Over the past week, tensions have escalated markedly in the Middle East, specifically between Israel and Iran. Tensions increased following military action by Israel, which involved missile strikes and assassinations of top Iranian military officials and nuclear scientists. Iran responded with missile strikes on targets in major Israeli cities, including Tel Aviv.

The escalation has caused major concerns within the energy markets, with players worried about the potential impact of military action on supply and the transport of goods. Indeed, concerns intensified because some of the attacks targeted oil refineries and depots on both sides, such as the Haifa refinery in Israel and a fuel depot in Tehran. Sources are now waiting to see what further action each side will take, and how the international community responds to the developments. In recent days, UK jets have been moving into position in the region in anticipation of further escalation.

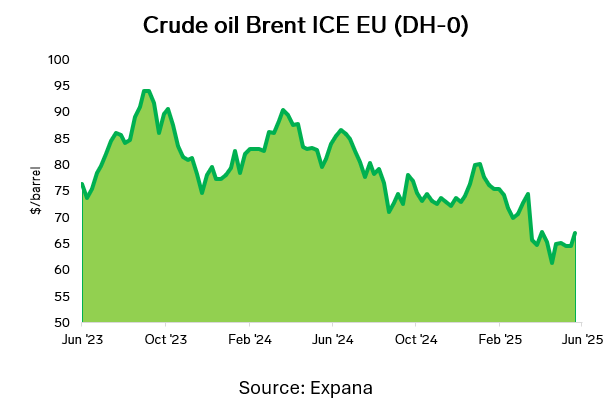

According to market players, the volatility in the crude oil price and the continued uncertainty will have a profound impact on plastics prices, which is heavily reliant on crude oil and refined products as feedstocks. As such, the sources believe that if crude oil prices continue to rise due to conflict-related supply concerns, plastics prices will likely increase in the coming months, increasing production costs for a variety of goods using plastic packaging.

Image source: Adobe

Written by Andrew Woods