As the new apple season gets underway in Europe, processors could struggle to meet demand, according to market sources, on the back of reduced yields and rising raw material prices.

For key producers, such as Poland and Turkey, adverse weather events persisted earlier in the year, with orchards struck by frosts, hail and heavy rains. Industry players in Poland, the region’s largest producer, have reported some potential quality issues among early varieties. Participants state that some parts of the country were hit much worse than others, and as such, the extent of the damage is difficult to gauge. In more recent months, heatwaves have also negatively affected fruit quality, although some reports suggest that favorable growing conditions have emerged overall and anticipate a robust crop.

Sources, however, expect a challenging season for processors. One source suggested to Expana that, “This situation will affect all regions. All producers will struggle to purchase apples for their own production”. The major frost events that hit Turkey in April are expected to have significant consequences on the apple juice sector. Market sources predict a 20-25% year-on-year (y-o-y) loss in crop yields in Turkey due to the frosts, expect raw material prices to rise as a result, and suggest that hitting production targets will be challenging.

The World Apple and Pear Association (WAPA) expects EU apple production for the 2025/26 season to be closely aligned with year-ago volumes, down by just 0.1% y-o-y, to 10.5 million metric tonnes (mt). Although the y-o-y change is minimal, it would represent a 7.5% decrease compared with the 5-year average, amid ongoing difficulties.

Indeed, the sector faces further challenges in addition to adverse weather. Speaking at the Prognosfruit Conference in Angers, France, on August 11, Philippe Binard, secretary general of WAPA, stated “Despite a steady production forecast, the sector faces worrying uncertainties. Climate variability, a limited toolbox to manage biosecurity threats, labor shortage, rising costs not totally offset by market price, geopolitical instability, a volatile trade environment, and currency fluctuation are conditions that are clouding long-term visibility”.

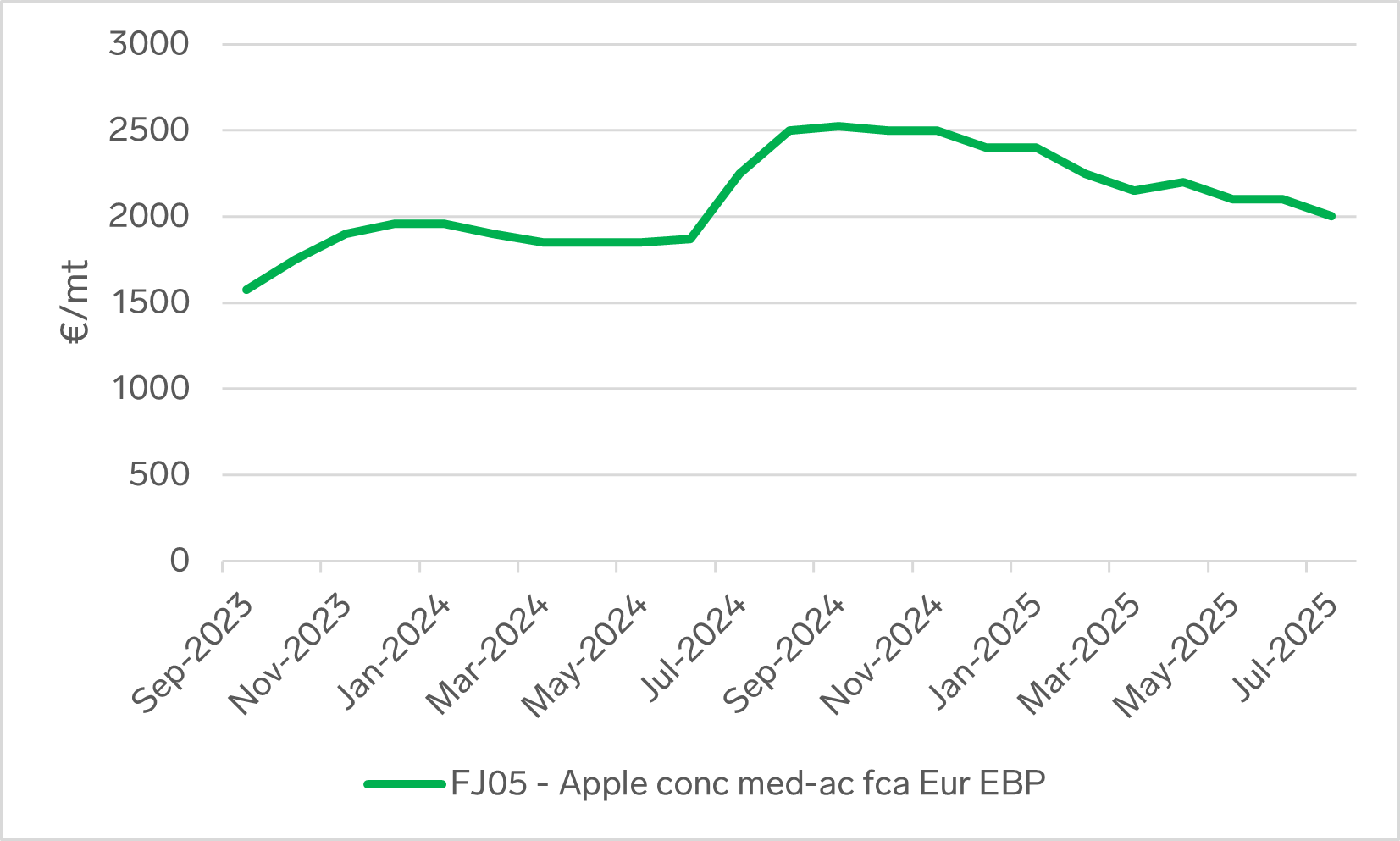

Expana Benchmark Prices (EBP) for European apple juice decreased slightly on July 31, with medium-acid apple concentrate fca Europe down by 4.8% month-on-month, to €2,000/mt. This decrease reflects a quiet period in the market, as the industry awaits the start of the new season.

Some regions have started with early apple varieties, and Turkey’s season is expected to start in September. Expana will continue to monitor the possible emergence of a tight supply situation and whether or not this drives an upward movement in prices for apple juice.

Written by Craig Elliott