The US blueberry market is in a transitional phase as it works to find equilibrium between tightening supply and steady global demand. Organic pricing is holding at $1.85/lb, a reflection of both constrained volumes and resilient demand. On the conventional side, the Asian market remains an important driver, purchasing fruit in the $1.25–$1.35/lb range for higher-spec product. Europe has also reentered the market after a period of slower buying, which has contributed to stronger movement of blueberries.

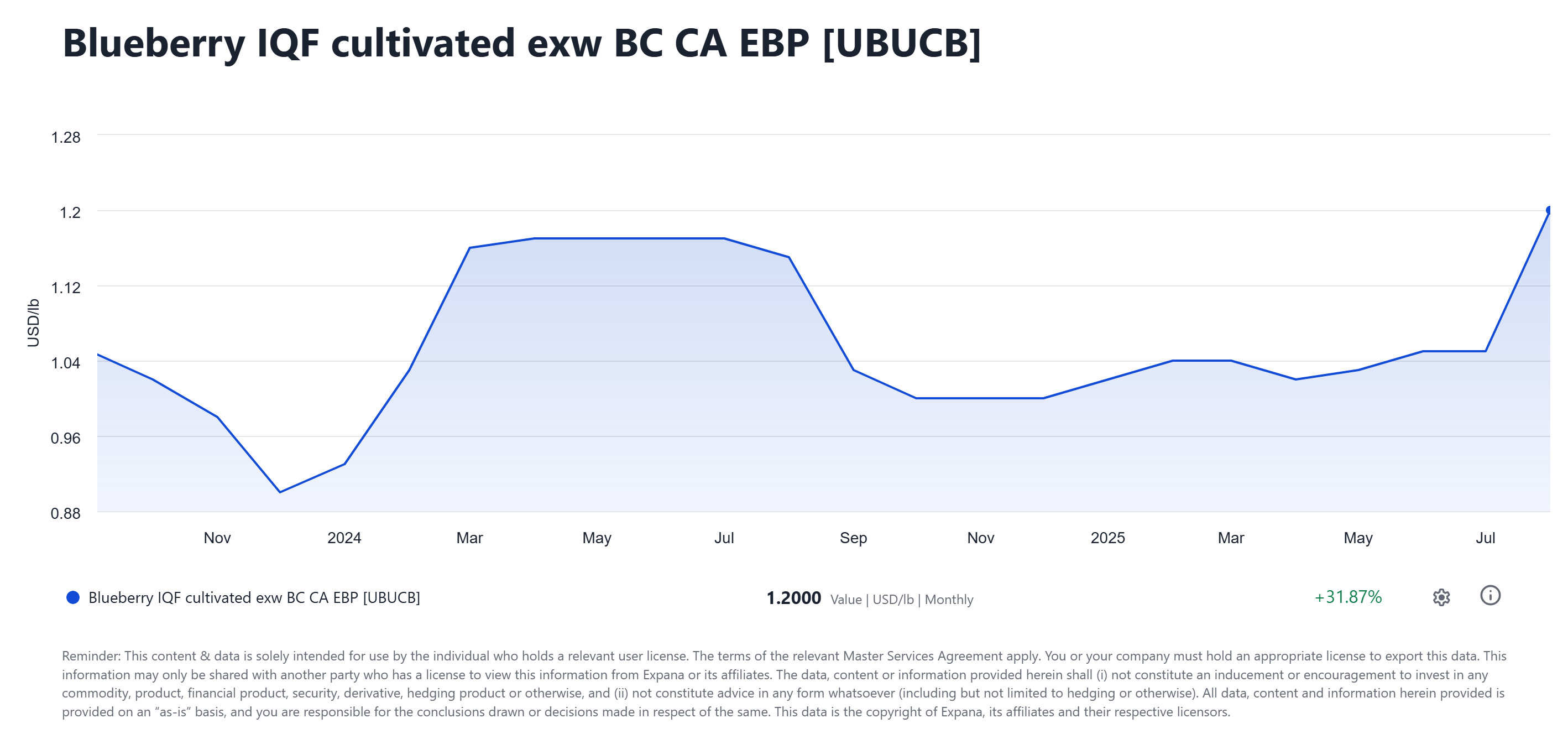

Regionally, domestic production dynamics vary considerably. Georgia’s crop is described as, “slightly tighter but closer to a normal profile compared to recent years,” according to an Expana source. While New Jersey is once again experiencing significant challenges, with production down somewhere around 20–40%, marking another season of crop disaster for the state. Michigan is trending only slightly lower, while British Columbia could be facing a 10–15% decline, though final results are not yet confirmed. In contrast, Oregon is reporting a larger crop, though much of this fruit is being diverted to the fresh market, limiting the volume available for processing. These shifts create uneven supply across growing regions, making localized shortfalls harder to smooth out.

The most significant disruption this season is in the wild blueberry industry. “Maine is suffering a severe crop disaster due to drought, dramatically reducing its contribution to the market,” stated an Expana market participant. Quebec, while faring better, is still slightly down and unable to fully compensate for the shortfall south of the border. With wild blueberry availability constrained, demand has shifted more heavily into cultivated blueberries, intensifying competition for limited supply. The result is a marketplace characterized by heightened demand across multiple regions, tighter availability, and ongoing adjustments in trade flows. As buyers in Asia and Europe remain active and North American production faces regional setbacks, the blueberry industry is working through a season where equilibrium will likely be defined by constrained supply, shifting sourcing strategies, and continued firmness in both organic and conventional pricing.

Expana tracks over 1000 fruit and juice price series. Find out more today.

Image source: Adobe

Written by Holly Bianchi