ICE London and ICE New York Cocoa futures have seen choppy trading, initially gaining in the week following the release of major Q1 grindings figures on April 17. Spot futures in London closed at £5,842/mt on April 16, and last traded at £6,360/mt, an increase of nearly 9% in the past week of trading as London was closed for a long weekend following the grindings figures. In New York, the increase has been slightly steeper due to a weakening USD over that same time period, with the spot NY cocoa futures contract rising from $8,096/mt on April 16 to $9,145/mt on April 28, an increase of 13% over the past week and a half (12% in GBP terms) and including a contract roll from MAY25 to JUL25.

Cocoa Futures Chart

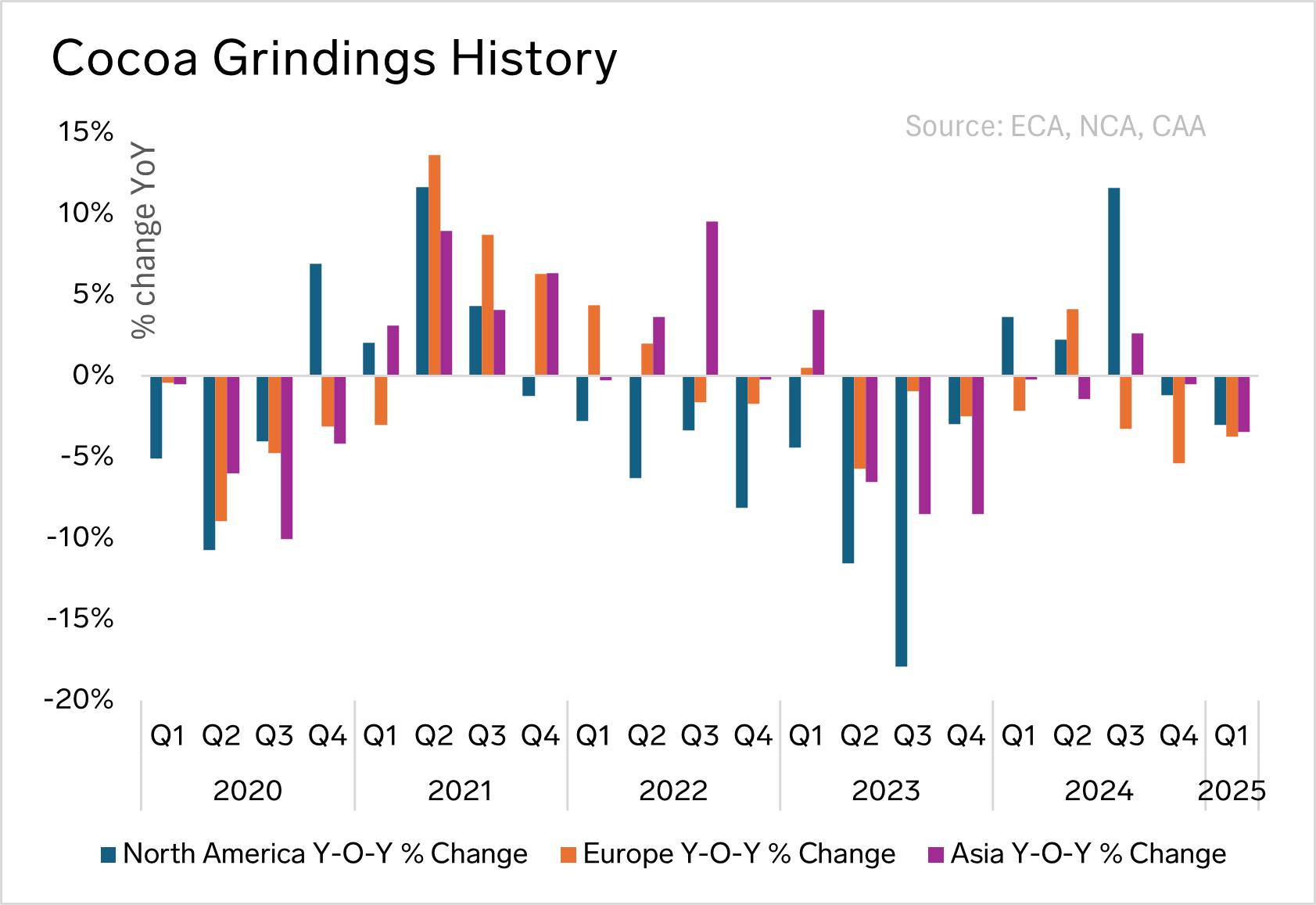

Despite falling year-on-year, Q1 grindings figures were generally stronger than many in the industry anticipated. Ahead of the release on April 17, market sources told Expana that confectionery retail sales in most major consuming regions were still lagging some 8-12% y-o-y in Q1, and that Easter sales were down by roughly 5% across Europe.

In the Expana Cocoa Insight report for April, we noted that market expectations for European grindings were for a decrease of 4-5% y-o-y. The actual figure came in at 3.75%, slightly stronger but still close to the higher end of the range. In North America, grindings fell at an even smaller rate, just 3% y-o-y, and in Asia, grindings fell 3.45%. All of these were just shy of the lower end of the range expected by market participants in calls with Expana. This contrasts with even lower grindings in many origin countries. The European Q1 grind of 353,522 tonnes represents the lowest Q1 grinding figure since 2017.

These slightly strong grindings figures did cause some price increases in the sessions that followed, though on choppy trading, the market in London is already beginning to give up some of those earlier gains. Sources told Expana that a simplification of the EUDR compliance mechanism announced by the European Commission on the same day as the grindings reports was also instrumental in providing some bullish pressure on price; as a result of the announced simplifications, the European Commission estimates the cost of EUDR compliance to be some 30% lower than previous estimates once it enters into effect at the end of this year.

Concerns still remain about the size of the upcoming midcrop in west Africa, with one trader telling Expana that weather forecasts continue to provide the majority of fundamental bullish support for prices, not the Q1 grindings.

We track 31 separate cocoa price series on the Expana platform. Request a demo to see more here.

Image source: Shutterstock

Written by Andrew Moriarty