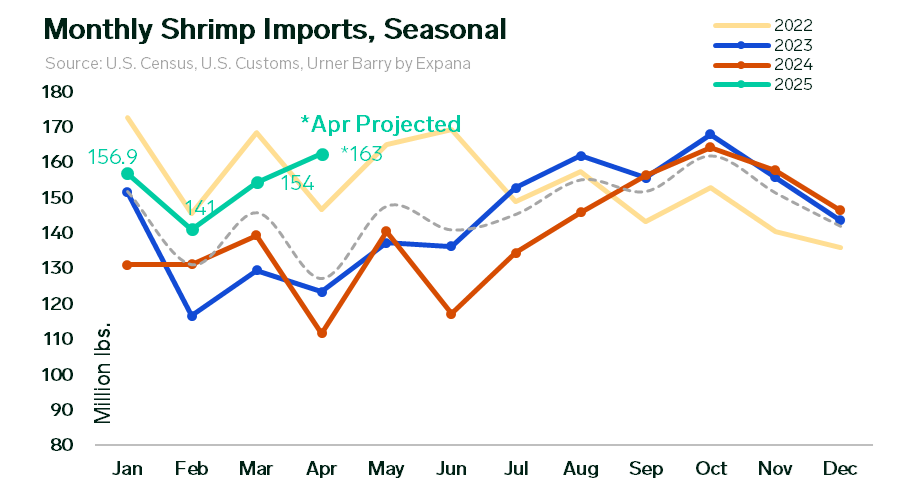

The US shrimp market remains in flux as April import estimates reveal substantial year-over-year growth, potentially creating inventory imbalances similar to those experienced in 2022. Based on current U.S. Customs data, our April projections indicate imports will reach approximately 162.5 million pounds, representing a remarkable 45.5% increase from the previous year (see table 2). But before diving into any conclusions, let us provide some context.

Key Factors Driving Shrimp Import Acceleration

Over recent months, U.S. importers have been aggressively purchasing product due to several converging factors. For example, low inventory levels in late 2024 initially triggered increased buying activity. Competition from other major markets such as China and Europe also intensified procurement efforts. Concerns about a potential January port strike and the looming threat of tariff increases then further accelerated import schedules.

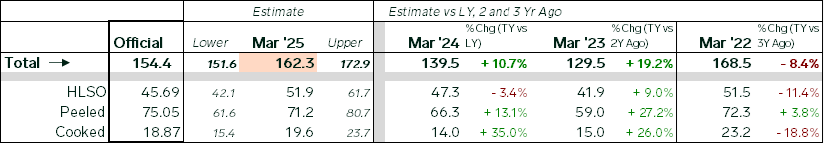

Our March estimates projected a 10% year-over-year increase to 162.3 million pounds, though official figures came in at 154.4 million pounds, within our standard 5% margin of error. Product category distribution shows particularly robust growth for shell-on product, pointing to a dramatic 90% year-over-year increase. Peeled and cooked shrimp also posted significant gains of approximately 27% and 40%, respectively. Naturally, we will know how these estimates fare with the official figures, which will be revealed in about three weeks. Still, everything points to a significant increase.

Table 1. Shrimp import estimates for March 2025 vs official figures. Source: US Census, Urner Barry by Expana.

Table 2. Shrimp import estimates for April 2025. Source: US Census, Urner Barry by Expana.

Critical Market Context

While current import volumes substantially exceed the previous two years, they remain comparable to 2022 levels—a period characterized by inventory oversupply relative to market demand. Current data suggests significant frontloading as importers increase procurement volumes, anticipating the ability to pass through both price increases and tariff costs to consumers. This positioning assumes U.S. demand can rebound from last year’s contraction.

