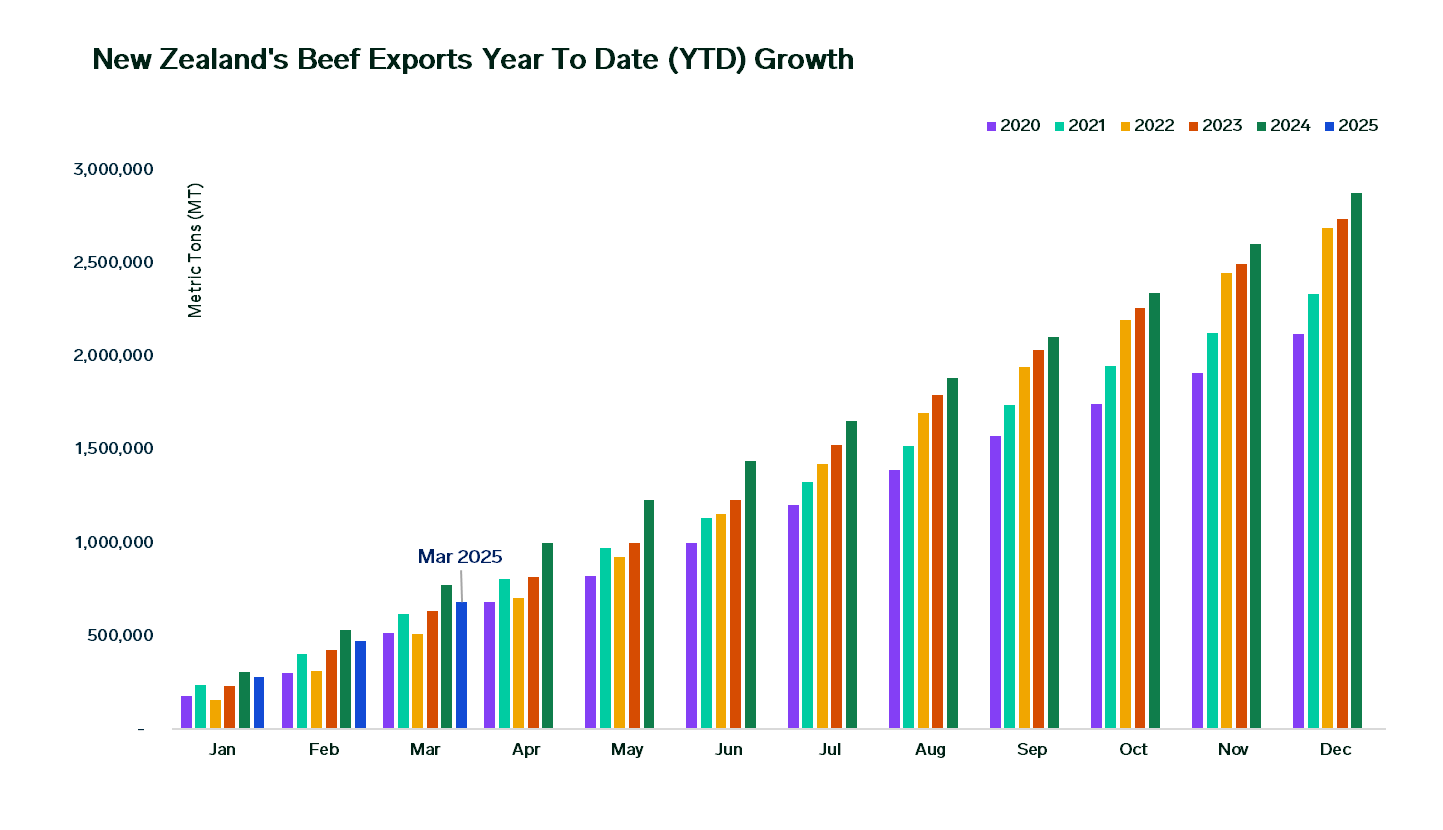

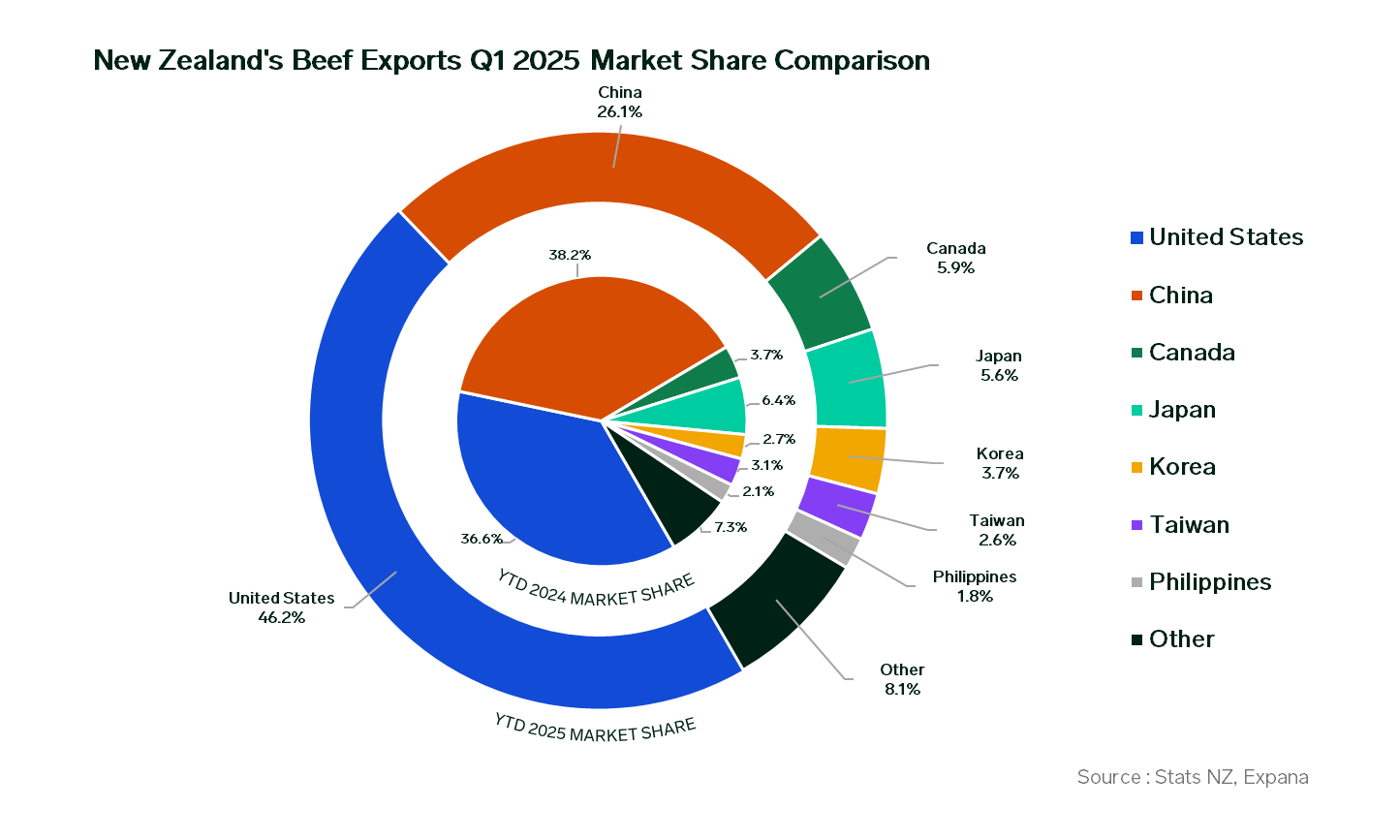

New Zealand’s beef exports in the first quarter of 2025 rose 1.3% year-on-year (YoY) to 134,240 metric tons, according to the latest data from Stats NZ. Stronger volumes to key markets including the United States, Canada, Korea, Taiwan, and the United Kingdom supported the quarterly gain. Exports to China and Japan pulled back, but total shipments still edged up by 1,781 mt.

In the first quarter of 2025, the US cemented its position as New Zealand’s top beef market, taking 62,017 mt or 46.2% of total exports. Shipments rose 27.9% YoY, (+13,521 mt) amid tightening domestic supply. China (customer access), once the leading destination, now accounted for a quarter of its trade. Volumes plunged 30.7% YoY, shedding 15,559 mt to 35,058 mt, weighed down by poor demand and an influx of low-cost South American beef.

Canada took in 7,944 mt, soaring 64.2% or 3,106 mt from the previous year, as shrinking US availability redirected trade flows to New Zealand. The UK also emerged as a key growth market, snapping up 2,070 mt, more than double year-ago levels as supply tightness persisted. Japan (customer access) remained under pressure, with exports slipping 11.0% YoY to 7,492 mt, while Korea (customer access) continued to gain ground, climbing 36.9% to 4,907 mt and claiming a 3.7% market share.

