On Friday, July 11, US President Trump announced tariffs of 50% against Brazilian goods to be imposed from August 1. The proposed tariffs again alluded to trade imbalances as well as a political angle in the ongoing trial of former president Jair Bolsonaro which with Trump has taken issue. The letter implied that tariffs may be removed should the trial against Bolsonaro cease.

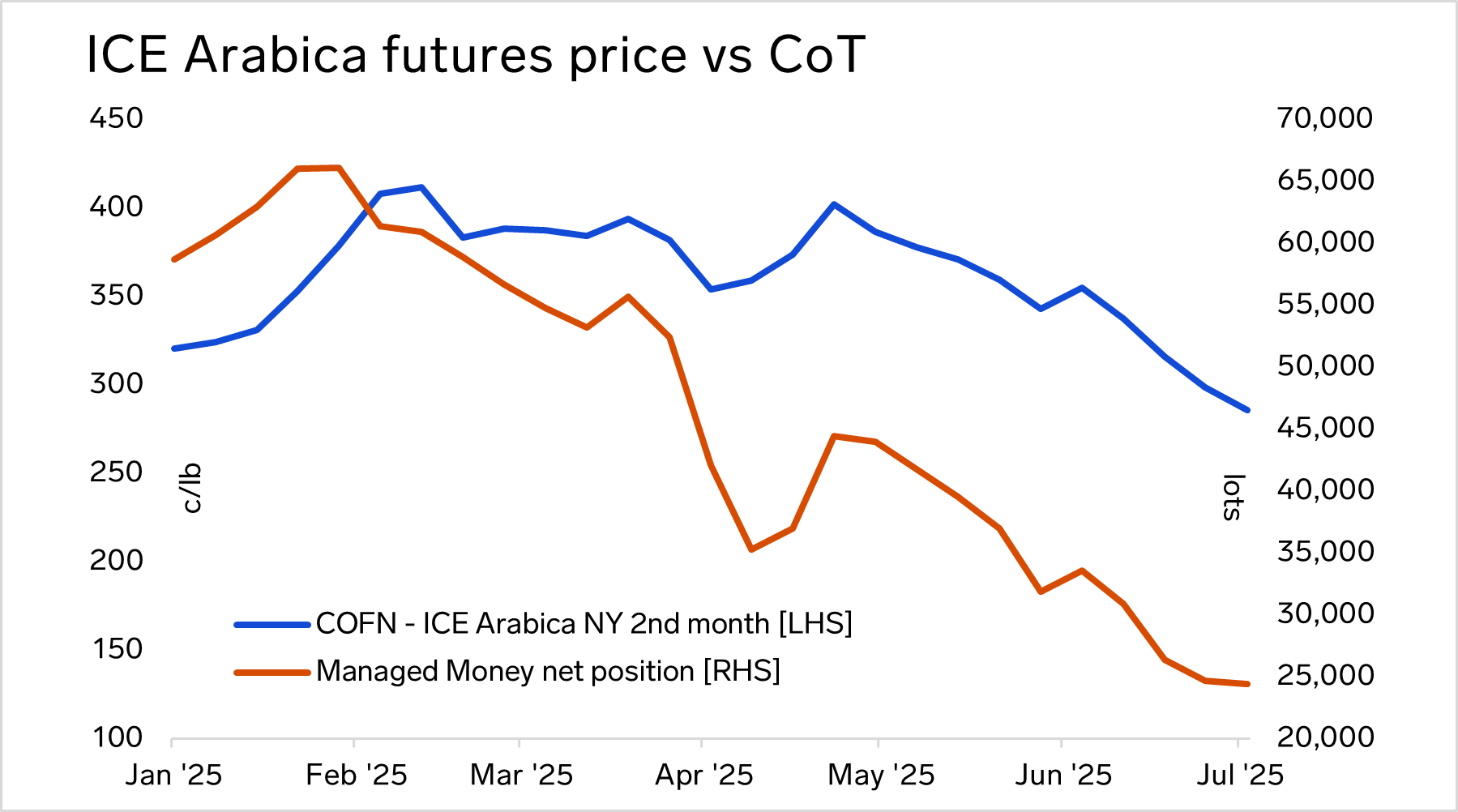

Following the announcement, ICE NY Coffee “C” market futures rose from a low of 286.60 c/lb nearby on the 11th to 305.70 c/lb on the 14th, an increase of 6.7% in just over one trading session. Market participants have pointed to several factors to explain the quick jump in prices. While the USDBRL rate has risen from 5.56 to 5.59 over the weekend, several participants noted that the market is increasingly vulnerable to short covering in the near term. According to the most recent Commitment of Traders report from July 8, the managed money short position has risen from 5,489 lots to 12,546 lots in the previous three weeks, driving the net long position to just half the level seen in April.

One trader told Expana: “Overall we are still pretty bearish with the tariffs in place; if we see lower demand out of the US as a result, that should drive prices down with the balance sheet tipping towards a greater surplus.” Several sources noted that the market could see increased volatility, and a few US buyers have told Expana that they are looking at the possibility of extending supply contracts into 2026, fixing differentials under the premise that they may continue to rise in the coming months should the terminal price fall further. So far on Tuesday July 15, prices have eased again, with the nearby futures price falling from 305.70 c/lb on the 14th to 297.95 c/lb as of the time of publication.

However, most market participants expressed skepticism as to whether or not the tariffs will actually come into effect on August 1, with one buyer telling Expana: “this time the motivation [against Brazil] seems much more political, which makes me think that there is more wiggle room to get out of this than the numbers-on-a-spreadsheet approach to the trade imbalance that has been the source of most of the previous announcements.” This sentiment was echoed by a few traders who agreed that most of their US clients were taking the view that 50% may well be walked back before the August 1 deadline.

Image source: Adobe

Written by Andrew Moriarty