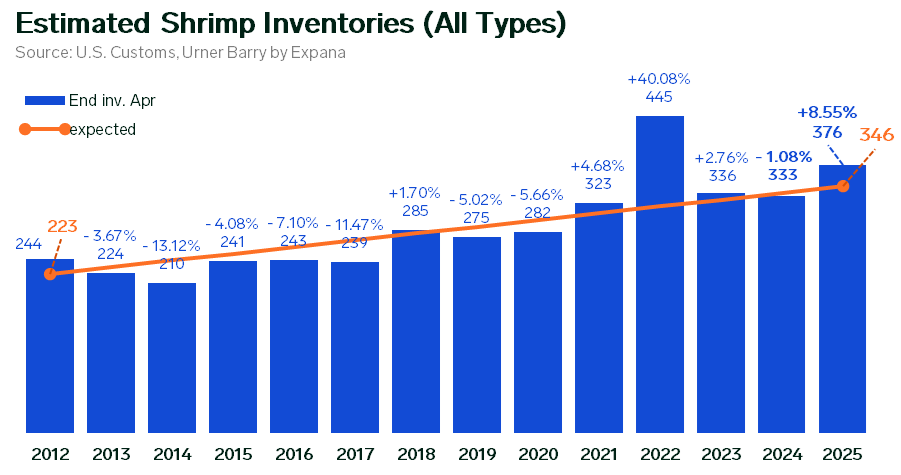

Our inventory assessment indicates holdings approximately 8.5% above equilibrium levels (with a ±5% margin of error). This calculation compares current inventory against a counterfactual growth trajectory absent pandemic disruptions, then adjusted for inflation and population growth.

Figure 1. Total estimated shrimp inventories, ending in April. Source: US Census, Urner Barry by Expana.

Shrimp Price Dynamics and Margin Pressure

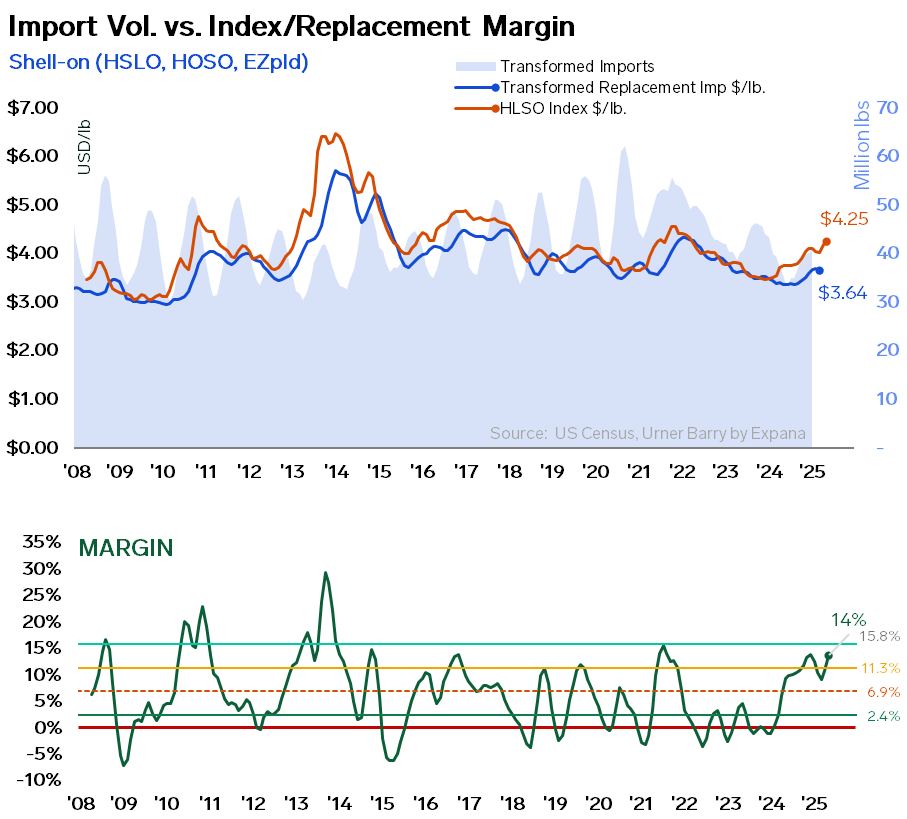

Shrimp market prices have been steadily rising throughout Q1 and Q2, seemingly reflecting supply-demand fundamentals. However, this upward price movement primarily demonstrates stronger purchasing activity from U.S. importers rather than confirmed strengthening of end-consumer demand. Importers have increased inventory holdings at higher prices, considering their ability to pass these costs downstream.

