In recent developments, Brazil has been officially recognized as free from foot-and-mouth disease (FMD) without vaccination by the World Organization for Animal Health (WOAH), as announced during the 92nd General Session held in Paris this week. The new status marks a significant milestone in Brazil’s long-term efforts to strengthen animal health systems and bolster sanitary credibility in international markets.

FMD is a highly contagious viral disease affecting livestock, including cattle, swine, sheep, goats and other cloven-hoofed ruminants. Though rarely fatal in adults, the disease causes serious productivity losses and remains a WOAH-notifiable disease. Brazil’s FMD trajectory dates back to its first recorded cases in 1895, followed by nationwide vaccination programs starting in the early 1990s. The country gradually expanded its status, with Santa Catarina recognized as the first FMD-free-with-vaccination state in 2007, followed by national coverage in 2008.

The recent certification is expected to broaden Brazilian beef trading opportunities, expanding destination options. For instance, Philippines and Indonesia have already signaled interest in Brazilian beef varieties following the announcement. While the Philippines was Brazil’s fifth-largest beef importer in 2024, taking 92,032 mt, Indonesia ranked 23rd with 11,418 mt, indicating further growth potential.

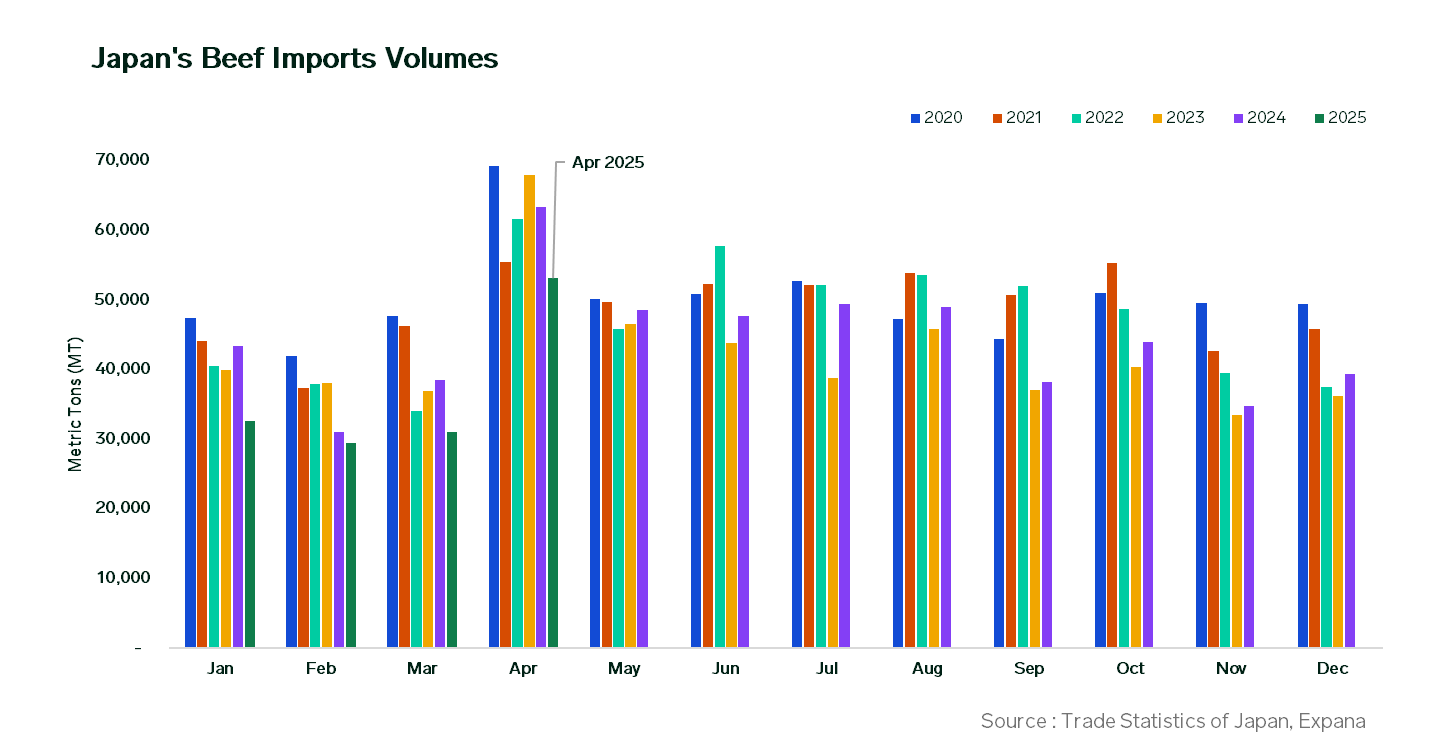

