As the August 1 tariff deadline draws closer, the fresh imported seafood sector is bracing for renewed disruption. Importers, buyers and distributors remain on edge amid uncertainty over how broadly the next round of tariffs will be applied. Countries not currently engaged in trade negotiations may continue to face a blanket 10% tariff, or potentially steeper rates. At the same time, a 50% tariff has already been announced on seafood imports from Brazil, a key supplier of fresh snapper, grouper and swordfish, raising concerns across the supply chain, as Expana reported.

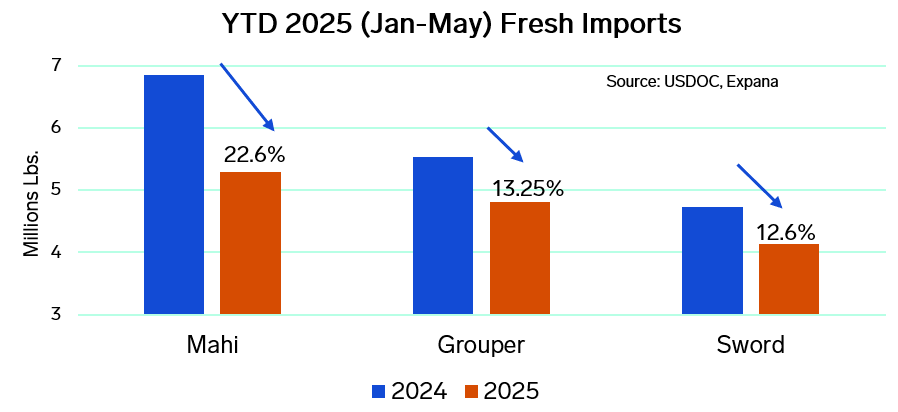

The pressure comes at a time when the market is already contending with tight supply and historically high prices. Year-to-date import data through May paints a stark picture: mahi imports are down 22.6%, grouper by 13.3% and swordfish by 12.4%. Fresh snapper imports have also declined, though more modestly, trailing 2024 levels by 4.7%. While not as severe as other categories, the consistent drop across key species underscores the broad supply challenges facing the imported seafood sector. These sharp declines reflect the mounting challenges facing wild-caught fisheries, which are increasingly disrupted by shifting ocean temperatures and erratic migration patterns—natural forces that make it difficult to predict and stabilize harvest volumes. As a result, landings across key producing regions, particularly in Central and South America, have been well below seasonal norms.

