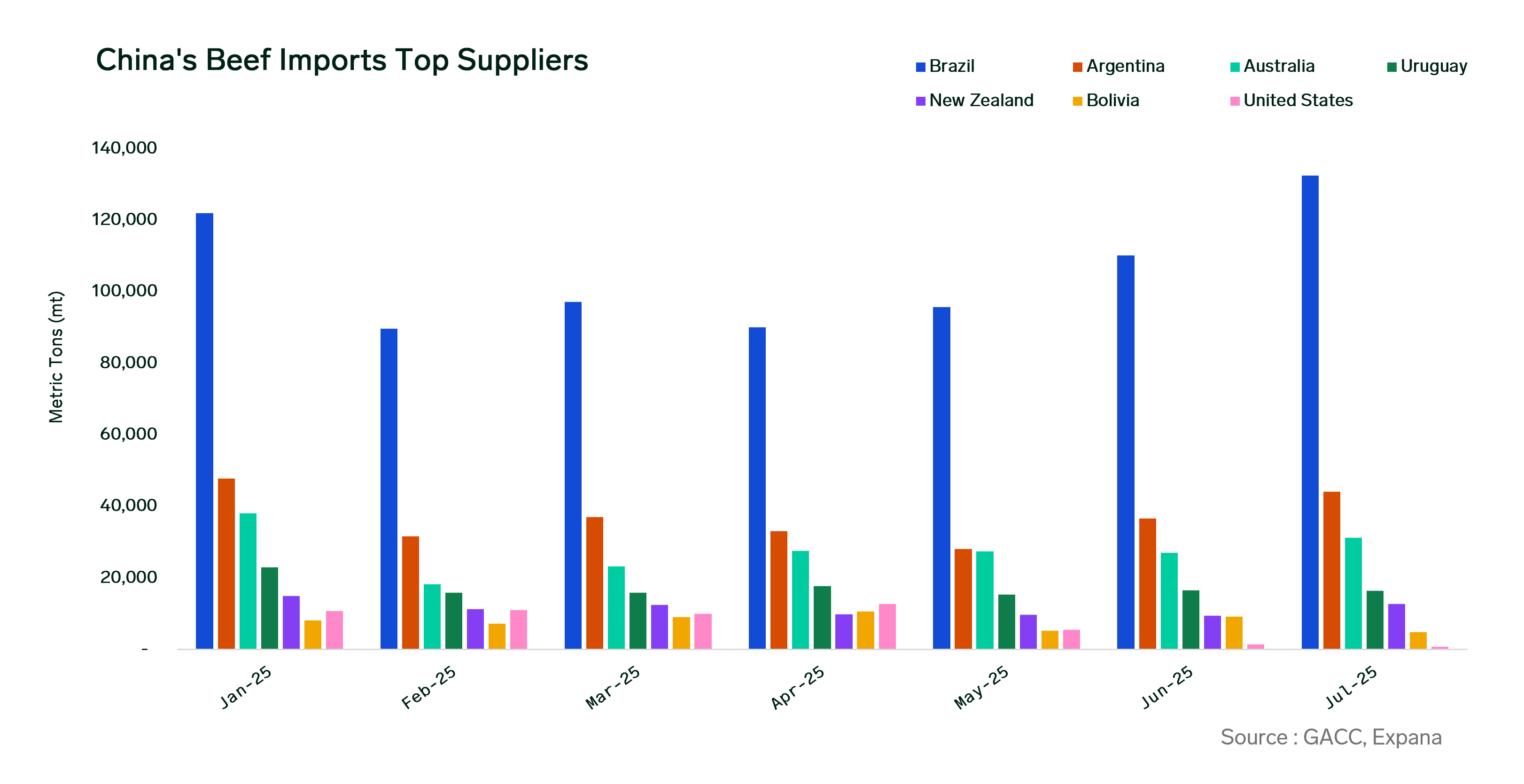

China’s total beef imports climbed for the second consecutive month, up 15.5% month-on-month (MOM) to 250,292 metric tons (mt) in July, according to the latest data from the General Administration of Customs of China (GACC).

In-bound shipments increased by 33,591 mt, driven mainly by gains from Brazil, Argentina, Australia, and New Zealand. Bolivia and Uruguay were the exception, posting declines as it partially offsetting the overall increase.

On a year-on-year (YOY) basis, July’s beef imports grew 16.2% (33,591 mt) compared to the same period last year, as winter replenishment and rising domestic Chinese prices supported the uptrend. Importers also ramped up imports from Australia ahead of its safeguard activation.