Strong growth in March 2025’s exports

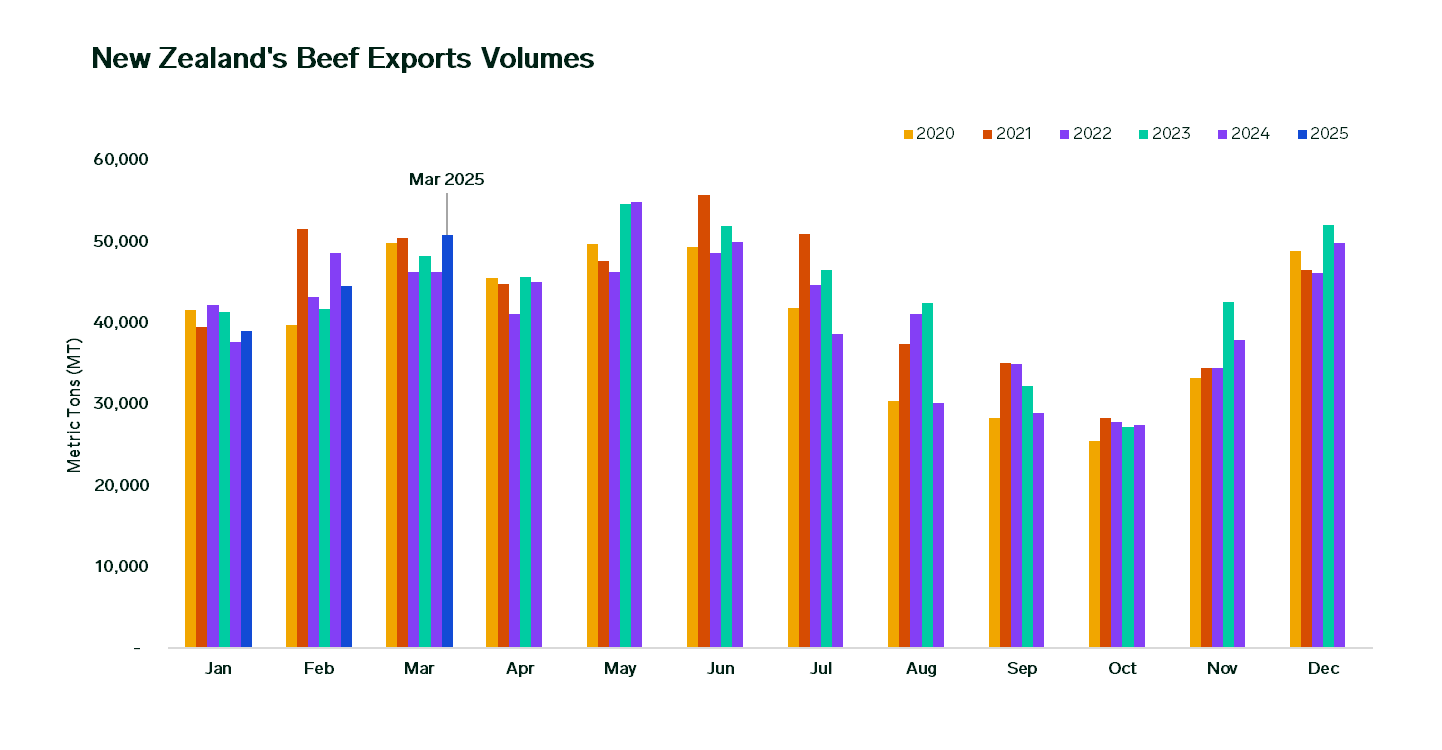

New Zealand (customer access) shipped 50,766 mt of beef in March 2025, up 14.0% from February and marking a ten-month high. Annual volumes rose 9.7%, underpinned by firmer demand from the US and Canada.

The US took the top spot with 24,416 mt of beef from New Zealand, up 17.5% month-on-month (MoM) (+3,644 mt). Annual growth surged 55.2% YoY (+8,679 mt), driven by tight domestic supply and frontloading ahead of Washington’s 10% baseline tariff coming into effect.

China followed in second place at 11,324 mt, down slightly by 1.6% m-o-m (-183 mt). Annual volumes fell a whopping 35.2% (-6,154 mt) y-o-y amid lackluster demand. With better netbacks, New Zealand sent 3,332 mt of beef to Canada, more than doubling from the previous year with a 120.7% increase (+1,822 mt). Exports to the UK rose sharply to 1,008 mt, nearly doubling y-o-y on the back of tight supply. Volumes to Japan softened to 2,897 mt, falling 14.0% y-o-y (-471 mt), weighed down by sluggish consumer demand and continued pressure from the weak yen. Outbound tonnage to Korea clocked in at 1,988 mt, marking a 40.9% rise from the previous year (+577 mt), as New Zealand moved in to plug in shortages left by snug US supply. Exports to Taiwan and the Philippines amounted to 1,267 mt and 1,166 mt, respectively.