However, the greater opportunity lies in Northeast Asian countries, such as Japan and South Korea, world’s third and fourth largest beef importers, respectively. Both markets are known for their preferences for high-valued beef options, maintaining stringent import restrictions on beef, particularly affecting the premium segment. In 2024, Japan imported 527,639 mt of beef, with nearly half sourced from Australia and over a third from the United States. Japan YTD imports in the first four months of 2025 dropped 17.0% YoY to 146,040 mt amid fragile macroeconomic situation, high living costs and a weakened yen. Nonetheless, some believe that this challenging scenario poses an opportunity for Brazilian beef to enter this market as a cheaper option to the Japanese consumers who still keep beef in their eating habits.

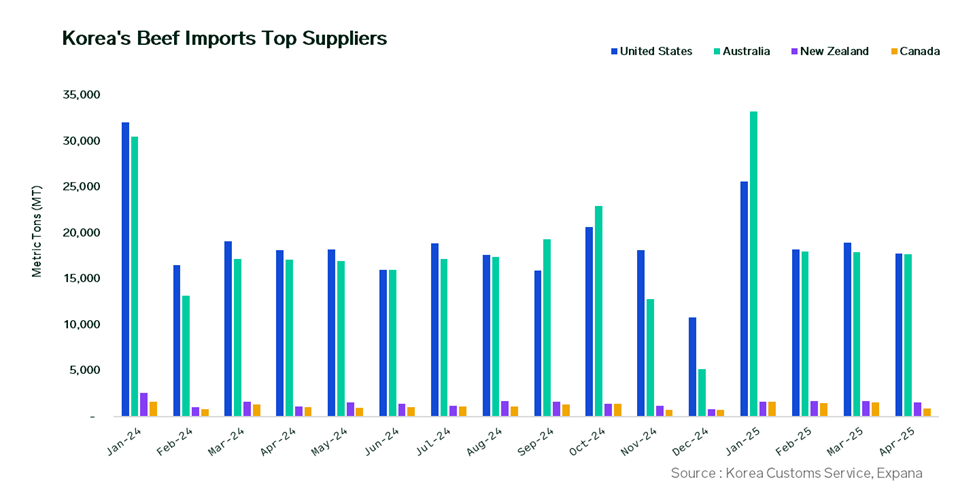

In the case of South Korea, the beef import market remains highly concentrated. The United States and Australia dominated supply in 2024, accounting for 48.1% (221,628 mt) and 44.6% (205,403 mt) of total imports, respectively. While the country faced subdued beef demand last year due to weak consumer spending and currency-related cost pressures, recent data suggest a modest recovery. In the first four months of 2025, cumulative imports rose 2.5% YoY to 180,083 mt, signaling an early improvement in trade dynamics and potentially opening a window for new suppliers.

