The Argentine Naval Prefecture has authorized the fishing of squid (Illex argentinus) in national waters north of the 44°S parallel. This decision, effective from March 26, 2025, follows recommendations from the National Institute of Fisheries Research and Development (INIDEP). This authorization is based on scientific evaluations by INIDEP, which examined the distribution, population dynamics, and migration patterns of the squid stock. The measure aims to ensure the sustainable fishing process of the resource, enhance the operational capacity of the Argentine fleet, and increase catches around the 200-mile zone, according to the Argentine Chamber of Jigger Fishing Vessel Shipowners (CAPA).

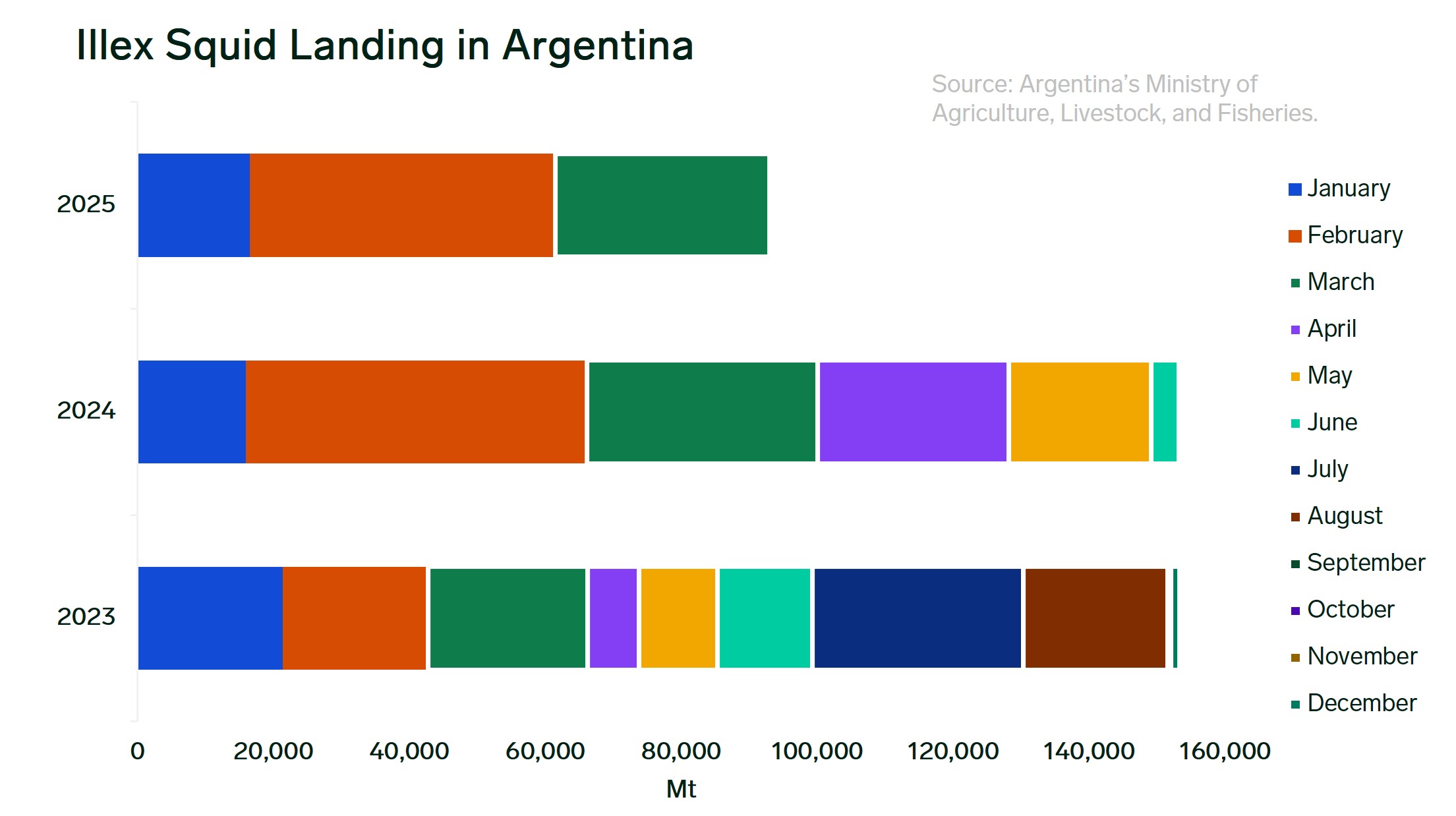

The latest update from Argentina’s Ministry of Agriculture, Livestock, and Fisheries, released on March 26, 2025, indicates that the catch level from January to March 2025 reached 92,972 metric tons (MT), representing a decrease of 7.1% year-to-date (YTD). However, market participants are optimistic that approving fishing operations north of the 44°S parallel will help maintain a catch level similar to that of 2024. Last year, annual landings of illex squid amounted to 154,565 MT within the Exclusive Economic Zone (EEZ).

Figure 1: Illex squid landings on MT until March 26, 2025. Source: Argentina’s Ministry of Agriculture, Livestock, and Fisheries.

