During the second half of June 2025, sugar production in Brazil’s main center-south (CS) area fell nearly 13% year on year, according to UNICA (Brazilian Sugarcane and Bioenergy Industry Association).

Despite both sugar production and sugarcane crushing coming in below June estimates, the sugar mix – the percent of total sucrose used for sugar production – came in at a record high, according to the Tropical Research Services (TRS) team at Expana.

The situation mimics the report industry members received regarding the first half of June – production in Brazil’s main sugar region decreased 22%. Industry participants were expecting a decline in Brazilian sugar production (customer access only). However, the decline in June 2025 was more than expected.

Brazilian Weather & Sugar Production

While there is less sugarcane available year-over-year, the availability was not the issue that caused the production and crushing decreases in June, according to Rodrigo Bermejo, a Sugar & Ethanol Analyst on the TRS team at Expana.

“Last year, in the first half of June, it was completely dry,” explained Bermejo who noted significant rainfall in April as well as in June. “But for the last fortnight this year, [sugar] mills lost two-to-three days to rainfall stoppages. This is basically what caused sugar production to decrease year-over-year – it’s not related to cane availability. There was lower crushing because of the rains.”

The recent frost is also worth highlighting, noted Bermejo. Some CS Brazil fields (mostly in Paraná and Mato Grosso do Sul states, but also some in São Paulo and Minas Gerais) were impacted by an event that occurred during the second half of June.

“This frost was more widespread than initially thought,” said Bermejo. “Initially, mills thought [frost] it was localized. But now we know it was widespread and affected several cane producing states… There will be some damage, but we’re still evaluating that… For now, we have reduced our total cane crushing estimate for 2025-26 crop year by 2.5M MT in CS Brazil…”

Weaker Cane?

Also this year, sugar mills are getting less out of sugarcane during processing. The sucrose concentration – in the harvested and crushed sugarcane – is down this year, according to Bermejo.

“Mills here in Brazil can either produce ethanol or sugar,” he said – mentioning that for the last three years sugar as a commodity is worth more than ethanol. “Only a few mills can do 100% of each product. So, this is what we call ‘the mix.’ The cane is crushed, and the resulting juice contains sucrose (or ATR). Mills choose what share of this juice they divert to sugar production based on industrial capacity and prices.”

For now, Expana’s team sees Brazilian sugar production almost unchanged year-over-year.

“Lower sugarcane availability and sucrose concentration should be compensated by stronger sugar mix, even considering that some mills will shift part of their production towards ethanol from now onwards,” according to Bermejo.

Sugar’s Meeting of Minds

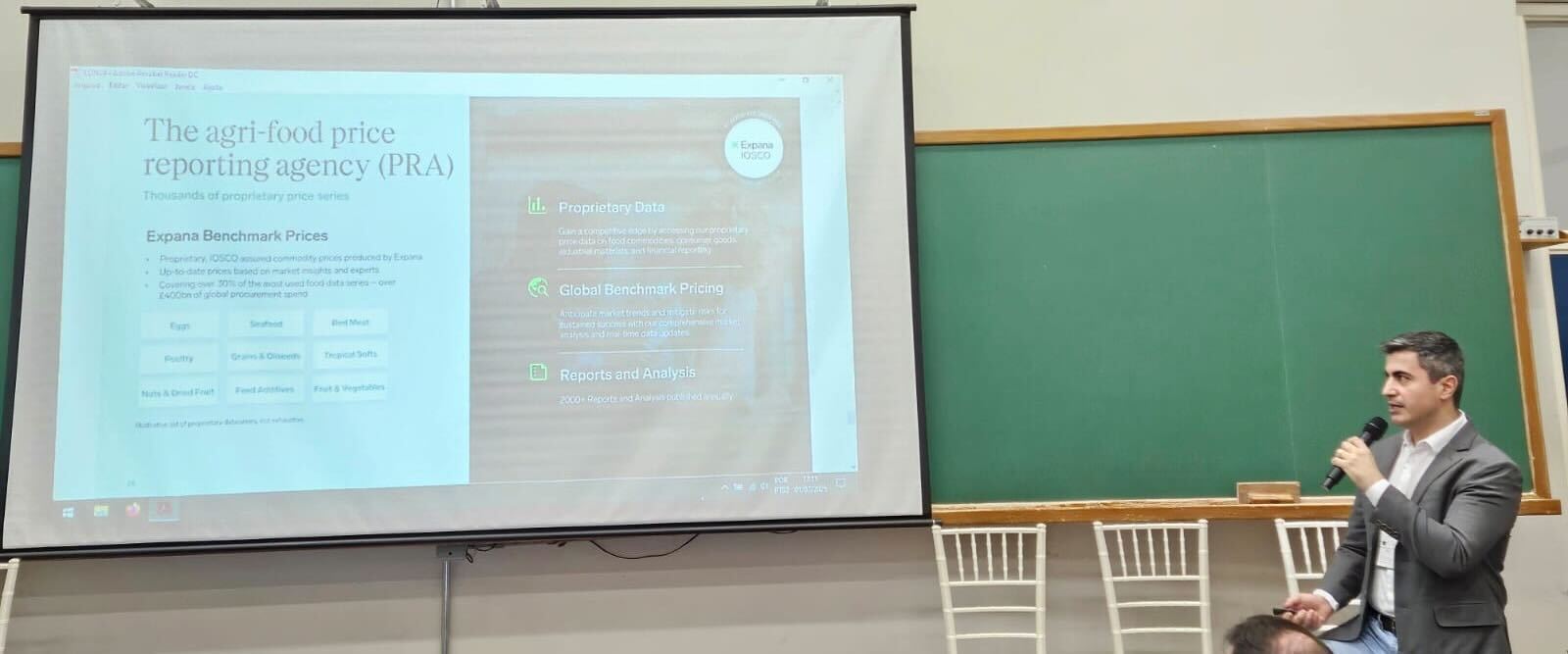

As the June data was being released by UNICA, Bermejo was heading back from an industry event where he represented Expana at the UDOP (National Bioenergy Union) Congress in Brazil.

“UDOP is a union of producers, with a focus on innovation and professional qualifications,” explained Bermejo. This was a big one, and it was the 18th annual UDOP event. It’s a traditional conference in Brazil where the whole industry gets together. Expana was invited to talk about global sugar market.”

Title image source: Shutterstock

Written by Ryan Gallagher