A potential recipe shift by Coca-Cola (customer access only) and other beverage industries to use cane sugar instead of corn syrup as a sweetener is the most recent win for the “Make America Healthy Again” movement. US President Trump stated last week that Coca-Cola had agreed to use cane sugar in its drinks in the United States following discussions with the company.

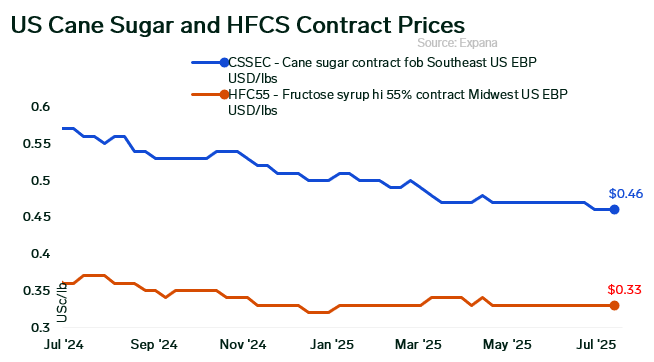

Coca-Cola began using high fructose corn syrup 55% in its US products in the early 1980s, with the switch completed by 1984. The change was driven by factors including increased supply availability in the US corn industry and lower prices compared to cane sugar. The Expana Benchmark Prices for these items continue to reflect this trend, with cane sugar contract FOB Southeast most recently assessed at $0.46/lb and high fructose corn syrup 55% contract FOB Midwest assessed at $0.33/lb.

Similar to the US sugar market, the sweeteners market has been quiet in recent weeks. High fructose corn syrup prices are under pressure from projected record high corn production and weakening demand for some products. Prices for corn sweeteners are mostly weaker from 2024, with stronger demand for high fructose corn syrup 55%. Also, the USDA is projecting record-high 2025 US corn production, and a lower average corn price.

Market participants tell Expana that Coca-Cola’s demand for sugar would be extremely taxing on the market, and domestically there would not be enough sugar available. According to Reflexity, a market intelligence firm, changing the composition of Coca-Cola in the US from high fructose corn syrup to sugar would increase sugar demand by 1.4 million metric tons annually.

Most domestically produced sugar in the US comes from sugar beets, representing between 55% and 60% of sugar production, according to the USDA. To fulfill Coca-Cola’s needs, Reflexity calculated that sugar cane production would need to increase by 36%.

The company would need to rely on imports to meet demand but based on market feedback this could also present a challenge as Brazil, the world’s largest sugar producer, is now facing a 50% import tariff from the US. Brazil’s finance minister stated today that the country will not give up on negotiating with the US but acknowledged that a trade deal may not be reached by August 1, when President Trump’s 50% tariff on Brazilian goods are set to go into effect.

Industry players are taking a wait-and-see approach as the trade situation continues to develop, and other companies are considering reformulation. Sources state that movement is starting to pick up as we are well into summer, while some buyers indicate they will not enter the market until next month. A few players cite that factors like import tariffs and strengthening demand could cause sugar prices to tick higher, and buyers that hold out for too long may miss the bottom of the market.

Written by Andraia Torsiello