Despite the reduction in catches, the Expana Benchmark Prices (EBP) for illex squid tubes and rings processed in China indicate an average price reduction of 2% in March 2025. For example, the price for U5 tubes, factoring in CFR to Europe (cost, insurance, and freight), has been assessed at $4.25 per kilogram, demonstrating a decrease of 1.2% month-over-month (m-o-m) and a drop of 2.8% year-over-year (y-o-y) in March.

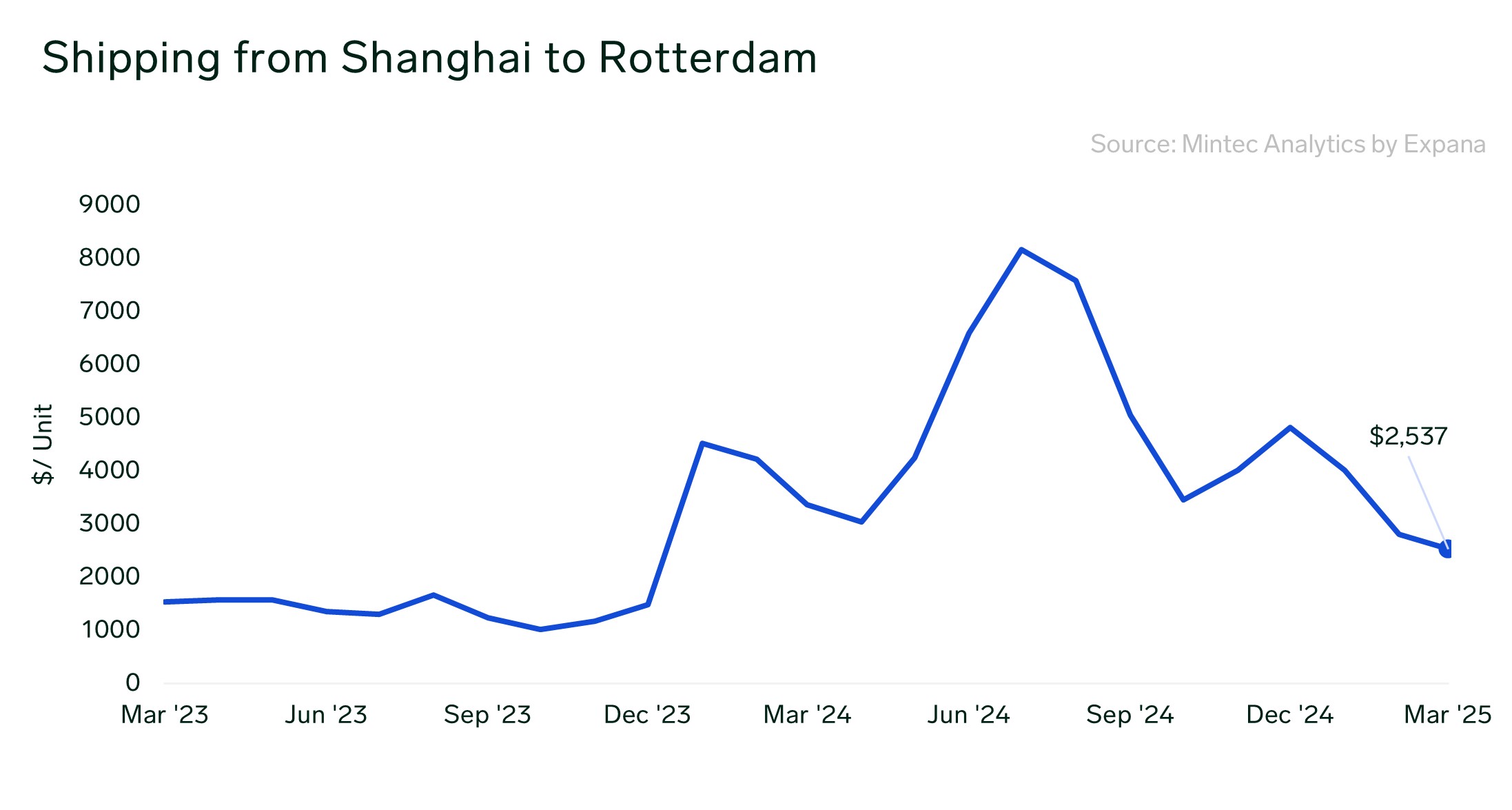

One of the main reasons for the reduction in the price of squid products in Europe is the decrease in shipping costs from Shanghai, China, to Rotterdam, Netherlands. As reported by Expana, these costs dropped by 9.5% m-o-m in March, reaching $2,537 per unit (Figure 2), which represents a 24.78% decrease y-o-y. The reduced demand for container shipping has significantly impacted container prices. Consequently, ocean freight rates have fallen to their lowest levels since early 2024, although they still remain above the rates seen in 2023, prior to the Red Sea shipping crisis.

Figure 2: Cost of maritime shipping of a 40-foot shipping container from Shanghai (China) to Rotterdam (Netherlands). Source: Mintec Analytics by Expana.

Written by Boris Ampuero