US President Donald Trump’s long-touted import tariff regime has started to take shape throughout February, providing some clarity amid the uncertainty that has gripped global markets since his election in November 2024.

Trump’s administration has targeted China with tariffs of 10% on all imports and 25% import tariffs were applied to Canada and Mexico (which were subsequently delayed by 30 days).

On February 13, Trump signed a memorandum ordering his advisers to create a plan to tackle the US trade deficit. “The ‘Fair and Reciprocal Plan’ will seek to correct longstanding imbalances in international trade and ensure fairness across the board,” according to a fact sheet from the White House.

This followed Trump’s announcement on February 11 that his administration would impose tariffs of 25% on all imports of aluminum and steel, without any exceptions or exemptions, due to take effect in March.

With food and agriculture trade already experiencing significant headwinds, Expana analysts have assessed the impact on packaging materials.

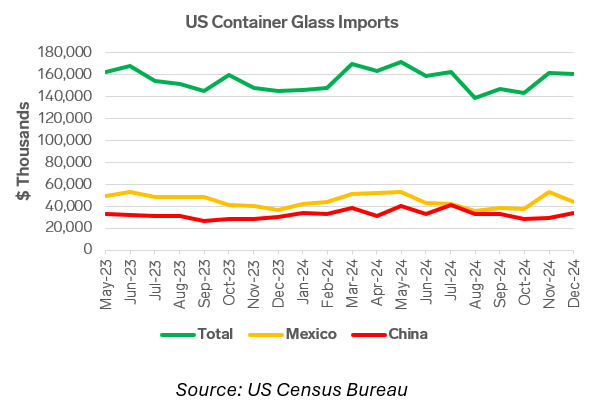

Container Glass

Market participants in the US import a significant volume of container glass products, including food jars, beer bottles and wine bottles. In December 2024, according to the US Census Bureau, the US imported around $160 million worth of container glass products, primarily from neighboring countries, including Mexico (which accounted for 29.1% of total glass imports in 2024). China is also a critically important supplier, accounting for 20.9% of the US’s total glass imports in 2024.

The US has previously examined container glass imports from Mexico, China and Chile, particularly wine bottles, through anti-dumping investigations. However, the Trump administration’s implementation of tariffs will fundamentally change the global container glass trade, according to market sources. Given the significant volume of glass imports coming from Mexico and China into the US that may become subject to tariffs, market participants have stated that they consequently expect buyers to purchase greater volumes from domestic manufacturers to avoid tariff risk, potentially increasing market prices.

Currently, participants note that the differential between market prices and manufacturing costs is far greater in the US than in Europe, for instance, highlighting the relative uncompetitiveness of the US container glass market.

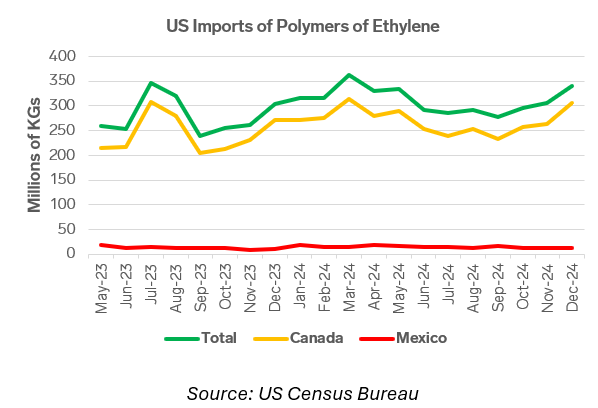

Plastics

US imports of polymers of ethylene mainly originate from neighboring Canada. Polymers of ethylene include low and high-density polyethylene (LDPE and HDPE) and polyethylene terephthalate (PET), used for various types of plastic packaging and plastic bottles.

According to the US Census Bureau, Canada accounted for 86.5% of polymers of ethylene imports in 2024. As such, the prospect of a 25% tariff on Canadian-origin plastics would greatly increase costs for US importers, according to market sources. Mexico is the second most popular origin for polymers of ethylene, which constituted only 4.7% of total polymers of ethylene imports in 2024.

Market participants remain on the alert for more developments in plastics markets, particularly regarding the imposition of tariffs on Canada and Mexico. If plastics become subject to 25% tariffs from these origins, market sources believe that US importers will prioritize domestic producers where possible.

Pulp

The US paper and pulp industry is highly integrated with that of Canada. It also relies heavily on imports from countries such as Brazil, Uruguay, and Sweden. The Trump administration’s recent threats of tariffs on Canada, Mexico, China, and other countries, if implemented, could have far-reaching consequences, including higher costs for consumer goods in the US such as tissue, toilet paper and paper towels, according to market sources.

Tariffs of 25% across most US pulp imports from Canada would represent roughly $488 million, based on the import value of Canadian pulp in 2024. The US imports a negligible amount from Mexico (~$300,000 in 2024) and China (~$650,000 in 2024), according to data from the US International Trade Commission.

Given that current pricing for Canadian softwood pulp (which accounted for roughly 90% of US softwood pulp imports from Canada in 2024) is already higher than that of similar US softwood pulp, the higher costs incurred by tariffs would likely push US producers to try to increase domestic sourcing, according to market players. While the US does have an adequate supply of trees, it would take some time and investment to bring pulp production up to necessary levels to meet domestic demand. Other major sources of softwood lumber are either too small to offset the loss of Canadian pulp (Scandinavia) or politically problematic (Russia).

Metals

The announcement of 25% tariffs on steel and aluminum imports has already increased metals demand and prices in the US: aluminum premium US Midwest on, February 14, rose by 25% w-o-w and Steel Hot Rolled Coil (HRC) 3 months futures on Chicago Mercantile Exchange (CME) rose by 9% w-o-w.

The US is particularly dependent on imported metals used in the packaging industry. In 2024, based on International Trade Administration data, the US imported about 5 million tonnes of unwrought aluminum and aluminum products, which was a decrease of 1% year-on-year (y-o-y). In contrast, foil imports rose by 9% y-o-y to 0.3 million tonnes, showing strong demand. US steel imports in 2024 grew by 2% y-o-y, but the weak growth was primarily due to falling demand for construction steel products. At the same time, imports of flat-rolled steel rose by 17% y-o-y, while imports of tinplate, primarily used to produce steel cans, rose by 32% y-o-y, reflecting dynamically growing import demand.

Packaging manufacturers and other metal-dependent industries anticipate another round of rising costs, which may lead to supply chain adjustments, price hikes and potential demand slowdowns. These developments could impact inflation and the overall economic climate, making the situation even more unpredictable for businesses.

Co-authored by:

Craig Elliott

Expana

[email protected]

Greg Potter

Expana

[email protected]

Andrew Woods

Expana

[email protected]

Written by Artem Segen