UK recycled glass prices drop amid a fall in exports

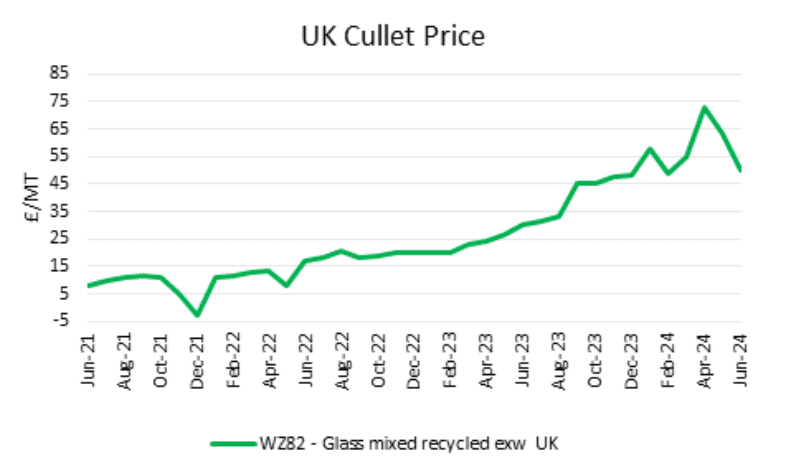

After several months of consecutive rises, prices for UK mixed recycled glass have started to fall, registering £50/MT in June 2024 (latest data). The June figure is the second successive price decline following a high of £73/MT in April 2024 and marks a 20.6% month-on-month (m-o-m) decline. Despite the recent downward price action, UK mixed recycled glass prices remain 65.3% higher on an annualized basis.

Source: Mintec Analytics by Expana

Recycled glass is a critical raw material in glass production, as its inclusion in batch materials, where it substitutes for silica sand, lowers energy costs for manufacturers and is beneficial for the environment. In recent years, the level of recycled glass included in glass container manufacturing has steadily increased, with some bottles now containing as much as 80% recycled glass. As such, demand for recycled glass remains robust and is expected to continue climbing, according to market sources.

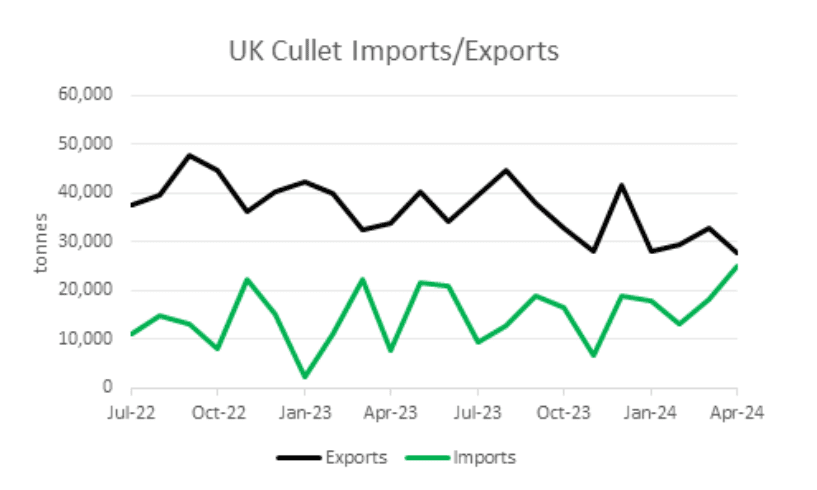

However, the recent price decline can be attributed to import/export dynamics. According to HMRC, in April (latest data), exports of UK cullet fell 15.2% m-o-m to 27,800 tonnes, representing a 17.8% year-on-year (y-o-y) decrease. Conversely, UK cullet imports for that month nearly exceed exports, hitting 25,100 tonnes in April, representing a 37.6% m-o-m increase, with the UK on the verge of becoming a net importer of cullet.

One hypothesis is, therefore, that the high April prices drew in international products as well as kept more domestic cullet within the country, and this additional supply helped drive the fall seen over the last two months. Market sources believe there have been efforts to keep more UK cullet within the country, with one trader stating that the “message may be slowly filtering through.” Expana will provide further updates as more information becomes available.

Base metal prices continued to decline in July

The downward trend in base metals prices continued in July. A seasonal decline during the holiday season in the EU and the US significantly reduced activity in base metals trading. This supported a bearish trend among investment funds. Also, globally metal consumption is currently less robust than production, risking supply/demand imbalances. As a result, prices for most base metals fell by an average of 2-6% month-on-month in July, although Zinc and Tin declined marginally. Nevertheless, looking at weekly price dynamics, the downward price trend was characteristic of all metals.

Speculative demand for base metals continues to weaken as investors are not prepared to go long on a falling trend. Market sources believe that investment funds are waiting for the price trend to reverse and once they are sure that the price bottom has been reached, they will probably continue to buy base metals again.

High inventories accumulated in the global market could also exacerbate the market surplus. Especially against the backdrop of a downward price trend and negative results of fundamental consumption industries. The construction and automotive industries in the US and EU showed a decrease in production for the first five months of 2024. Residential construction in the US is experiencing a downturn in demand as the number of new homes for sale has been rising steadily since H2 2023 and in May was at the highest level in 14 years. The Production in construction index in the EU in May fell to the worst level since August 2021. Production of motor vehicles in the EU in May fell by 14% y-o-y, and by 8.4% y-o-y for the first five months of 2024. In April and May, new car registrations were stable. However, the May figure was 3% lower y-o-y. Total vehicle sales in the US fell by 4% m-o-m and 5% y-o-y in June; new car sales fell by 7% m-o-m and 3% y-o-y. The upcoming US presidential election is a significant deterrent to buyer activity, due to economic uncertainty.

Want to dig into further insights? Discover more on our insights page.

Written by Nick Wood