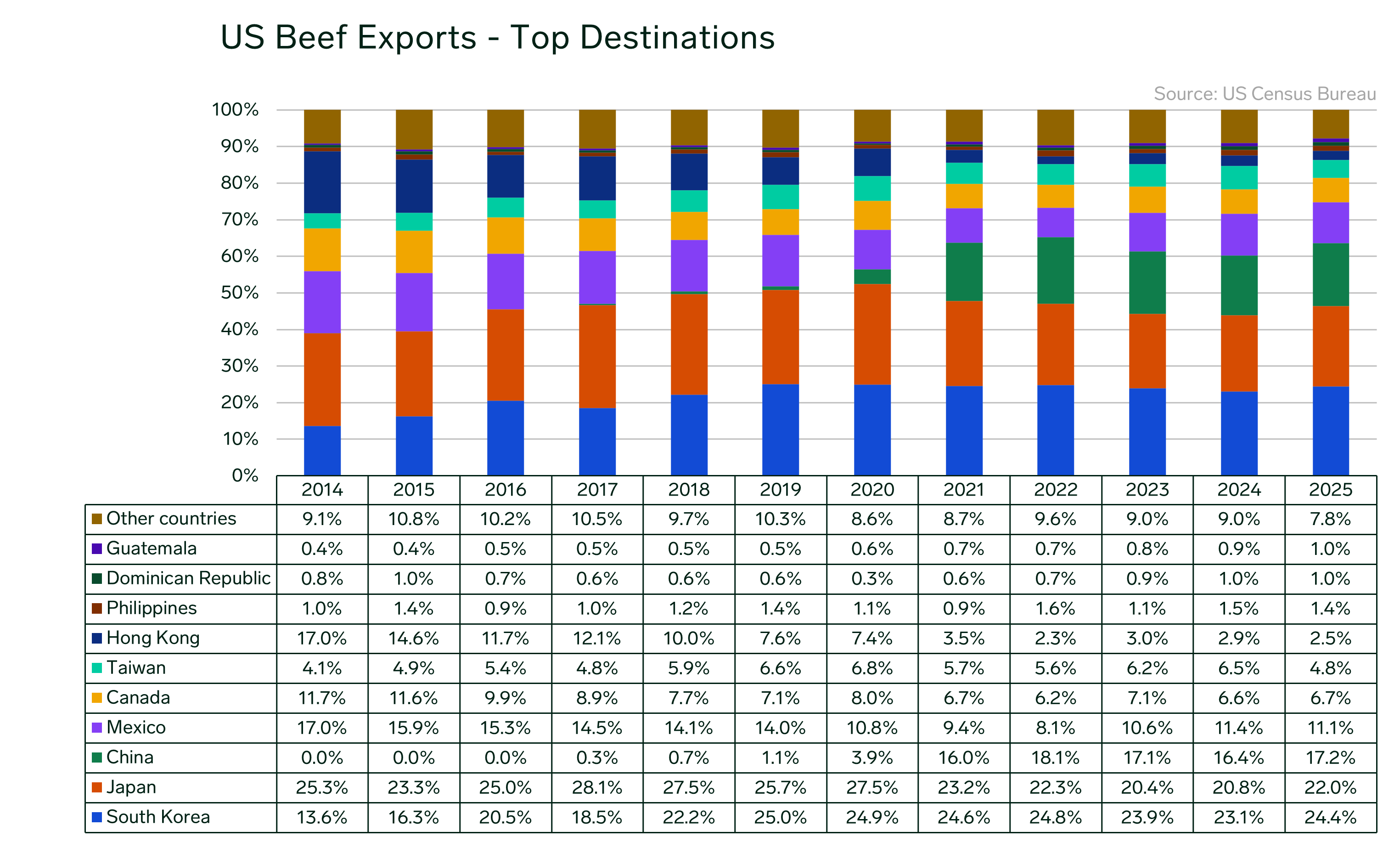

After more than a decade of building momentum, US beef exports to China hit a wall in Q2 2025 as tariffs disrupted one of the world’s most dynamic meat trade lanes. The pause in duties since mid-May has since eased tensions, but trade has yet to see signs of reviving. Over the years, China became US’s third largest key destination for American grain-fed cuts especially offal cuts, prized for their suitability in local cuisine. While the reprieve is welcome, the structural challenges that defined the last ten years, from access restrictions to shifting consumer trends continue to shape the path ahead.