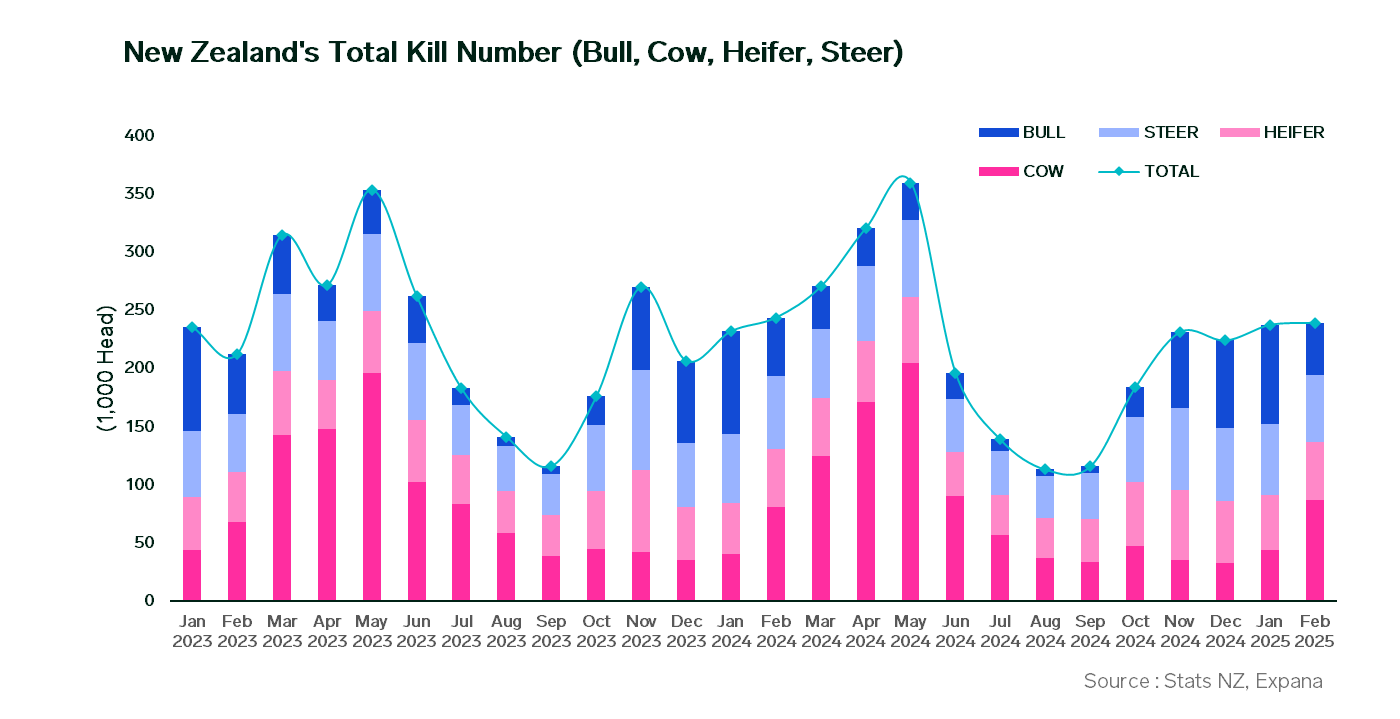

New Zealand’s Cow Season Early Exit

Ample rainfall across drought-stricken parts of the North Island and upper South Island has eased drought conditions but also held back slaughter numbers in recent weeks, alongside with the string of national and state holidays. Industry sources now suggest the peak cow kill season may have passed earlier than usual, with volumes likely peaking by late April rather than May. This would equate less supply available for the rest of Q2 2025 and consequently hurt export growth. New Zealand’s total livestock slaughter in February 2025, covering bulls, cows, heifers, and steers, were recorded at 239,049 head, according to official Stats NZ data.

In line with seasonal trends, the end of its bull production season and start of the cow season pushed figures up by a paltry 0.8% m-o-m (+1,855 head). The Waitangi public holiday also capped kill rates in the first week of the month. On a yearly basis, the cull rate slipped 1.8% (-4,357 head) amid a firm stance on herd retention. Fresh March figures are expected to be released in the coming weeks. Revised official figures now place New Zealand’s beef exports at 37,924 mt for November 2024, 49,826 mt for December 2024, and 39,068 mt for January 2025.

Expana provides regular beef market coverage for the geographies listed in this analysis. Click below to dive deeper in the beef market prices for different origins and destinations:

Asia Pacific (customer access)

Co-authored by:

Joe Muldowney

1-732-240-5330 ext. 244

[email protected]

Bill Smith

Expana

1-732-240-5330 ext. 265

[email protected]

Image source: Shutterstock

Written by Junie Lin