Our margin analysis—which measures the relationship between spot market (UB) prices and replacement cost—reveals that current margins through March appear elevated relative to historical norms. The graph below illustrates that these margins are approaching resistance levels, with the blue line representing replacement costs (the price at which U.S. importers purchased product) and the orange line representing Urner Barry’s HLSO weighted index. Importantly, anecdotal information suggests replacement costs have continued rising throughout Q1 2025, but depending on the origin—a significant reason for these rising costs—these shipments won’t appear in the data until Q2. In addition, the increased costs for covering the tariff will not show up in the data (following the blue line in Figure 2), even in Q2. Theoretically, these costs would be passed on to some degree into selling prices.

Figure 2. Estimated margin for HLSO vs Shell-on imports. This is for illustration purposes only, to identify trends. Source: US Census, Urner Barry by Expana.

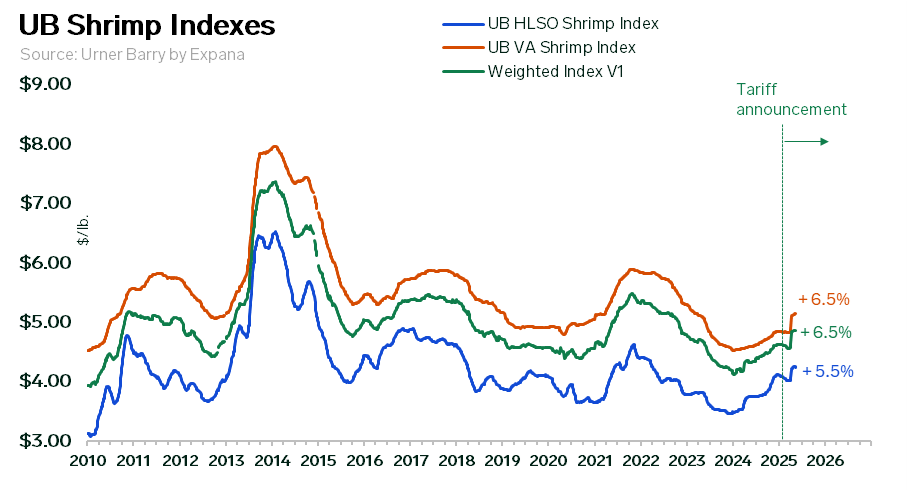

Consequently, these historically high margins will likely contract as the full impact of rising costs and the 10% tariff materializes. Since late Q3 2024, prices have increased by approximately 10% on average, with roughly 6.5% attributable to tariff implementation, thus suggesting external pressures account for more than half of recent price movement.

Figure 3. Urner Barry by Expana shrimp index price + a weighted index between HLSO and value-added. Source: US Census, Urner Barry by Expana.

Forward Outlook

The current shrimp import pattern bears a striking resemblance to 2022, when frontloading created significant carryover inventories and disrupted seasonal holding patterns. The key distinction is that entering 2025, inventories were not substantially above equilibrium levels, unlike the inventory excesses preceding the 2022 disruption.

Figure 4. Seasonal monthly imports 2022-2025 + April Projection. Source: US Census, Urner Barry by Expana.

As such, the market faces two primary scenarios moving forward. Either summer demand strengthens sufficiently to absorb the increased volume at higher price points, or demand remains flat, potentially crushing margins as UB prices stagnate or decline. We anticipate import volumes remaining counter-seasonally strong through at least July, thereby increasing the likelihood that U.S. importers will substantially reduce procurement in the year’s second half.

The market has not fully absorbed the 10% tariff increase, indicating demand resistance in the face of higher costs. For a complete tariff pass-through to occur, either consumer demand must increase relative to imported volumes, or imports must contract to restore market equilibrium. As it stands, current frontloading and artificially elevated prices create significant potential for margin compression if demand fails to strengthen proportionately.

To keep on top of tariff changes, how they could impact your business and how to respond to upcoming changes, sign up to our weekly Tariff Talks rundown.

Image source: Getty

Written by Angel Rubio