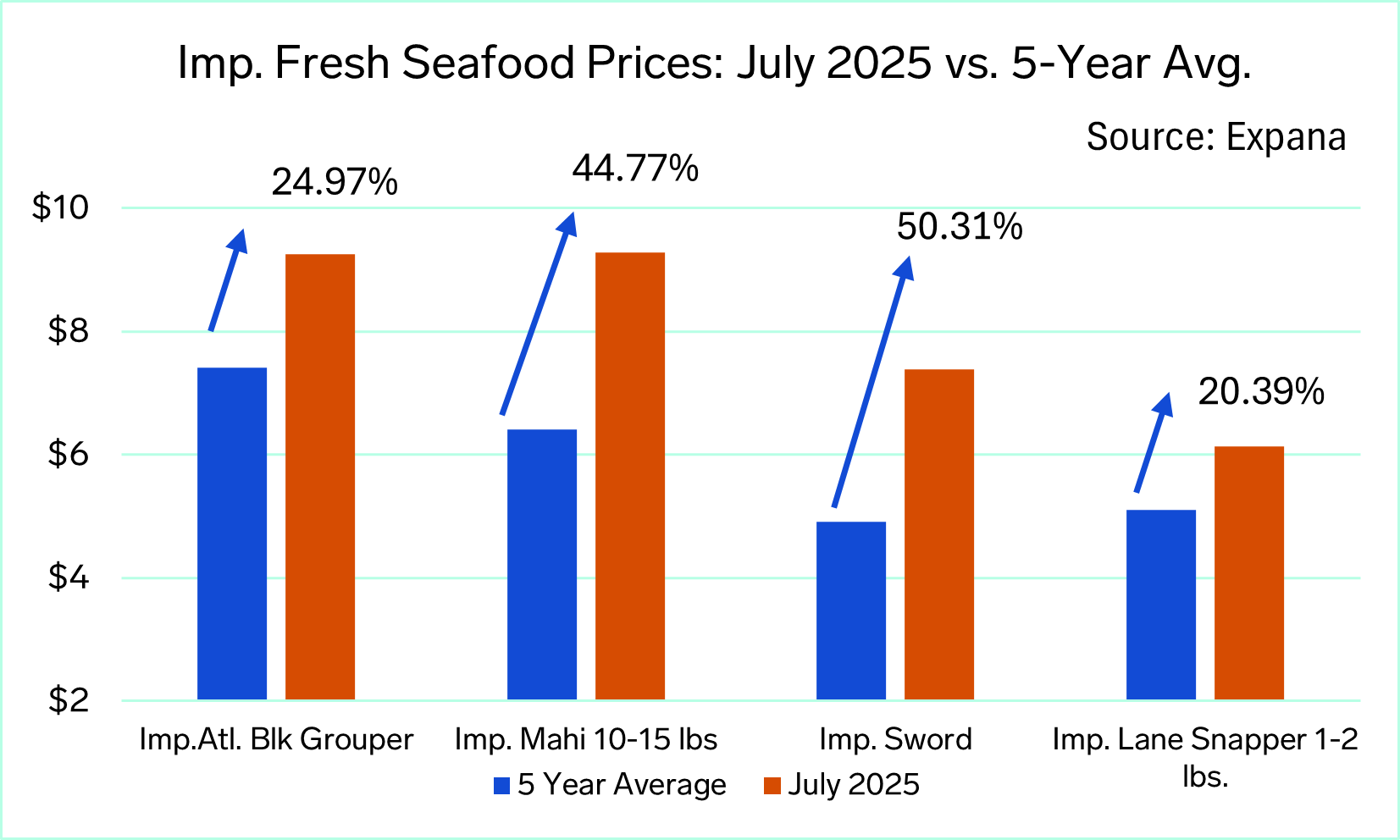

The lack of available product has been felt throughout the summer, with market prices elevated across the board. Mahi, in particular, has seen sustained upward pricing pressure and is currently trading at record levels. Despite these elevated prices, demand has remained relatively firm, with many buyers continuing to cover seasonal needs while also preparing for possible tariff-related cost increases.

Adding to the market’s complexity is the evolving tariff landscape. Brazil has already been hit with a 50% duty, while other countries await clarification on the matter. Mexico and Canada remain largely exempt under the United States–Mexico–Canada Agreement (USMCA), so long as shipments meet origin requirements. However, products failing to meet these standards may still be subject to duties as high as 25%. Other key suppliers such as Costa Rica, Venezuela, and Suriname are expected to fall under the current 10% blanket tariff unless individual exemptions are negotiated. The European Union now faces a newly announced 15% tariff on seafood imports, directly impacting high-demand items like branzino. While earlier discussions suggested rates as high as 30%, even a 15% duty poses pricing challenges for key EU suppliers such as Spain and Greece. Notably, Turkey, a major branzino producer outside the EU, is not subject to the tariff, potentially giving its exporters a competitive edge in the US market.

Looking ahead, industry stakeholders are closely monitoring whether tariffs will be expanded, delayed, or adjusted before the August 1 deadline. The threat of additional or higher duties continues to cloud the outlook, adding pressure to an already tight and expensive market. With trade flows, sourcing strategies, and pricing all at risk, importers are taking a cautious approach, evaluating sourcing options, managing inventories conservatively, and reassessing pricing strategies, as they prepare for a potentially more volatile seafood landscape in the weeks ahead.

To keep on top of tariff changes, how they could impact your business and how to respond to upcoming changes, sign up to our weekly Tariff Talks rundown.

Image source: Adobe

Written by Liz Cuozzo