The global salmon market is currently being impacted by a complex web of tariff impacts, seasonal demand shifts, and evolving supply dynamics as April unfolds. With Holy Week beginning April 14 and the recent imposition of a universal 10% tariff on several major salmon-exporting nations, volatility has intensified across both the farmed fillet and whole fish markets.

Tariffs Disrupt Market Flow

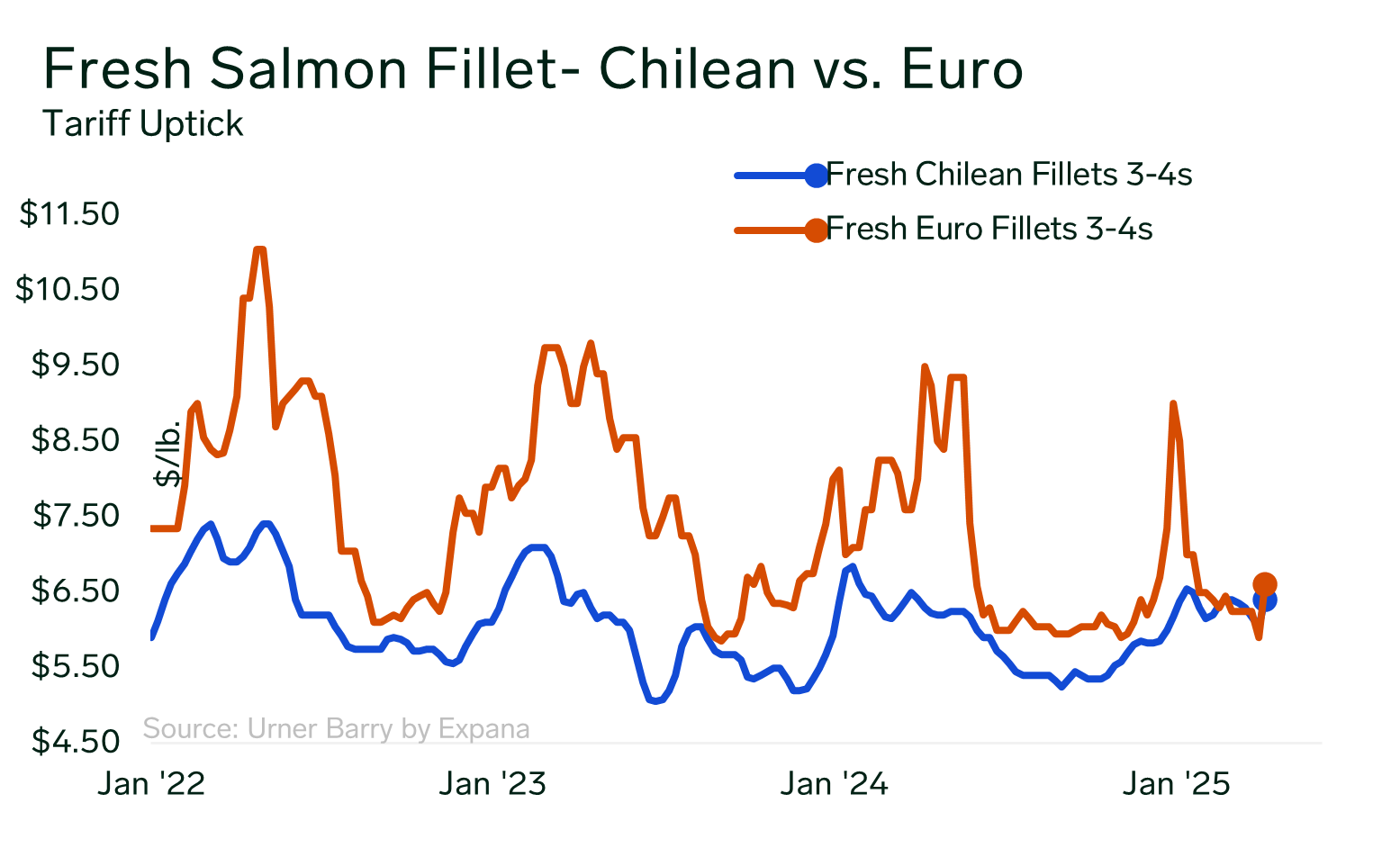

On April 5, a 10% tariff was implemented on fresh farmed salmon imports from Chile, Norway, Scotland, and Iceland. Canada, however, remains exempt under the USMCA trade agreement, maintaining a 0% tariff rate. The fresh or non-frozen nature of fresh salmon as a commodity makes it particularly sensitive to such shifts, and the market has responded swiftly. Fresh Chilean fillets have seen a 6% price increase over the past week, while European fillets surged by 12%. The larger increase in European products is likely due to earlier assumptions that reciprocal tariffs from the European Union would begin April 9. Under the anticipated escalation, Norway’s tariff was set to rise from 10% to 15%, Scotland’s would remain at 10%, and processed products from EU countries such as the Netherlands and Germany would be hit with a 20% tariff. Although these reciprocal measures are now on a 90-day pause, the uncertainty continues to weigh on the market.

