The outlook for West Africa’s next cocoa harvest remains uncertain, with some market participants telling Expana that growing areas, particularly in Ghana, are facing drought conditions, while growers in parts of Côte d’Ivoire have described conditions as generally stable. The contrast underscores the uncertainty of forming a clear picture ahead of the main crop, due to begin in October 2025, particularly with the implementation of EUDR at the end of 2025.

Tensions in Ghana’s producing regions are adding to the uncertainty. Farmers have stepped up protests over what they describe as unacceptably low farmgate prices, with some along the border threatening to smuggle beans into Côte d’Ivoire, which is raising concerns about availability of exports in the coming main crop and has added to the upward and choppy price moves seen over the past several sessions.

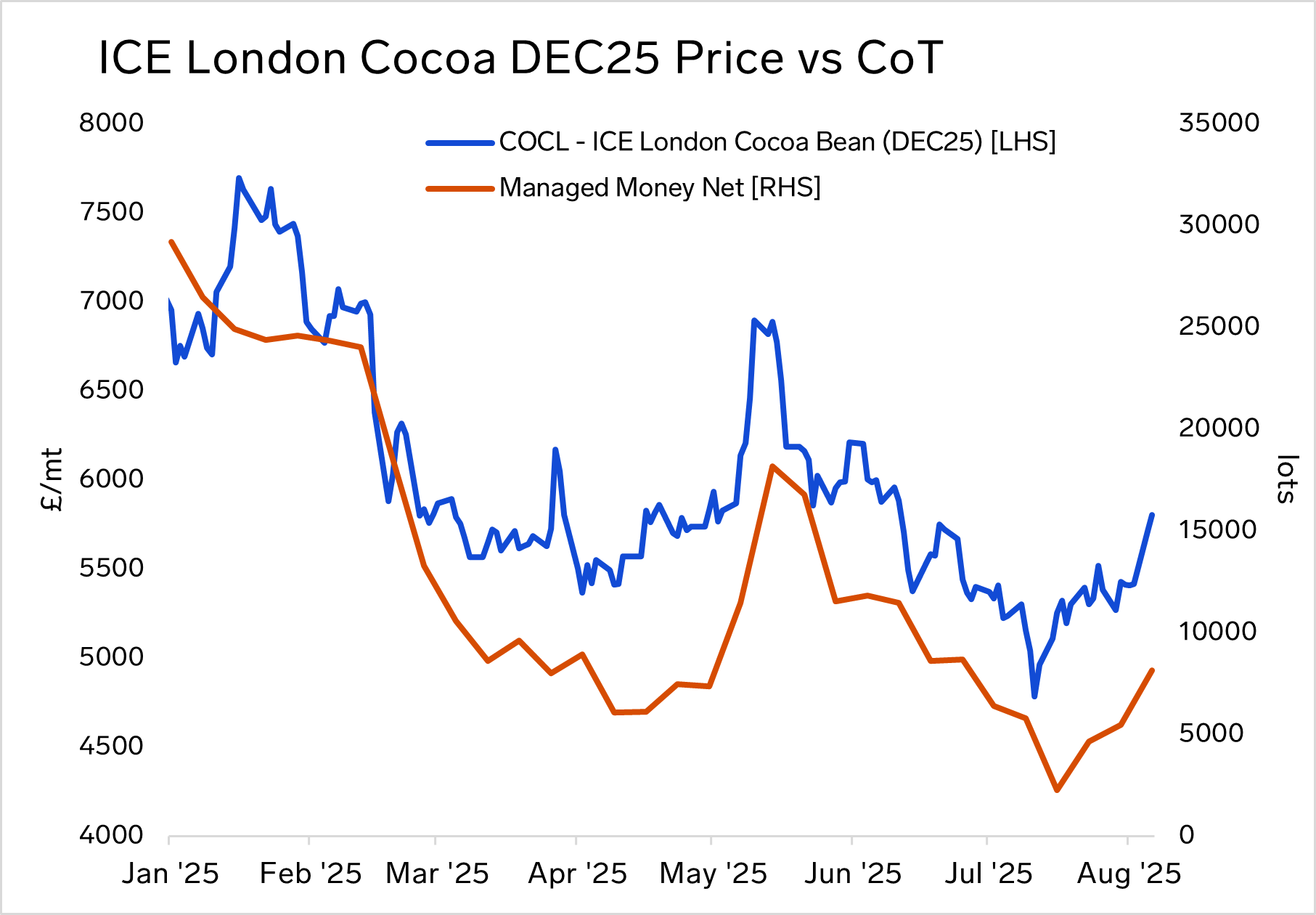

Expana crop surveys in Ghana point to additional challenges. Pod set is at its weakest for this point in the season since 1999. Although pod survival remains in line with normal seasonal patterns, overall pod load has dropped to 91% of the ten-year average, down from 100% three weeks earlier. Price action on the ICE London futures exchange moved sharply higher last week, with the December 2025 contract briefly rallying to £5,800/mt last week before losing some momentum. The contract closed at £5,551/mt on August 15 and has made few additional gains today as of the time of publication. News of the dry weather concerns last week saw speculative buying increase, with funds increasing their net long position by nearly 3,000 lots week-on-week as of the most recent report, which was met with producer selling. Traders report that hedging flows and a lack of speculative follow-through have kept the market capped below £5,900, even as supply risks mount.

Image source: Adobe

Written by Andrew Moriarty