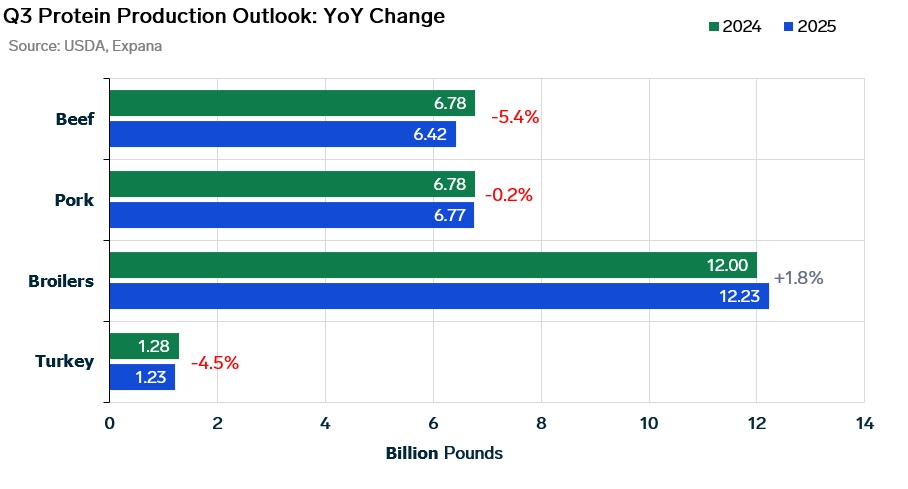

The USDA is forecasting a mixed outlook for U.S. protein production in Q3, with significant declines expected in beef and turkey, while pork and broiler output remain steady or edge higher.

Beef Production

Beef production is projected to fall sharply year-over-year (YOY), down 5.4% from 6.78 billion pounds in Q3 2024 to 6.42 billion pounds in Q3 2025. This reflects a tightening cattle supply pipeline, a trend that has persisted throughout much of the year and continues to pressure beef availability.

Turkey Production

Turkey output is also forecast to contract, slipping 4.5% YOY to 1.23 billion pounds. The reduction in turkey availability remains tied to disease-related disruptions, robust domestic demand, and limited hatchery expansion. With migratory bird season ramping up, market participants are keeping a close watch on highly pathogenic avian influenza (HPAI) cases. At the same time, ongoing vaccination programs targeting Avian Metapneumovirus (aMPV) have left some players speculating whether or not production could stabilize in the months ahead.

Pork Production

Pork production is expected to remain nearly unchanged, edging down just 0.2% YOY to 6.77 billion pounds in Q3. According to USDA, tighter slaughter hog availability in July was the primary factor weighing on overall quarterly output. Broiler production, however, tells a more positive story. Ready-to-cook (RTC) broiler output is projected to increase 1.8% YOY, climbing from 12.0 billion pounds in Q3 2024 to 12.23 billion pounds in Q3 2025. This gain aligns with broader industry trends, including record-setting weekly live weights and ongoing year-over-year increases in hatchery figures and headcount. These gains incremental gains reinforce chicken’s position as the growth engine of the protein sector.

Chicken Production

In addition to stronger production figures, chicken continues to benefit from its competitive pricing relative to other proteins. Wholesale values for chicken remain significantly below those of other protein options, supporting demand at both the retail and foodservice levels. This affordability advantage, combined with reliable supply growth, has left many industry participants optimistic heading into the fall.

Image source: Adobe

Written by Dylan Hughes