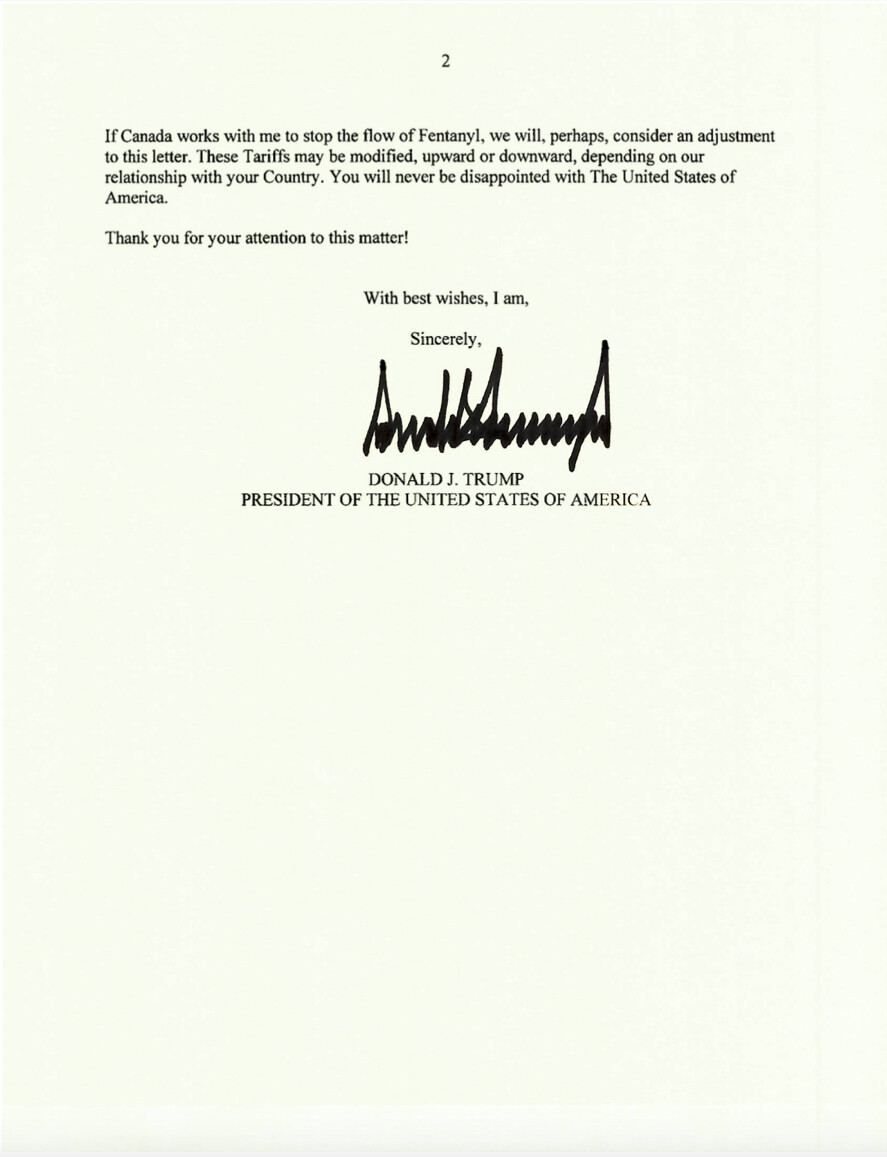

US President Donald Trump announced a sweeping 35% tariff on all Canadian goods entering the US on July 10, a move that could send shockwaves through seafood industries on both sides of the border. The tariff will take effect on August 1.

The news arrived via a Trump tariff letter addressed to Canadian Prime Minister Mark Carney. Trump’s letter criticized Canada for its efforts to stop fentanyl from entering the US. Trump said Canada had chosen to retaliate with its own retaliatory tariffs rather than cooperate, prompting his steep escalation.

Trump also highlighted the US trade deficit with the neighboring nation and the impact Canada’s tariffs have on US dairy farmers in the message.

The latest letter is part of a growing collection of Trump missives sent to world leaders, each outlining new or revised US tariff rates amid mounting global trade tensions.

The 35% tariff marks a significant increase from the 25% levy Trump imposed on Canada earlier this year, which was later rescinded.

USMCA exemptions reportedly still in place

Before Trump’s letter, Commerce Secretary Howard Lutnick had indicated that products previously compliant under the USMCA would be exempt from tariffs, as Expana reported last month. The exemptions would significantly mitigate the impact of the tariffs on many seafood products.

