The squid market continues its volatile trajectory into 2025, with many of the same challenges persisting and one significant development poised to reshape the broader market landscape. Supply across most squid species and origins entering the U.S. remains difficult to navigate, a trend that has persisted for some time. Meanwhile, the market continues to show signs of disruption, with sourcing diversification, a long-standing advantage for this wild-caught species, now proving even more critical. A major turning point came with the introduction of new presidential legislation on April 2, establishing “Liberation Day” tariffs. This policy imposed a blanket 10% tariff on all U.S. imports effective April 5, alongside elevated duties on 57 individual countries. Most notably, Chinese imports are now subject to tariffs as high as 145%. A temporary 90-day suspension of reciprocal tariffs was granted starting April 9, though China was explicitly excluded. This pause has contributed to growing uncertainty regarding the possible reinstatement of tariffs for other countries after the grace period expires.

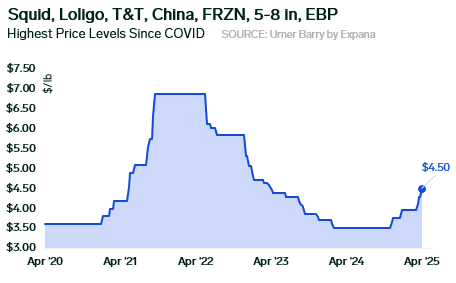

Squid Price Chart

Chinese loligo, which had already begun facing upward price pressure in 2024 due to ongoing global shortages, particularly from Peru and India, is now approaching price levels that were last seen during the 2021 foodservice recovery. At that time, China’s strict zero-COVID policy disrupted supply chains and created a significant supply-demand imbalance. This led to a sharp pricing spike that extended into 2022. The recent implementation of punitive tariffs on Chinese-origin squid is adding further upward pressure, accelerating shifts in sourcing and pricing dynamics. Currently, 5–8 tubes & tentacles from China is priced at an average of $4.50/lb, marking a 28.5% increase compared to the same period last year.

As the market absorbs the implications of the new tariff landscape, sourcing strategies are being actively reassessed across the supply chain. Buyers are expected to pivot more aggressively toward alternative origins where possible, though capacity constraints and ongoing production shortfalls in key regions may limit near-term flexibility. With the potential for continued volatility and cost structures continuing to evolve, the squid market enters a phase that underscores the need for adaptive procurement strategies and close monitoring of geopolitical and regulatory developments.

To keep on top of tariff changes, how they could impact your business and how to respond to upcoming changes, sign up to our weekly Tariff Talks rundown.

Image source: Adobe

Written by Josh Bickert