Norway’s Biomass Boosts Whole Fish Supply

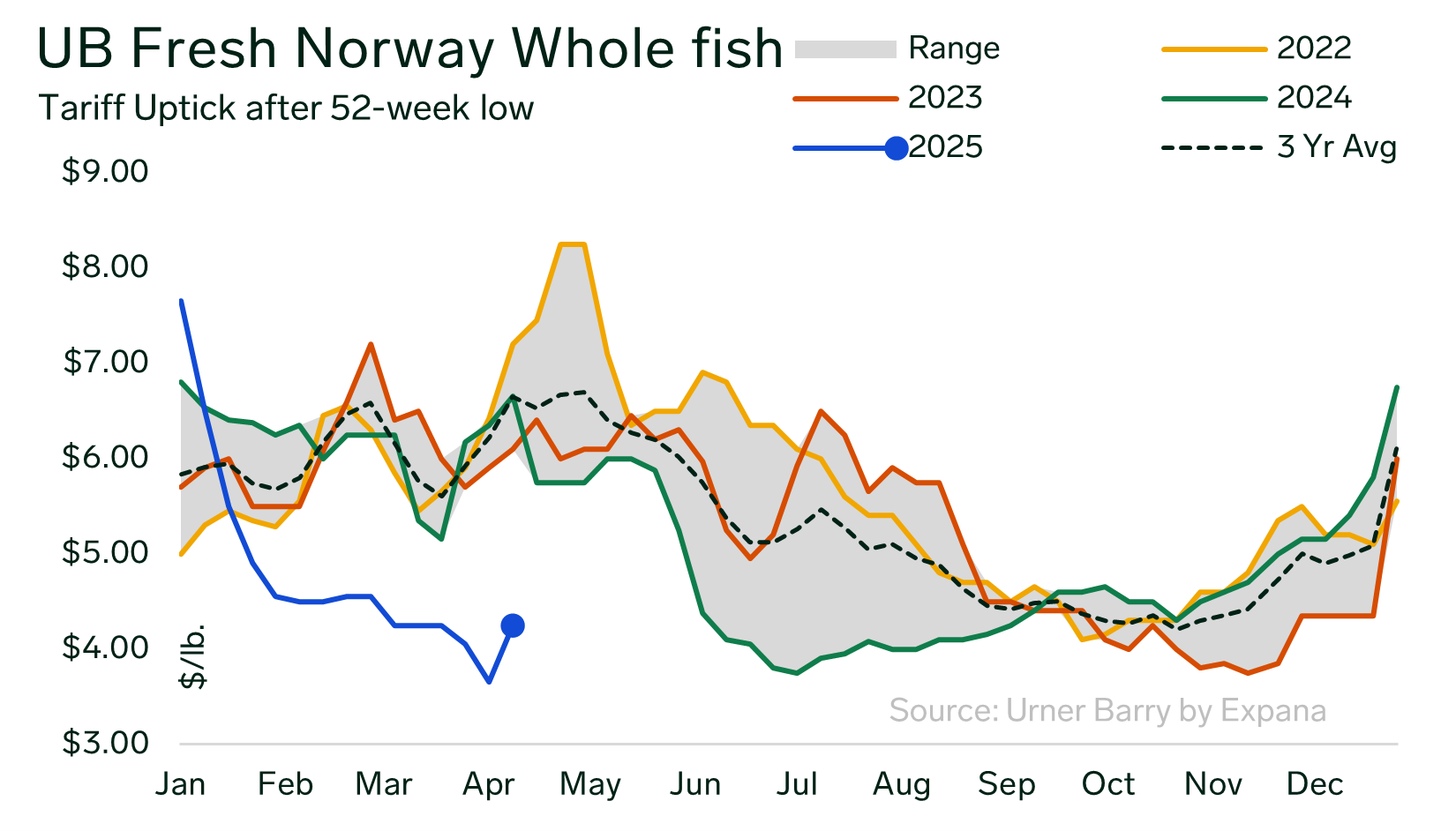

In the whole fish segment, Norway has maintained fully adequate to strong supply levels since the start of 2025. Market participants report increased biomass, which has translated into rising U.S. import volumes. Recent data through February 2025 shows imports of fresh whole Norwegian salmon are up 82%, while fresh fillet imports from Norway have grown by 35%.With this supply influx, pricing pressure continues. Fresh whole Norwegian salmon—particularly 6–7 kg fish—hit a 52-week low at the beginning of this month. Even after a recent 12% price adjustment, values remain 36% below the three-year average, suggesting lingering softness in demand or an overhang from pre-tariff inventories.

