Global amino acid markets remain under pressure, with low FOB China prices, cautious purchasing, and trade policy uncertainty continuing to suppress demand across most regions. While hand-to-mouth buying remains the norm in many markets, methionine is showing a firmer trend amid planned maintenance and freight disruptions. Freight costs are rising globally, further limiting the price advantage of low ex-China offers and introducing additional risk into planning.

Europe

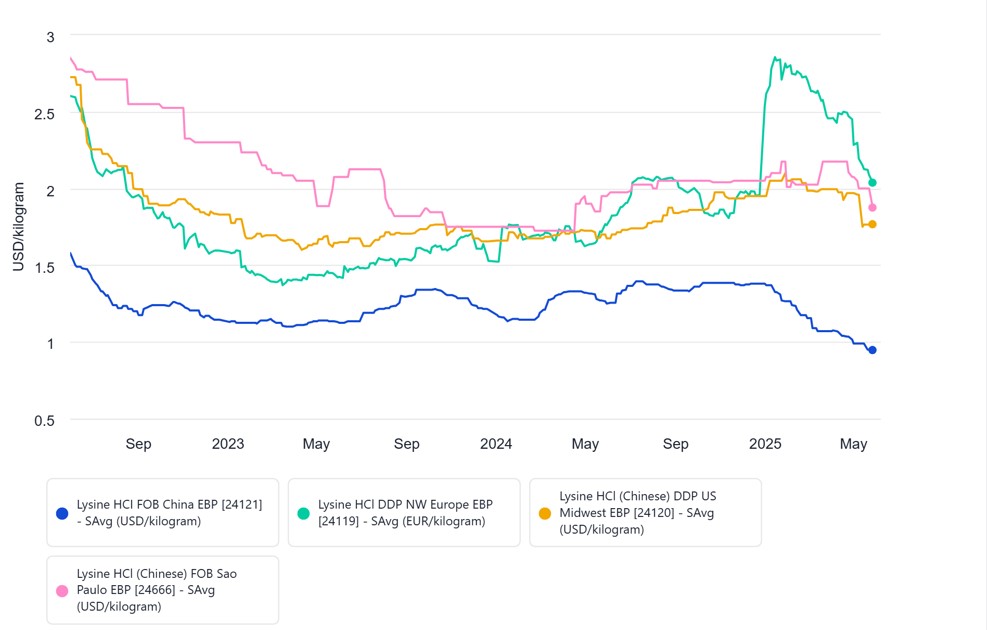

European lysine HCl prices have dropped nearly 15% over the past month, reaching six-month lows. Sellers describe the market as “difficult,” with buyers reportedly overbooked and relying on short-term purchasing. Meanwhile, methionine prices are steady to slightly firmer due to tighter availability and fewer active offers as suppliers navigate earlier maintenance plans and weather-related logistics disruptions. Adisseo’s methionine production in France was disrupted by recent weather-related transport issues, and while limited volumes are now available, supply is expected to remain tight through the end of Q3, a company source said.

Asia

The amino acids market remains stable overall, though valine shows strength driven by increased domestic orders and rising demand. Lysine HCl domestic prices dipped slightly as one producer reported high inventory levels. In contrast, lysine sulfate supply is tight, with one major producer reportedly sold out until the end of June. Exporters are closely watching freight trends and geopolitical developments, especially the looming July 12 EU anti-dumping ruling on lysine and US tariff uncertainty, which could shift global price direction.

North America

Concerns over tariffs and freight hikes kept buyers cautious. Trump’s threat of 50% tariffs on EU goods and an ongoing review of reciprocal tariffs on Chinese amino acids continue to cloud visibility. Lysine prices remain mixed, with wide spot price variation ($0.76–0.98/lb) and lower FOB China offers driving deals for late Q3. Still, rising freight costs and overbooked inventories are making buyers hesitant to commit. Threonine demand is subdued, though improved sentiment has followed progress in US-China negotiations. Tryptophan spot pricing is steady, but demand has dropped significantly—some estimate more than 30%—while valine continues to see minimal use due to favorable corn/soy economics and steep US tariffs on Chinese-origin supply.

South America

Brazil’s methionine market remains steady, with prices around $2.70–2.75/kg and expectations of firming following Q3 price increases. Lysine HCl prices continue to fluctuate with DDP levels between $1.65–1.75/kg, though some large-volume quotes for late Q3 have been reported landing as low as $1.37/kg. Local traders appear well stocked, but global uncertainty over tariffs and anti-dumping rulings continues to dampen forward booking interest. Threonine and tryptophan prices were stable, but demand remained tepid.

Sign up to our upcoming webinar to find out more about how freight is affecting the commodity market in 2025.

Image source: Adobe

Co-authored by:

Elliot Holgate, Market Reporter (Latin America)

Lydia Ma, Market Reporter (Asia)

Karolina Zagrodna, Market Reporter (Europe)

Written by Heather McGuire Doyle