The Atlantic Norwegian salmon industry has experienced strong production levels so far this year. In 2024, the sector faced several health challenges, notably Winter Ulcer Disease (WUD), which resulted in a higher proportion of low-quality fish and raised concerns regarding animal welfare. The primary bacteria responsible for WUD is Moritella viscosa, which negatively affected both survival rates and market prices. However, the situation has improved in 2025 due to the enhanced performance of a vaccine targeting M. viscosa, leading to increased production year-on-year (y-o-y).

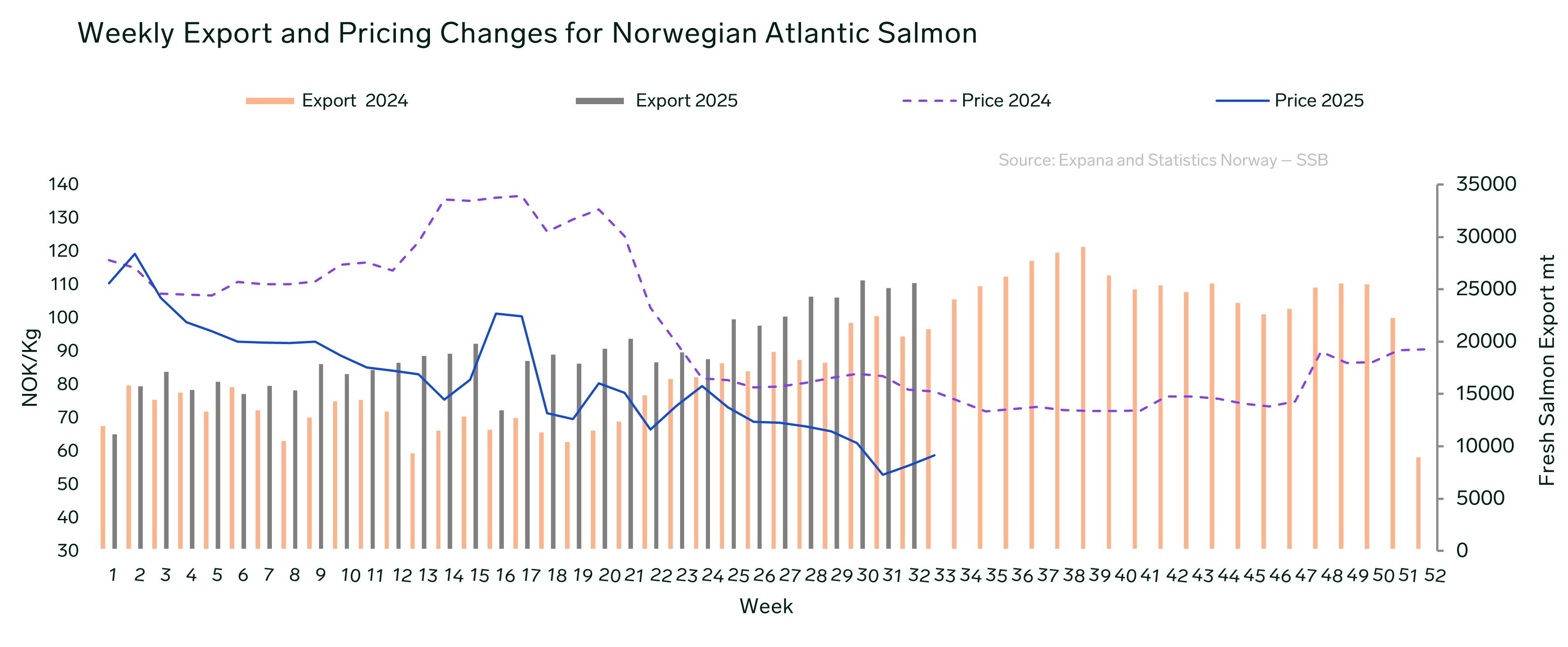

Figure 1: Weekly exports of Norwegian fresh salmon (metric tons) by week in 2024 and through week 32 of 2025, based on data from Statistics Norway. The figure also displays the price trend in NOK/kg for Norwegian Atlantic farmed salmon, fresh whole fish (FOB Oslo, Norway, 4–5 kg) for 2024 and through week 33 of 2025, as reported by Expana.

Norwegian Salmon Exports

Weekly export data for fresh and chilled salmon, as reported by Statistics Norway, indicates that exports have exceeded 2024 levels since week 7 (February 10–February 16, 2025). Market participants have observed a recent slowdown in the growth rate of supply from Norway. This development is reflected in official figures: exports of fresh salmon from weeks 23 to 27 increased by 17.9 % y-o-y to reach 22,600 metric tons (mt), while the supply increase between weeks 28 and 32 was 5.3 % y-o-y at 25,796 mt. There is also information suggesting that some Norwegian producers are choosing to freeze their salmon, which may explain the slower speed of export growth. It is expected that export volumes will peak between weeks 36 and 39 (September), as a result of a more intense harvesting activity as the summer holiday period ends.

Norwegian Salmon Price

In terms of price performance, the Expana Benchmark Price (EBP) for Norwegian Atlantic farmed salmon, fresh whole fish (FOB Oslo, Norway, 4–5 kg), has trended lower year-to-date compared to 2024. Since week 3 of 2025, prices have been well below 2024 levels, and the gap widened during spring (weeks 9–22), with 2025 prices in the mid-NOK 70s, whereas 2024 prices remained around NOK 120 kg. Recently, market activity has become firmer; from week 31 to week 32, 2025, exports increased from 24,317 mt to 25,796 mt (up 1.9 % week-on-week, w-o-w), and prices rose from NOK 55.6/kg to NOK 58.6/kg (up 5.5 % w-o-w).

In summary, unless demand increases to match the elevated supply projected for 2025, prices in the Norwegian Atlantic salmon market may remain under pressure throughout the year.

Written by Boris Ampuero