On Thursday, June 19, front month ICE Brent Crude futures peaked as hostilities in the Middle East and bombing of key Iranian nuclear sites led to Iran’s government threatening to close the Strait of Hormuz, a key shipping lane for oil exports in the region. Crude prices peaked at $78.85/barrel, up 13.7% over a single week. However, starting on Friday the 20th, oil prices have gradually settled lower following US strikes in Iran which culminated in a reduction of the bombing campaign, talks of a ceasefire and widespread market sentiment that the Strait of Hormuz would not be closed.

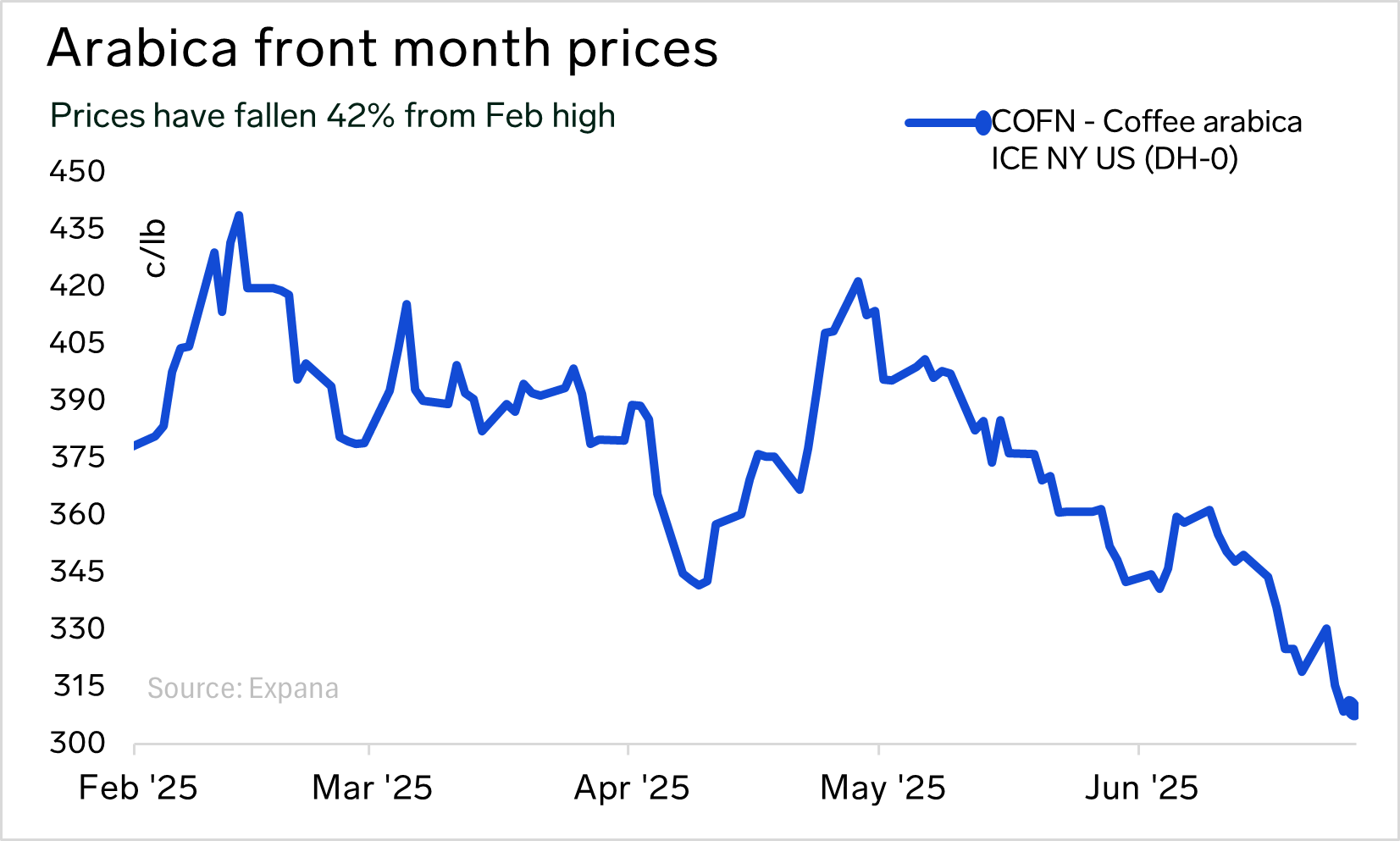

Coffee prices – like many agricultural commodities – are heavily influenced by energy as an input cost, and will often rise and fall with sharp movements in crude futures. ICE NY Arabica futures rallied on Monday June 23 following the US strikes in Iran, with the SEP25 contract alone gaining over 11 cents/lb in a single session, before resuming their slide lower on Wednesday.

The industry waited early on Wednesday morning as sources told Expana that several areas of Brazil had experienced some overnight frost, with one grower saying, “it got real cold here last night, and we’re assessing to see if there is any damage so far.” Within a few hours, market participants reported that the frost had not materially affected the coffee-growing regions, with the lowest overnight temperatures having occurred in Sao Paolo state in the regions in and around the city, with overnight temperatures ranging from 1-3 C near Campinas. Another trader told Expana, “there may have been a few farms that saw limited frost damage, but everything I am hearing so far is that most of the main growers escaped the worst of the cold,” adding, “[the] weather is meant to warm up over the coming days which should keep us safe for at least a week while the harvest continues.”

Image source: Adobe

Written by Andrew Moriarty