The Wall Street Journal cited an anonymous White House official who stated that the exemption for USMCA-compliant goods would “apply for now.” If confirmed, it could be a massive sigh of relief for many seafood businesses. Another official mirrored the same sentiment to Yahoo Finance. The official stressed that no final deal has been drafted and Trump has yet to make a final decision, a similar report to a Reuters story published on July 10.

Lobster trade in the crosshairs

Expana market reporter Liz Cuozzo highlighted that the tariff could significantly disrupt the lobster trade. The US–Canada lobster trade flow is symbiotic, with each country importing from the other during their respective peak production seasons to maintain year-round market stability. In 2024, total U.S. lobster imports from Canada—including live, in-shell (tails and whole cooked), meat, and tails—totaled 97.36 million pounds.

Canada remains the dominant supplier to the US, with peak volumes arriving during the Canadian spring season and again in the fall, when Maine landings begin to taper off ahead of the winter months.

“If enacted, the proposed tariff would sharply raise replacement costs, complicate sourcing strategies, and place additional strain on an already tight supply chain,” Cuozzo said. “Product priced out of the US market would likely be diverted to alternative destinations such as China and the European Union. Even then, Canada does face a 25% tariff on lobster exports to China as well.”

“Industry stakeholders have expressed concern over potential price volatility, trade disruption and longer-term impacts on consumer access and affordability,” Cuozzo added. “With seasonal demand expected to climb in the coming months, the outcome of this tariff decision will be closely watched throughout the global supply chain.”

The US seafood industry, notably the lobster industry in Maine, had expressed its worries over a tariff on Canadian goods earlier this year. Maine’s former Marine Resources Commissioner Patrick Keliher said the tariffs could “cripple” the state’s lobster fishery, according to NHPR.

Senator Susan Collins (R-ME) also pressed Commerce Secretary Howard Lutnick on the extent of the seafood connection between Canada and Maine, as the majority of lobsters are processed in Canada.

Canadian snow crab industry may have dodged tariff troubles

Canadian snow crab stakeholders may be breathing a collective sigh of relief, given how their season aligned with recent tariff uncertainties over the past several months, Expana’s Seafood Managing Wditor Janice Schreiber explained.

The vast majority of Canadian snow crab is harvested between April and August. According to Fisheries and Oceans Canada (DFO), the Gulf of St. Lawrence snow crab fishery has already reached 100% of its quota, while Newfoundland’s fishery is currently at 88% completion.

“This seasonality may have helped the industry avoid the brunt of potential tariff impacts, effectively dodging a proverbial bullet,” Schreiber said.

In terms of volume, US imports of Canadian snow crab reached 60.2 million pounds through May 2025—up 3.4% compared to the same period in 2024. Last year, Canada exported a total of 117.8 million pounds of snow crab to the US

Canadian salmon market facing pressure

Canadian salmon imports totaled 178.2 million pounds in 2024. Through May 2025, 66.8 million pounds have entered the US, down approximately 25% year-to-date compared to the same period in 2024. Of last year’s total, approximately 83%—or 148.6 million pounds—was fresh whole fish trucked across the border, the primary form of Canadian salmon entering the US market. So far in 2025, 55.4 million pounds of fresh whole fish have been imported.

Josh Bickert, market reporter for Expana, noted that with the proposed tariff, salmon sellers would likely redirect product away from the US toward alternative markets such as the EU and Asia, along with an added focus on domestic sales. Bickert noted that production may also slow, as was the case during April when output dipped before the US granted USMCA seafood exemptions.

“Given the reliance of the US market on Canadian whole fish, domestic buyers may increasingly turn to alternative sources such as the EU, the UK, and Chile,” Bickert said. “With trade negotiations unsettled for the EU and the potential for similarly high tariffs, both the UK and Chile may become more attractive options for US buyers, as tariffs on their product still appear to remain at the baseline 10% for now.”

Earlier this year, when Trump threatened to impose the initial 25% tariff, the Canadian seafood industry raised alarm bells over the potential impact of tariffs, as Expana highlighted at the time.

Here’s the letter Trump sent to Carney later in the evening on July 10:

To keep on top of tariff changes, how they could impact your business and how to respond to upcoming changes, sign up to our weekly Tariff Talks rundown.

Image source: Shutterstock

Written by Ryan Doyle