After hitting a low of 273.20 c/lb on July 7, the DEC25 ICE Arabica futures contract rose to 300.90 c/lb on July 16 before falling back to 291.8 c/lb as of the time of publication. A number of factors within the coffee market have led to the choppy and uncertain trading conditions.

Weather Impacting Production

A hailstorm in key grower Minas Gerais in Brazil on Friday the 25th lent a bullish undertone to prices, with market participants telling Expana that although the damage may be somewhat limited, it could still have the impact of removing several tens of thousands of bags from Brazil’s next crop in 2026. Meanwhile, according to Safras & Mercado, the current Brazil harvest is around 85% complete, compared to a five-year average of 77%.

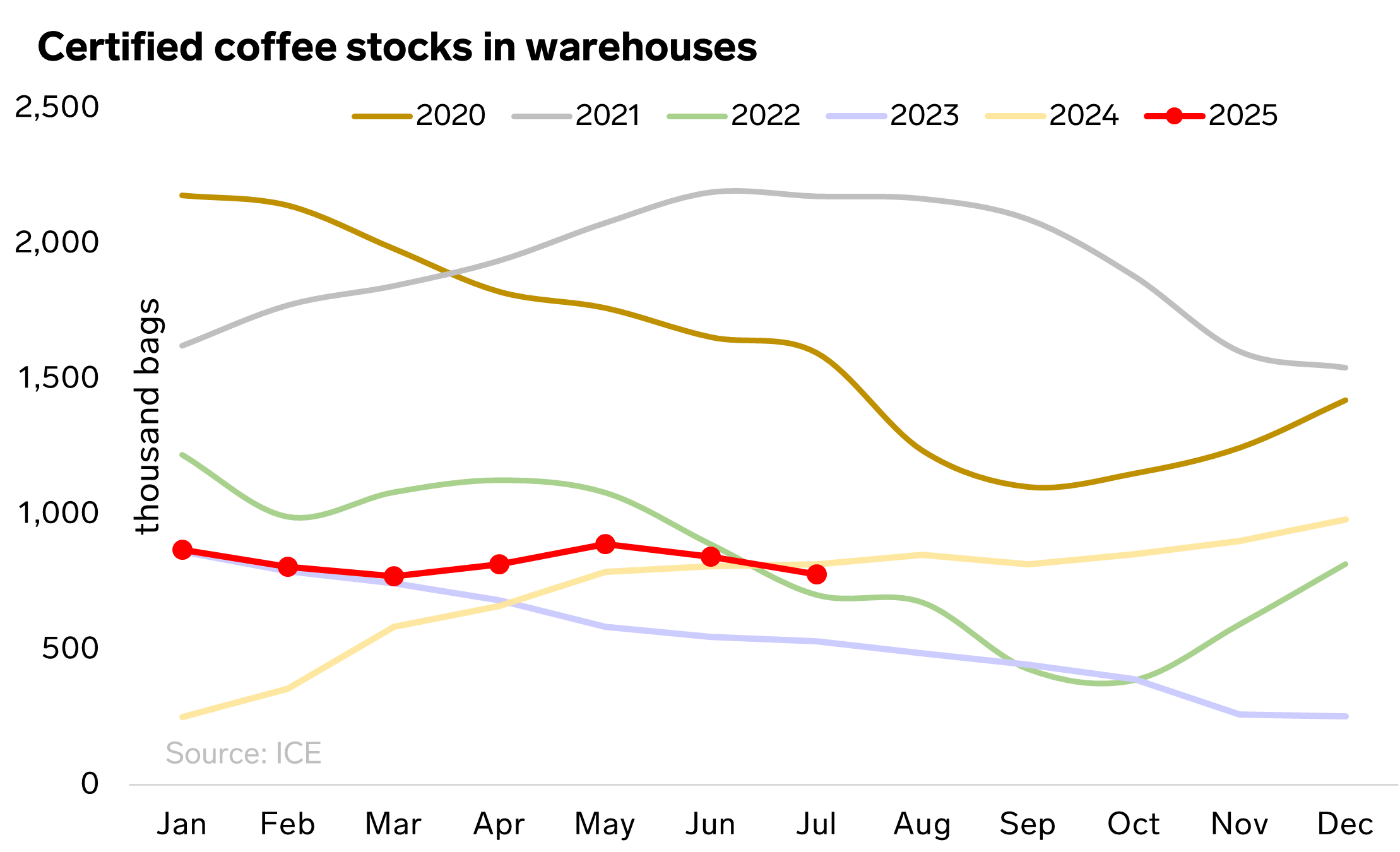

Dwindling Inventories

Certified inventories have also continued to dwindle, primarily in Antwerp where majority of stocks are held. The most recent report from July 30 shows a total of 775,476 bags of coffee in stocks, with Brazil’s share dwindling in recent months as origins like Mexico and Peru have increased their volumes. A handful of traders have told Expana that at current market levels around 300 c/lb, prices still remain above cost of production for most commercial grades in many origins, but as prices tick below that level, tendering to the exchange becomes less attractive. In addition, many of these lots may have been presold at higher price levels, prompting traders to draw down these inventories now to make delivery.

Tariffs Driving Volatility

Tariffs are also driving price volatility, with US Commerce Secretary Howard Lutnick saying on Tuesday, July 29 that examples of agricultural products not typically grown in the US could be zero rated as part of new trading deals done with the US. Secretary Lutnick was speaking specifically about a trade deal with Indonesia, where coffee was mentioned specifically as a kind of agricultural item not produced in any notable quantity. One trader told Expana: “[Brazilian president] Lula has been taking a firmer stance in discussions with the US, so we’re still trying to interpret what this means for wider consumption patterns. If an were signed with the US [and Brazil] that lets coffee escape the proposed 50% tariff level, that could potentially be bullish. Americans still want to drink coffee and Brazil is their largest supplier.”

Image source: Adobe

Written by Andrew Moriarty