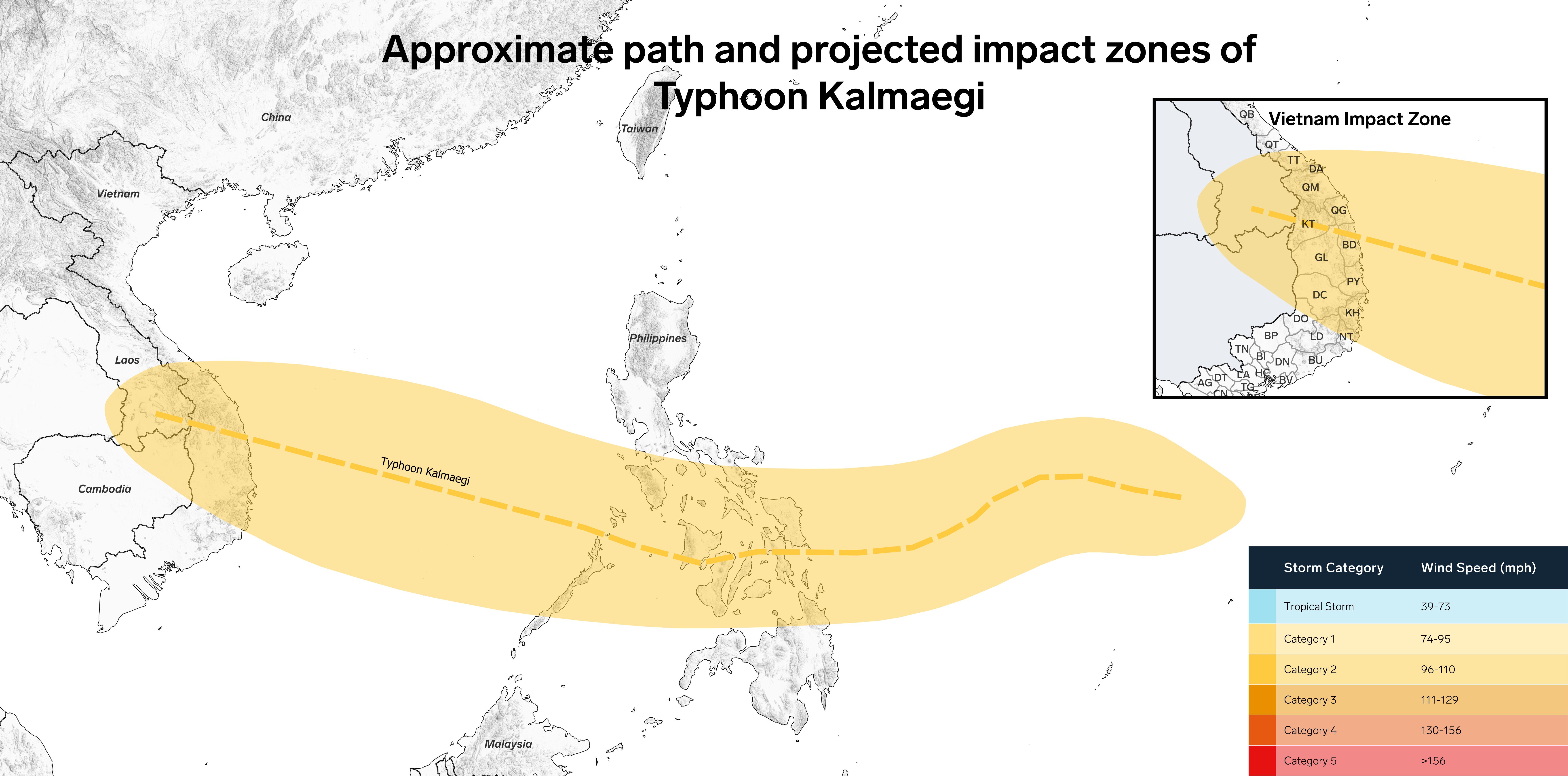

Typhoon Kalmaegi has become the near-term focus for the Vietnam coffee market this week, with heavy rainfall continuing to develop across major robusta producing regions. Kalmaegi formed in the Philippine Sea on November 1 and made landfall in the Visayas, Philippines, on November 4 at Category 2 strength on the Saffir Simpson Scale. A second landfall along Vietnam’s South-Central Coast is expected today, November 6. At least 114 people were killed in the Philippines and over 35 have died in Vietnam due to flooding and landslide events. Although the typhoon was initially expected to intensify to Category 3, its latest trajectory keeps it at a lower intensity window, though still capable of bringing further disruptive rainfall. According to one industry source, storms in Vietnam are unlikely to materially affect final production volumes this season but are likely to slow the pace of the crop, especially in terms of logistics, drying and forward movement of cherries from upcountry toward export channels.

October rainfall overall was highly uneven, with very heavy rain recorded in the first and last ten days of the month, while the middle ten days were noticeably drier. Rainfall year to date remains mostly above normal in key producing provinces.

On fundamentals, Vietnam’s 2024/25 crop is now estimated at 28.6 million bags, up 4% year on year, according to Expana data. Combined Ho Chi Minh City and upcountry stocks are assessed at around 3.1 million bags, revising total export availability higher to 31.5 million bags versus 30.1 million in the previous season. Robusta is expected to contribute around 27.3 million bags, while arabica output is assessed at approximately 1.3 million bags. Shipments remain firm, with October to September green exports seen up 4% year on year at 21.8 million bags, while processed product exports are up 18% year on year.

Given stronger availability, Vietnam export pace into Q1 2025 is expected to remain active and meet near-term global robusta demand. However, typhoon headlines and continued weather volatility remain key short-term risk factors to monitor in the weeks ahead.

Co-authored by: Demelza Knight, Expana

Written by Sammy Rolls