Cocoa futures prices on the ICE London exchange continue to see choppy sideways trading as all eyes focus on weather and its effects on the setting of the end of the upcoming main crop as well as the 2026 mid-crop. Recent rains in parts of Ivory Coast are being offset by concerns about a potential poor start to the main crop, as well as poor pod survival in Ghana’s growing regions.

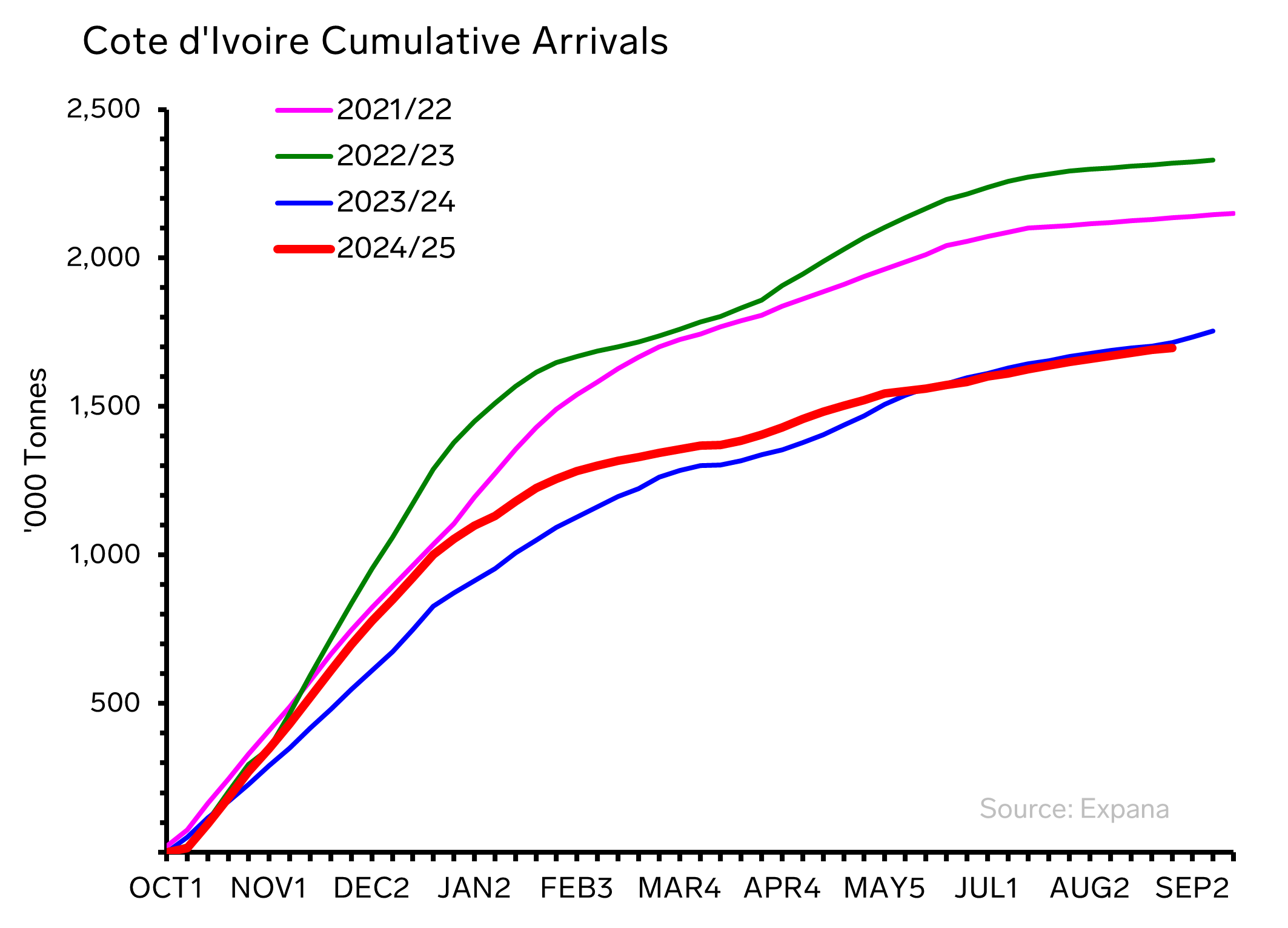

Newswire data shows Cote d’Ivoire port arrivals through September 14 totalled 1,686,000 tonnes, including 7,000 tonnes that reached port during the most recent week. These figures align with Expana’s updated arrival projection of 1,720,000 tonnes for the 2024/25 season.

Northern growing regions in Ivory Coast have received some rainfall over the past few weeks, exceeding what regional precipitation data indicates, as current data reflects below normal rainfall levels with forecasts calling for continued below normal precipitation over the coming two weeks. Expana’s crop assessment finds pod development trailing average levels, supporting expectations for a diminished main crop tail. Pod retention rates have exceeded normal levels, however. Black pod disease occurrence surpasses typical seasonal levels but remains within manageable ranges, notably lower than last year’s incidence. Total pod counts lag the 10-year average by the same margin recorded three weeks prior. These findings provide no basis for adjusting the 2025/26 TRS by Expana’s production forecasts.

Ghana’s pod development continues showing significant weakness while pod retention performs poorly. Main crop outlook has declined further over the past three weeks. Reflecting these unfavourable crop conditions, Expana’s TRS has again lowered its 2025/26 main crop estimate, cutting an additional 30,000 tonnes.

Expana continues to project an increase in the stocks-to-use (STU) ratio in the upcoming 2025/26 season, driven by a combination of weaker demand due to ongoing high prices as well as a recovery in crop sizes and larger production, particularly outside of West African growing regions. The STU ratio is expected to climb from 28% in the current 24/25 year to 30.5% in 25/26.

Written by Andrew Moriarty