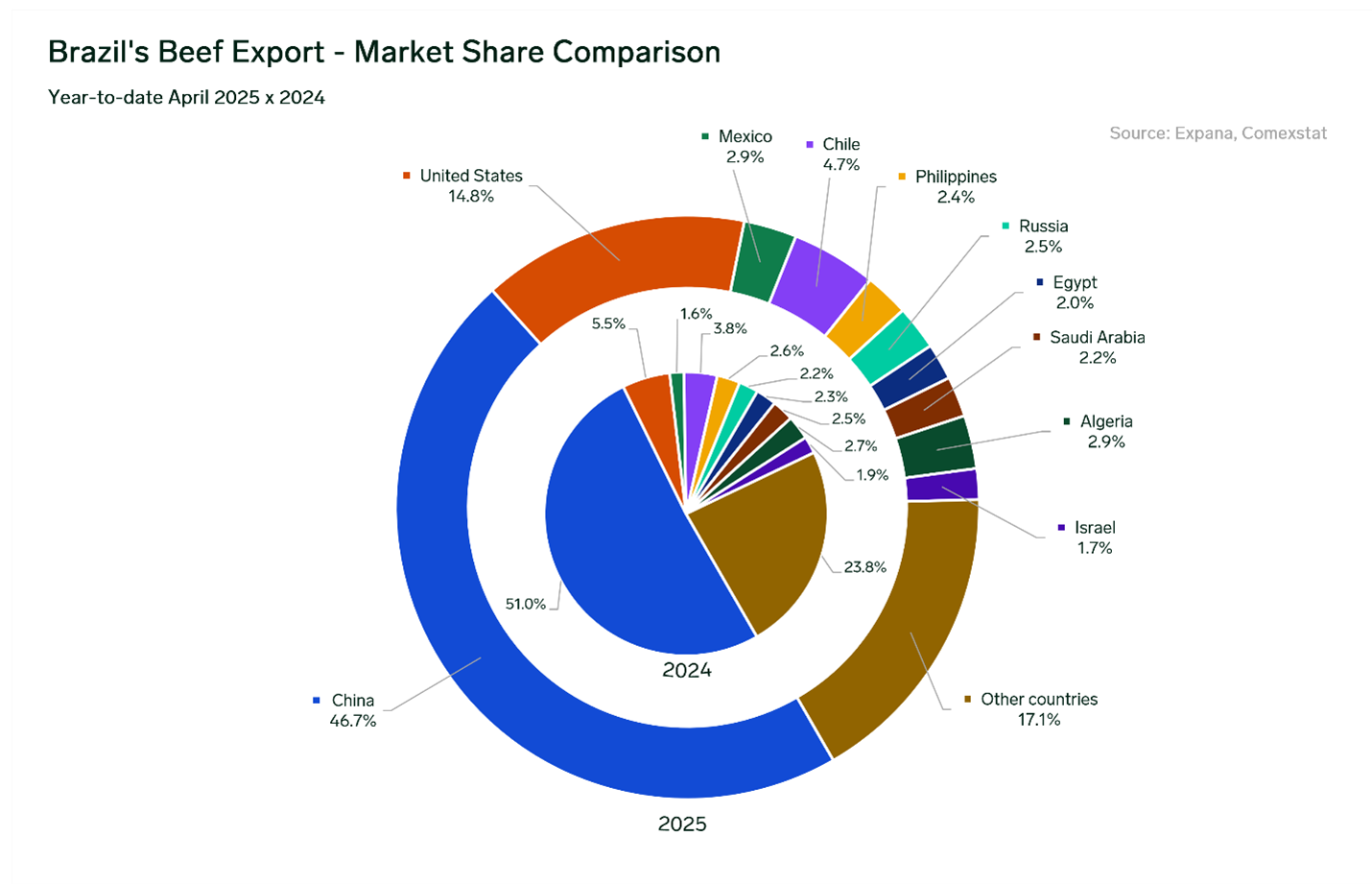

From Brazil’s perspective, beef exports totaled 2.45 million mt in 2024, remaining the major global beef supplier. China continues to be the top destination, absorbing 51.95% of total exports, followed by the US (7.55%) and the United Arab Emirates (5.07%). The country’s ability to consistently supply large volumes at competitive prices has been a key driver of its global position.

For estimated comparison purposes, based on customs data from each importing country, the average price of beef imports in 2024 was USD 6,202/mt in Japan and USD 8,079/mt in South Korea. In contrast, Brazil’s average beef export price stood at USD 4,369/mt during the same period. The considerable price gap reinforces the potential for Brazilian beef to compete as a lower-cost alternative in premium markets, particularly in segments where affordability is gaining relevance.

In a hypothetical scenario where Brazil gains access to these markets, it could be argued that the main implications would revolve around shifts in supply distribution and increased price-based competition, primarily in these two Asian markets. On the supply side, Brazil’s entry could introduce a high-volume, lower-cost origin into two of the world’s most value-driven beef import markets, potentially displacing a portion of current volumes from traditional suppliers such as Australia and the United States. This could also favor end consumers in these countries, providing more affordable imported options, thus exerting strong pressure on existing suppliers’ prices. For Brazil, access could not only diversify export flows but also enhance its ability to navigate demand fluctuations in core markets like China, improving overall market resilience.

In addition, ripple effects would likely extend beyond Northeast Asia. Increased Brazilian presence in these high-value markets could tighten supply availability in other regions currently served by Brazil. Likewise, if traditional suppliers shift volumes away from Japan and South Korea in response to greater competition, other importing regions could benefit from improved access or more favorable pricing. Overall, access to these markets could potentially reshape competitive dynamics in the international beef trade.

Co-authored by:

Bill Smith

Expana

732-575-1977

[email protected]

Junie Lin

Expana

[email protected]

Image source: Getty

Written by Augusto Eto