Retail Trends: More Features, Higher Prices

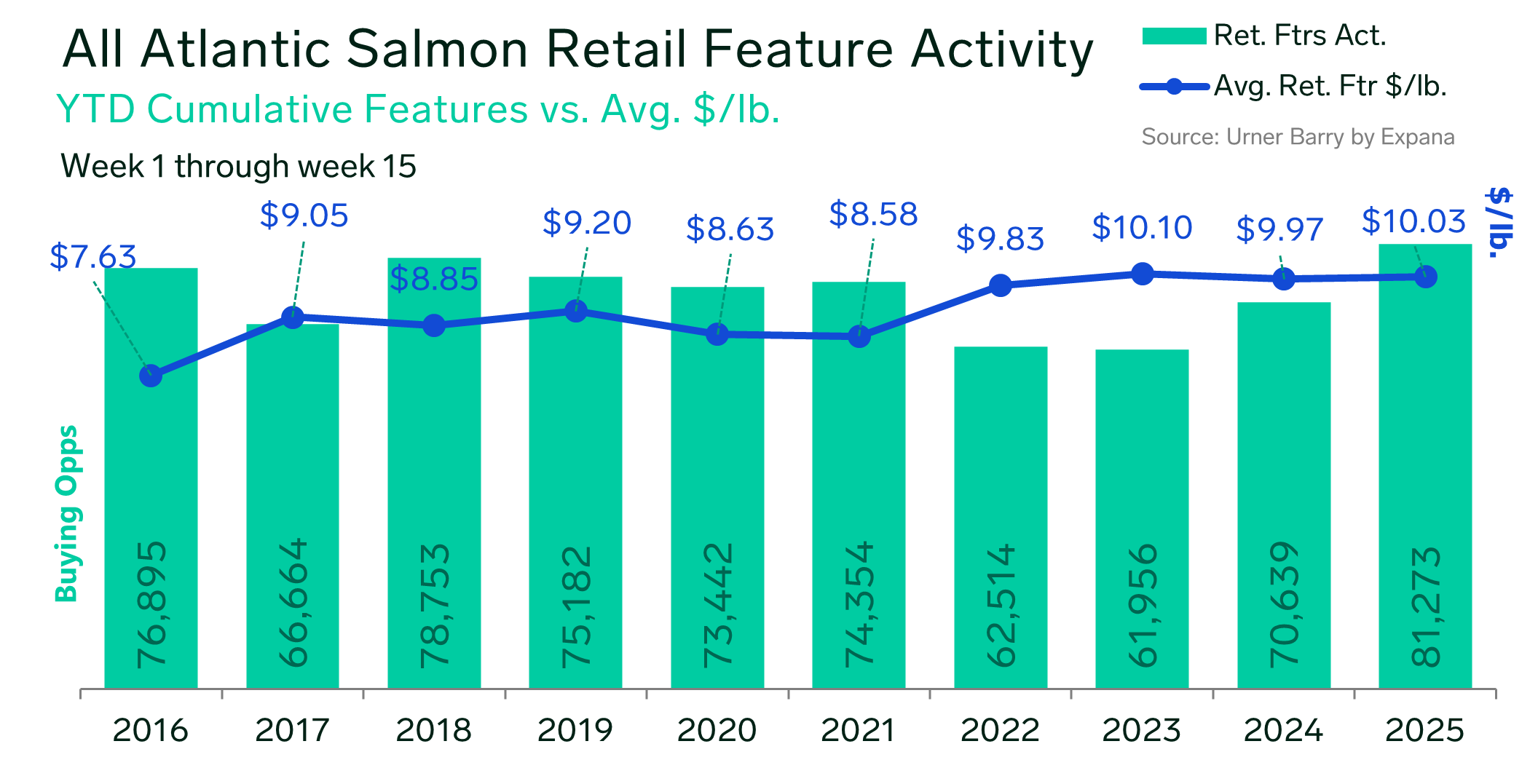

In the U.S. retail space, promotional activity for fresh salmon fillets has increased 15% compared to the same period last year. The average price per pound has climbed slightly—up 0.6%—and now sits above the $10 mark.

Looking Ahead: Mother’s Day in Focus

As Easter concludes the Lenten season, attention shifts to Mother’s Day—a key demand driver for fresh farmed salmon in the U.S. With the global market still contending with the aftermath of tariff adjustments and the looming possibility of future reciprocal tariffs, stakeholders are bracing for continued volatility. In the coming weeks, market participants will closely monitor tariff developments, supply volumes out of Europe and Canada, and U.S. consumer demand. Canadian producers may gain a competitive edge due to their exemption from the new tariffs, while European suppliers face ongoing uncertainty.

At Expana, our seafood market intelligence is industry leading. Request a demo of our platform here.

Written by Janice Schreiber