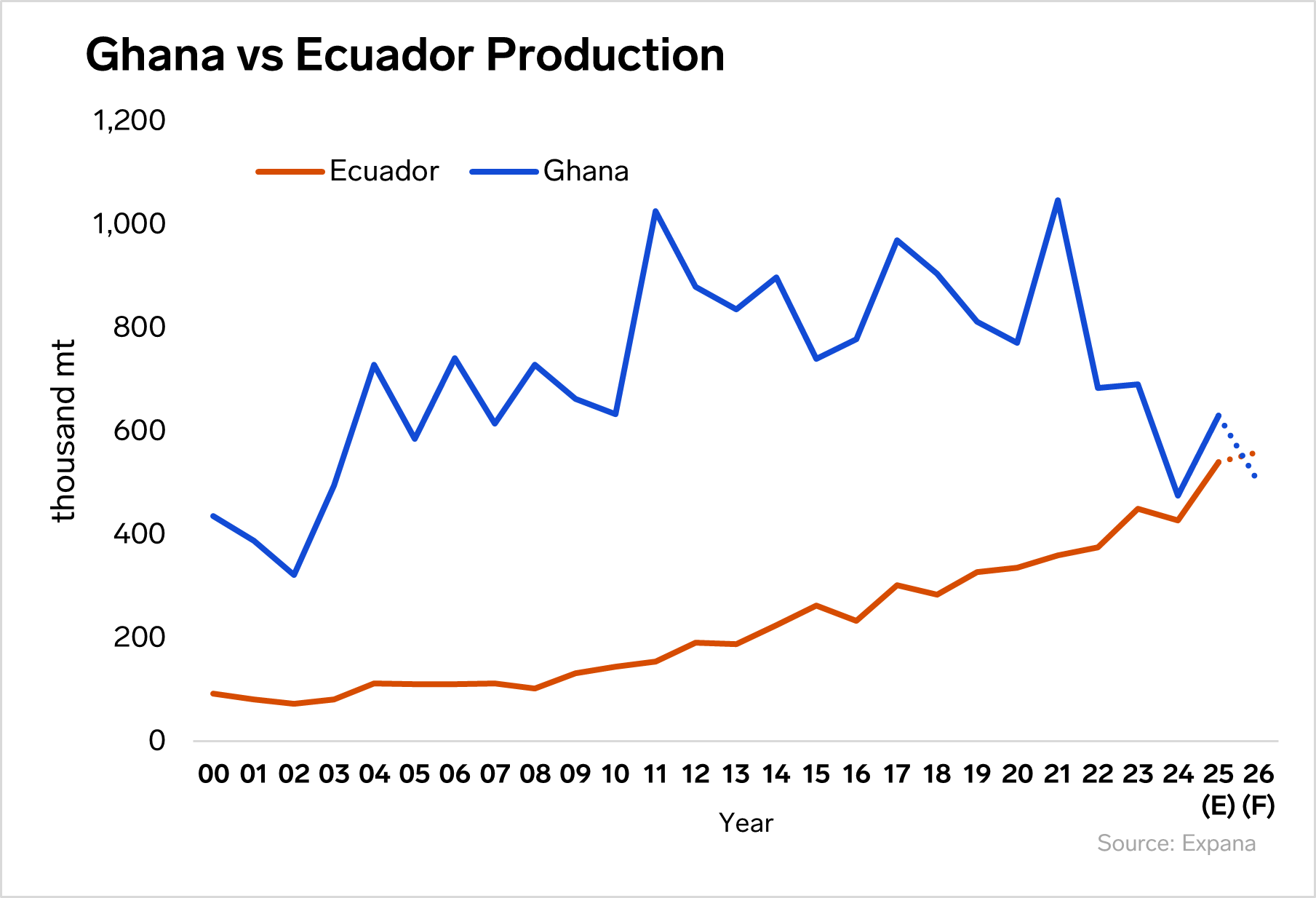

Ecuador’s ascension to the world’s second-largest cocoa producer reflects sustained structural advantages reshaping global supply dynamics. In September 2025, monthly shipments reached 51,303 mt, the highest September volume on record.

The 2024/25 season (Oct-Sep) concluded with total exports of 568,233 mt, a substantial 35% year-on-year increase. At the same time, after a strong 2024/25 season of nearly 630,000 mt, Ghana now faces a steep decline as a mini dry spell that hit the country in the middle of the year has reduced cherelle counts and small pod numbers, and poor canopies and farmer maintenance have resulted in lower quality beans and reduced yields according to Expana’s Fundamentals team.

According to industry sources, forward projections for Ecuador’s 2025/26 production range between 560,000-650,000 mt across major forecasting houses, suggesting continued growth, with Expana’s Fundamentals team projecting a 2025/26 crop of 560,000 mt. Conversely, Ghana’s recent weather woes have led to expectations of a decline, with Expana’s Fundamentals team currently projecting just 500,000 mt of production in the current year, a drop of nearly 21% y-o-y.

Recent heavy rains in West Africa could boost hopes for next year’s midcrop, according to industry participants, but current small pod counts have dashed hopes for a recovery in the main crop tail later this year. The key watch point now remains the weather in West Africa, and whether additional flowering and leaf recovery occur if forecasted rainfall materializes.

Written by Sammy Rolls