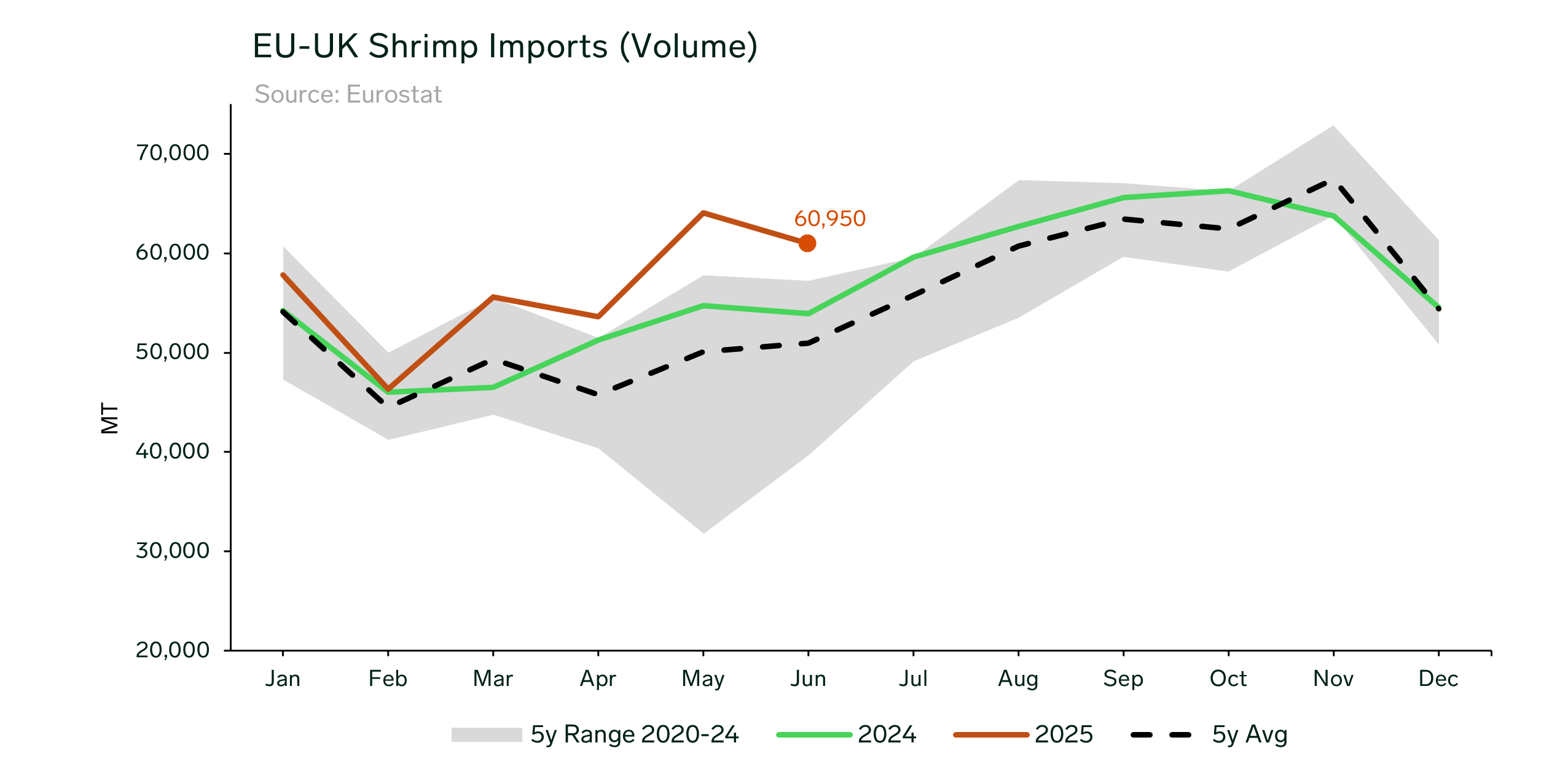

The European Union has just released its latest trade volume data for June 2025, revealing that total shrimp imports in the EU-UK region remain well above the five-year historical averages, reaching 60,950 metric tons in June. Although this represents a 4.9% decrease compared to May, it marks a notable 13.0% increase year-over-year. This figure is 19.7% higher than the five-year average for the month of June. The decline in June follows a typical seasonal pattern: European importers tend to place orders for summer supplies in May, resulting in full inventories by June.

During the first half of 2025, the EU and the UK imported 338,383 metric tons of shrimp, consolidating the region’s status as one of the major buyers this year. Imports for H1 stand at 10.3% higher than last year and 14.8% above the five-year average for the same period.

Ecuador emerged as the top supplier to the EU-UK region in H1, exporting 122,271 metric tons—accounting for 36% of total imports. In June, Ecuador posted a remarkable 62.5% year-over-year increase, and a 36.4% rise for the first half overall. India and Vietnam followed, representing 14% and 10% of H1 imports respectively. Both countries reported positive year-over-year growth, with imports rising by 18.4% from India and 20.8% from Vietnam so far this year. Notably, Vietnamese exports to the region jumped by 20.3% in H1 compared to last year, signaling growing demand for value-added shrimp from European buyers. Argentina and Greenland ranked fourth and fifth, each holding about 7% of the market. Both supply wild-caught shrimp, with Argentina fishing Pleoticus Muelleri whereas Greenland catches Pandalus Borealis. They benefit from strong demand in Europe; however, exports remain constrained this year due to reduced landings in Greenland and fishermen strikes in Argentina.

Recent U.S. tariff announcements have significantly impacted global shrimp trade, with countries such as India now facing a 50% duty when exporting to the United States. These high tariffs are prompting shrimp exporters to focus on alternative markets, and Europe represents an increasingly attractive destination for them.

Written by Fabienne O'Donoghue