When Did the Beef Start?

US beef exports to China resumed in June 2017 after a 14-year ban imposed in 2003 due to concerns over Bovine Spongiform Encephalopathy (BSE), or mad cow disease. The market reopening followed the 100-Day Action Plan agreed upon by the Trump administration and Chinese officials in May 2017. Initial trade volumes were modest, totaling $63 million (7,188 mt) in 2018. However, exports soon gained momentum, despite facing trade disruptions. China raised tariffs on US beef from 12% to 37% in July 2018 as part of broader retaliatory measures during escalating tensions. By 2024, annual shipments to China surged to approximately $1.5 billion or 157,341 metric tons (mt)

Asia remained the dominant export destination for US beef, with China, Japan, and Korea collectively accounting for 63.7% of total volumes in 2024. Overall US beef exports reached 962,144 mt in 2024, a notable figure given the nation’s smallest cattle herd in 74 years. However, severe droughts and high feed costs over the past several years compelled many US producers to reduce their herds, sending more animals to slaughter instead of retaining them for breeding. Persistent dryness in key producing regions has further delayed herd rebuilding, a process that typically takes two years.

China’s Cold Shoulder: The Urgent Search for New US Beef Markets

American beef has rapidly lost ground in China’s price-sensitive market following the imposition of steep retaliatory tariffs since April 2. A strong US dollar and stiff competition from South American suppliers have further eroded trade flows, prompting US exporters to seek alternative markets amid growing pressure. American beef offals such as hearts and kidneys are wide consumed in Chinese traditional cuisines. Total variety volumes from the US skyrocketed from 2021 onwards, hitting a peak of 15,239 mt in 202. In 2023 and 2024, volumes slipped slightly amid Chinese consumption woes, but still hovering above the 10,000 mt mark. In the beef segment alone, the failure to renew 398 US beef exporter registrations dealt a heavy blow to American suppliers. As of early June, none of the expired licenses have been reinstated, effectively sidelining access to more than half of the total plants.

Korea and Japan, although key markets for American beef, are subjected a safeguard volume cap and higher import duties. While some argue that losses in one market can be offset by gains in another, this may hold true for larger companies with broader footprints and diversified networks. However, for smaller players, who often rely on a concentrated pool of buyers, this balancing act becomes far more challenging. These businesses face greater risks when key markets are disrupted, as they lack the flexibility to quickly pivot or compensate for lost sales in other regions.

As Tariffs Bite, Which Suppliers Gain China’s Attention?

While US beef grapples with punitive duties and licensing hurdles, rival exporters are stepping up. Brazil has entered talks with China to deepen agri-trade ties, including beef, as it eyes greater market access. Brazil has been officially recognized as free of foot-and-mouth disease without vaccination, according to a May 29 update from the World Organization for Animal Health (WOAH). The new status could potentially accelerate Brazil’s access to Japan and Korea, Asia’s largest beef markets after China. Australia is fast gaining ground, especially in the grain-fed segment, buoyed by a weak currency and strong production. New Zealand has seen growing enquiries but remains constrained by limited output.

Ironically, all this plays out as China continues an antidumping investigation into imported beef launched last year.

As Sino-US Tariff Tensions Thaw, What’s Next?

“The quickest way to end a war is the one that never started.” a sentiment often attributed to Winston Churchill, highlights the importance of diplomacy and timely intervention in preventing prolonged conflict.

The US still hold a smaller percentage in China’s beef trade and it’s a multilayered question. With China reliant on South American beef, that’s where the main price and market direction will be leading, market players said. The only active segment remains grain-fed beef, with Australian and US product competing alongside a growing domestic supply. China’s own grain-fed production has increased this year, following a series of government-led initiatives to support local farmers.

As the trade war grinds on, the need for a resolution is becoming more urgent, particularly in sectors like beef by-products such as offals and hides, where both markets are feeling the pinch. The coming months may reveal whether these tariff barriers are on the verge of a cease and desist, offering a potential reprieve to both nations.

To keep on top of tariff changes, how they could impact your business and how to respond to upcoming changes, sign up to our weekly Tariff Talks rundown.

Written by Augusto Eto