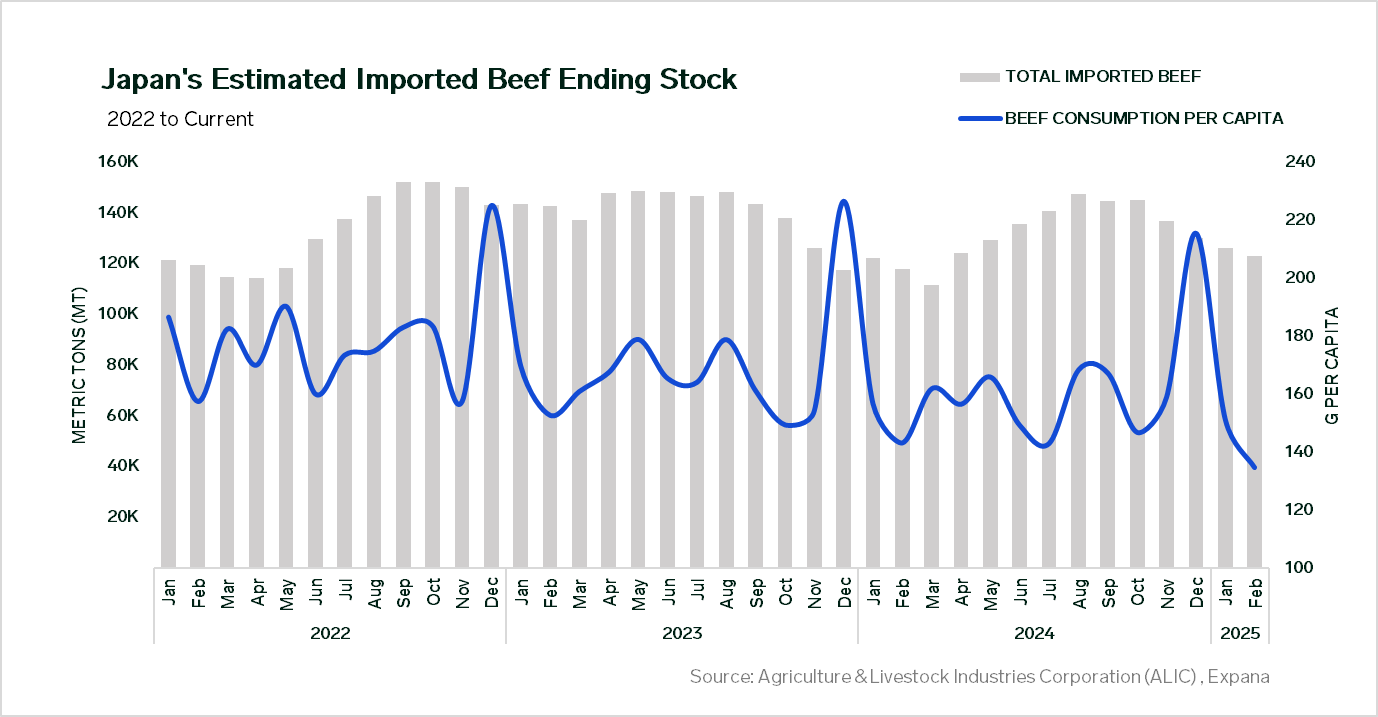

Japan’s beef consumption dropped to a 23-year low in February 2025, with per capita intake falling to just 134 grams, according to data from the Agriculture & Livestock Industries Corporation (ALIC). This marks the lowest level since November 2001, driven by inflationary pressures and a continued squeeze in household budgets. The weak yen has exacerbated the situation, pushing up the cost of imports, including food and energy, and fuelling broader inflation.