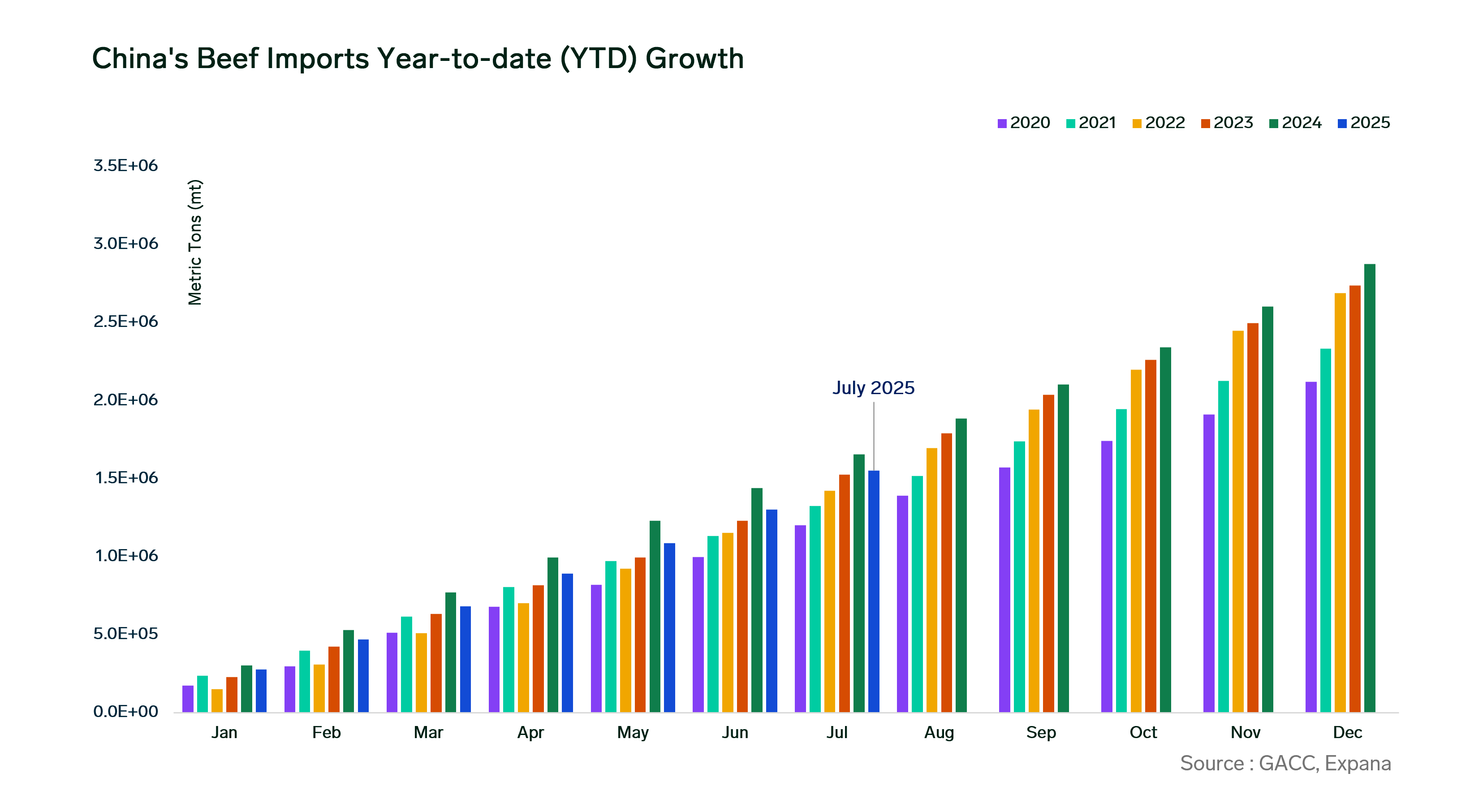

In the first seven months of 2025, China imported 1.55 million mt of beef, shedding 6.1% YOY or 101,669 mt, on the back of faltering consumption and macroeconomic concerns.

Brazil and Argentina Post Gains, while Uruguay Lags

Imports from Brazil, China’s main beef supplier, rose a strong 20.2% MOM to 132,504 mt in July, up 22,310 mt. This marked the third consecutive monthly increase since the April’s pull back, as demand rebounded following the Sino-China trade tensions.

Imports from the world’s largest beef exporter grew a whopping 36.9% YOY or 35,715 mt amid high production and wider market access.

Argentina followed up next as the second largest supplier, accounting for 44,098 mt shipped in July, up 20.3% MoOM or 7,440 mt. Volumes also edged 4.4% higher YOY, adding 1,840 mt from last year.

Conversely, China’s demand for Uruguayan beef softened slightly in July, slipping 0.7% MOM to 16,408 mt, down 114 mt. Imports from Uruguay fell 8.5% from a year ago, a decline of 1,518 mt, reversing the modest gains observed in June.

