Prices for organ meats have been steadily rising, influenced by both supply and demand dynamics in the beef industry. On the supply side, reduced cattle slaughter limits the availability of organ meats, which are already produced in minimal quantities, contributing a relatively small portion to the total carcass weight.

Demand-side factors also play a significant role. Organ meats have long been favored in export markets and are commonly used in pet food manufacturing. Additionally, certain organ cuts, such as beef hearts, can be incorporated into beef patties and patty mixes, provided they are labeled accordingly when comprising more than 2% of the product.

Recently, consumer interest in organ meats has surged, largely driven by their reputation as nutrient-dense foods which some indicate support immune function and boost energy levels. In response to this growing health-conscious market, some food companies have introduced “ancestral blends”, which are a mixture of traditional ground beef with added organ meats such as heart and livers. Ancestral beef blends typically command a premium retail price when compared to traditional ground beef blends.

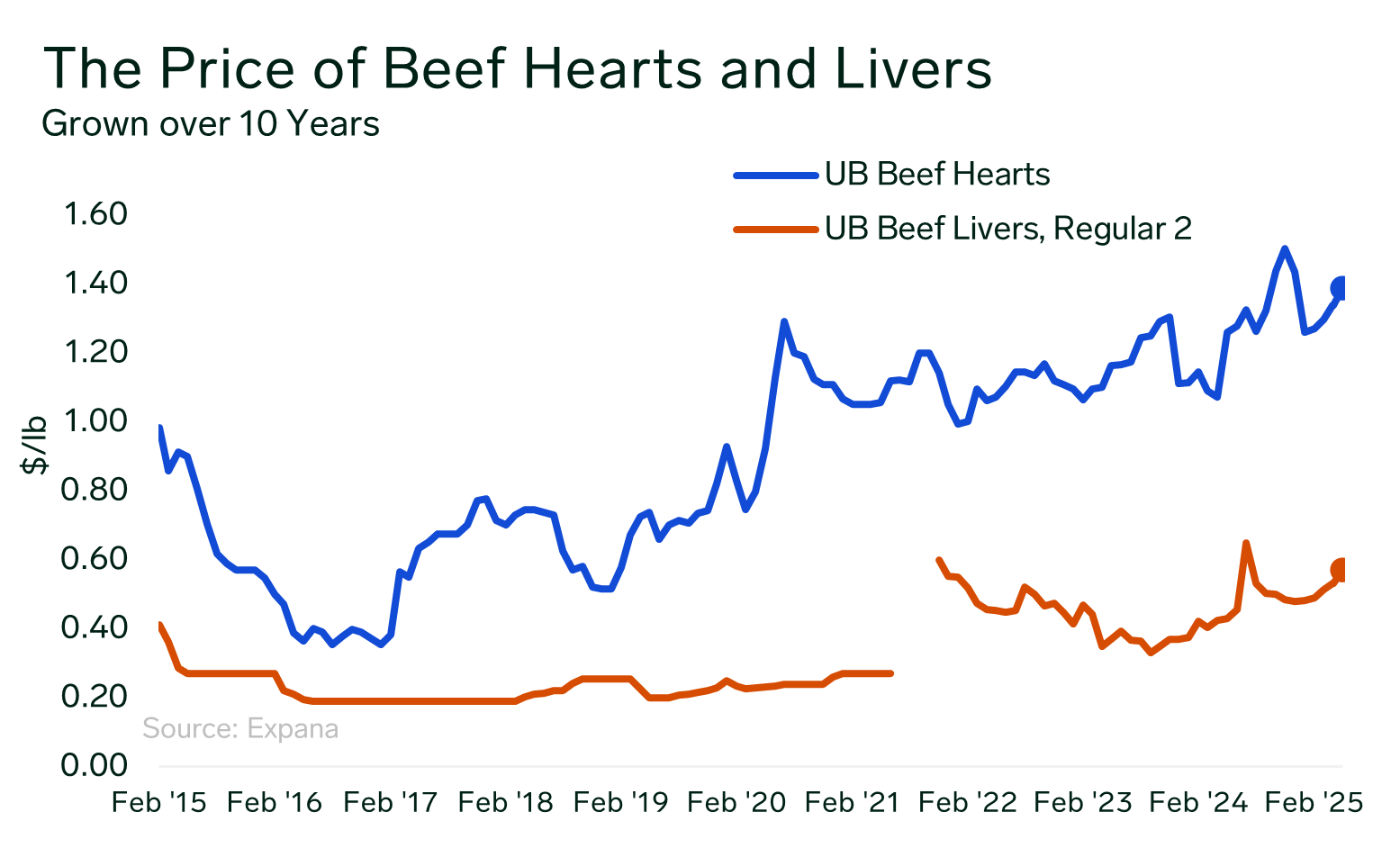

As beef heart and liver prices continue to climb and ancestral blends gain traction across health and wellness communities since 2019, it is worth examining the extent to which these evolving consumer trends are contributing to higher prices for beef hearts and other organ meats.

Methods and Results:

Two regression models were developed using the wholesale prices of beef hearts and livers as dependent variables. Ancestral beef presence was a binary (1=yes, 0=no) variable for when blends made it to supermarket shelves in 2019. The analysis uses monthly time series data from Expana over the past 10 years (2015-2025).

To interpret percentage changes, all variables were transformed using natural logarithms and lagged by two time periods, which stabilizes the variance.

Both models examining the effect of ancestral beef on heart and liver wholesale prices were statistically significant with a positive coefficient. Since the introduction of ancestral beef at retail floors, the average wholesale price of hearts increased by 56.8% and livers by 41.4%.

Conclusion:

Taken together these findings suggest that the rising popularity of organ meats in health-focused food products is contributing to upward price pressures for organ meats. As consumer demand for nutrient-dense, “ancestral” foods continues to grow, it could continue to lead to some impacts on the wholesale prices of these items.

However, while a relationship is evident, it is important to acknowledge that in recent years, cattle slaughter has also declined as part of the regular cattle cycle, influencing both supply and price dynamics over multiple years. As ancestral beef blends remain available through subsequent cattle cycles, future analyses should reassess their impact on organ meat prices to account for ongoing market evolution.

Image source: Getty

Written by Emily Schlichtig