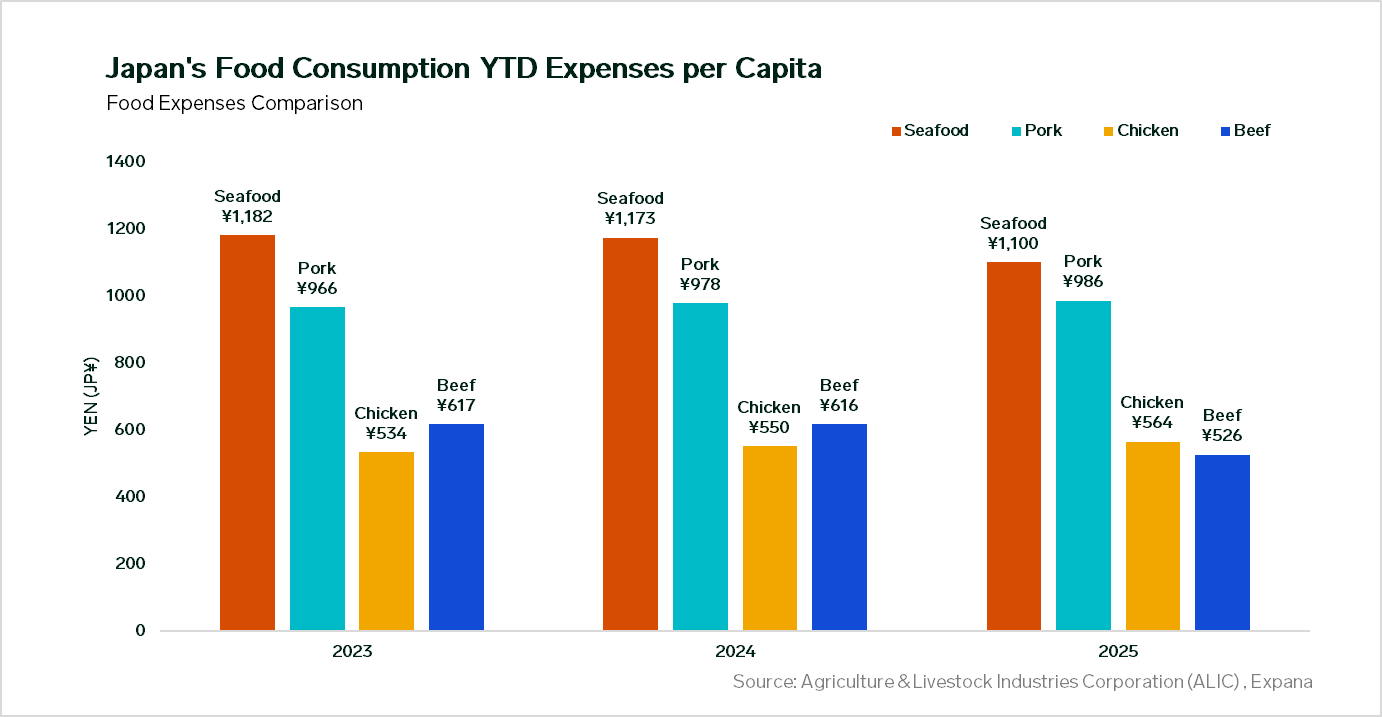

Industry sources have long commented that budget-conscious consumers are turning to cheaper proteins such as pork and chicken, with some chicken now selling for less than half the price of beef at retail counters. The foodservice sector has followed suit, with beef bowl chains broadening chicken-based menu items to maintain margins and foot traffic. Rising staple food prices, including rice and vegetables, have compounded pressure on protein spending. Poor harvests following the record heat in the summer of 2023 have led to sharp price hikes for locally produced crops, further squeezing household budgets.

Beef Inventories Fall, but Import Demand Remains Stagnant

Japan’s frozen beef inventories fell to their lowest level since April 2024 yet import demand has failed to rebound as households pull back spending and inflationary pressures persist. Data from the Agriculture & Livestock Industries Corporation (ALIC) showed imported beef stocks at 126,960 mt at the end of February, marking a sixth straight monthly decline and down 2.3% from January. While inventories remained 3.1% above year-ago levels, the steady drawdown has not led to a meaningful pickup in import (customer access) activity in 2025.

Weak Yen Continues to Weigh on Trade

A persistently weak yen remains a major drag on trade. The Japanese currency has hovered around 140 yen to the US dollar through most of 2024 and into early 2025. In late June 2024, it fell to 160 yen, the weakest level in 38 years.

By comparison, in the early 2020s, the exchange rate was closer to 100 yen to the greenback. The weaker yen continues to squeeze households by pushing up the cost of imports, including food and energy, which is fuelling inflation and weighing on consumer demand.

Industry Eyes Golden Week for Signs of Recovery

Despite the challenges, some in the industry remain cautiously optimistic about a potential recovery in demand. Many are closely monitoring Japan’s current Golden Week holidays, traditionally a period of increased travel and dining out. This could provide critical insights into the outlook for beef consumption as Japan moves further into 2025.

Expana provides comprehensive beef market coverage around the globe with over 4500 price series in our database. Speak to our team for more information here.

Co-authored by:

Joe Muldowney

Expana

1-732-240-5330 ext. 244

[email protected]

Bill Smith

Expana

1-732-240-5330 ext. 265

[email protected]

Written by Junie Lin