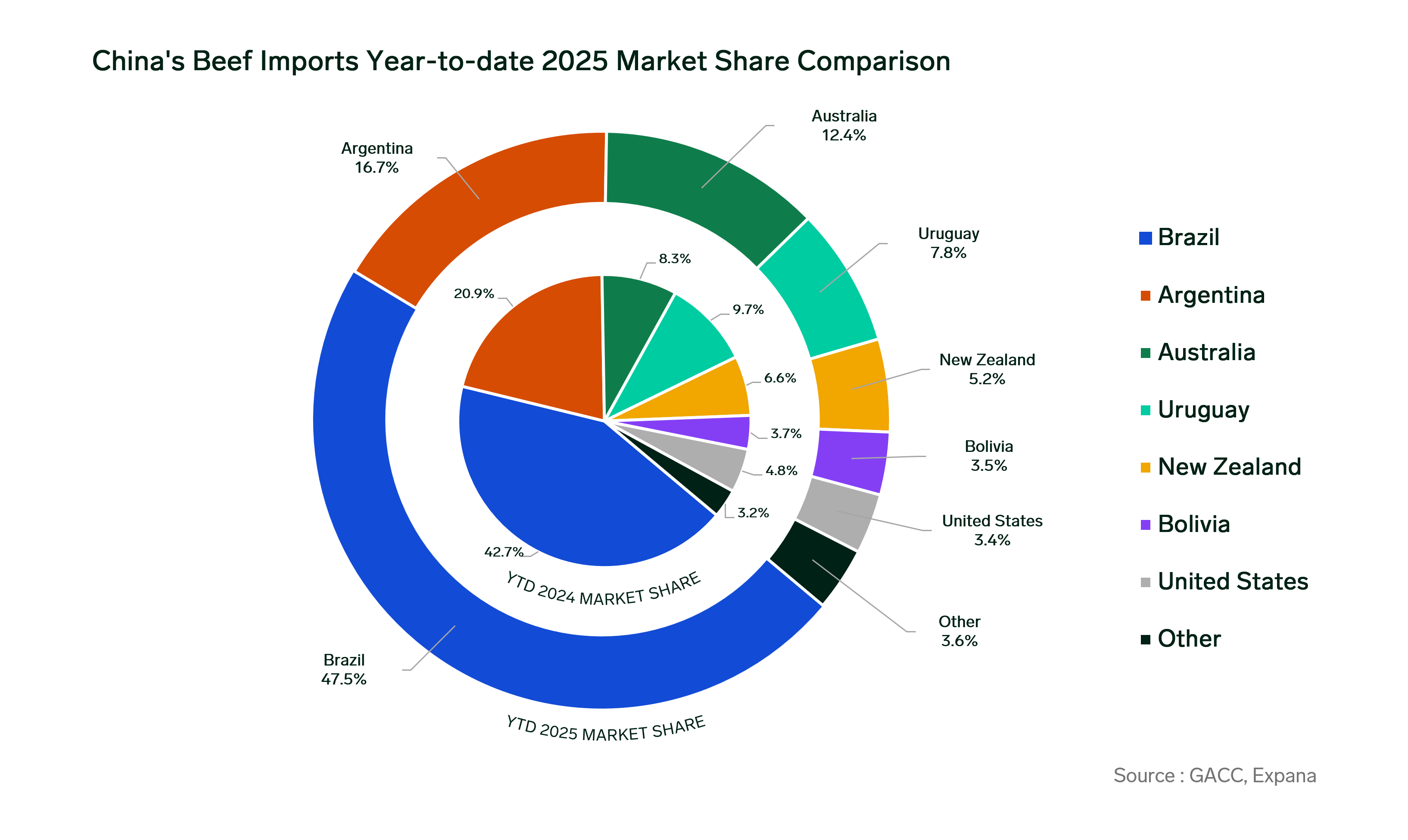

Year-to-date (YTD), volumes from the South American bloc accounted for 73.2% of China’s market share.

China’s Australian Beef Safeguard Activates on July 24

Beef imports from Australia in July 2025 surged to a 7-month high at 31,222 mt, marking a 15.3% MOM increase, or 4,141 mt, as importers frontloaded parcels ahead of its safeguard trigger.

Volumes surged 72.3% YOY, up 13,102 mt, driven by strong demand for grain-fed beef since Q2 as buyers shifted away from US product limited by retaliatory tariffs and suspended import permits.

The shift accelerated Australia’s role in China’s premium market and ultimately brought forward the safeguard trigger, which was activated on July 24 despite a higher quota this year. The threshold was reached in just 205 days, 75 days earlier than in 2024.

Volumes arriving from New Zealand also soared to the highest since March, rising a staggering 35.4% MOM in July to 12,800 mt, which was 3,345 mt above the prior month. Winter replenishment and rising domestic Chinese prices also saw higher demand for New Zealand product.

However, constrained supply and a weaker-than-expected cow season restricted overall production. Despite this, shipments still edged up by 5.2% YOY, or 633 mt.

US Beef Volumes Plunges Further

US beef volumes nosedived another 45.4% MOM (654) in July 2025 to just 786 mt, down another 654 mt.

Compared to the same period last year, shipments slumped 93.1% YOY. This marked the lowest monthly total since Covid’s July 2020, taking just 0.3% of China’s market share.

Trade tensions between China and the United States kept duties high and US access limited since April.

Please note that import figures may vary from export data published by other official sources due to differences in the methodologies used by each entity/organization for collecting and reporting data.

Expana provides regular beef market coverage for the geographies listed in this analysis. Click here to dive deeper into the beef market today (customer access only).

Co-authored by:

Junie Lin

Expana

[email protected]

Joe Muldowney

Expana

1-732-240-5330 ext. 244

[email protected]

Written by Augusto Eto