For the aluminium packaging segment in the US, continued import tariffs pose both protective advantages and serious challenges. The tariffs remain at 25%, including for aluminium and steel semi-finished products such as coils, cans, and lids for can packaging. This means that U.S. packaging manufacturers are protected from cheap imports on the one hand, but face rising costs due to their dependence on foreign materials on the other.

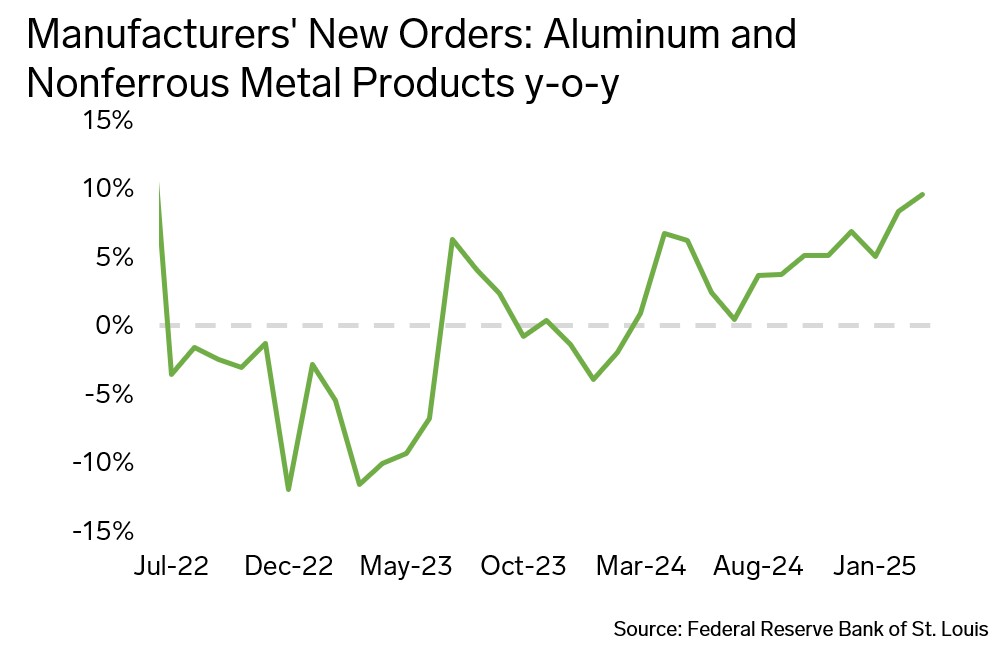

According to the Federal Reserve Bank of St. Louis, new orders for aluminium and nonferrous metal products in the US rose 9.6% y-o-y in March 2025, showing the highest growth rate since July 2022. This surge in activity is a direct indication of stronger domestic production fuelled by protectionist measures.

As a result, the US is actively importing unwrought aluminium for further processing into aluminium products; unwrought aluminium accounted for 70% of total imports in Q1, with a growth rate of 18% y-o-y. However, imports of finished products are growing even more dynamically, as domestic production is not sufficient to meet demand. Consequently, imports of aluminium foil in Q1 grew by 21% y-o-y.

This leads to an increase in prices for packaging products in the USA. For example, the price of aluminium foil in the US rose by 3% y-o-y in April, while in the EU prices were 7% lower y-o-y, and in China prices were 3% lower y-o-y.

Rising domestic aluminium prices and limited access to the right grades of metal lead to higher packaging costs, which reduces the attractiveness of US products on both domestic and export markets. Therefore, the US tariff policy does have a protective effect and stimulates domestic production, but this advantage comes at the expense of flexibility and competitiveness of the industry as a whole.

To keep on top of tariff changes, how they could impact your business and how to respond to upcoming changes, sign up to our weekly Tariff Talks rundown.

Image Source: Shutterstock

Written by Artem Segen