Canada’s durum wheat harvest is expected to be abundant for the 2025/26 campaign, primarily due to large acreage for the second consecutive year. Export capacity of the world’s largest exporter of durum wheat should therefore ensure a comfortable market balance. However, the quality of Canadian durum is becoming a key watchpoint. Across the vast plains of Alberta and Saskatchewan, recent rains risk delaying the harvest and impacting quality – just as global demand for high-quality durum is predicted to be stronger than the previous year.

Canada: A Key Player in the Global Market

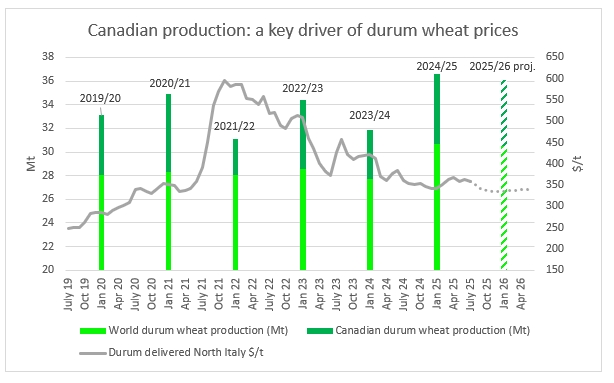

Canada stands as one of the world’s largest producers and the leading exporter of durum wheat, accounting for an average of 57% of global trade. The country’s reputation is built on producing high-quality, protein-rich grains that meet the stringent demands of major global markets, particularly Italy and North Africa (primarily Morocco and Algeria). These importers often use Canadian durum wheat alone or mixed with local production to enhance the grade of the wheat used in semolina production. Consequently, the health of the Canadian harvest has direct repercussions on global durum wheat prices and supply.

In 2021 and 2023, Canada faced catastrophic durum wheat harvests due to drought and extreme heat during crucial growth periods, causing global prices to spike as the market tightened. In 2024, Canadian production rebounded to a strong level, with prices returning to spring 2021 values.

(Source – Expana – durum report)

For the upcoming harvest, Canada’s main durum regions faced unusually dry spring 2025 weather, sparking market concern once again. However, recent July rains significantly improved yield prospects. With vast planted areas, a sizable production is anticipated. Our current forecasts estimate Canada’s harvest to reach 5.6 million tonnes, a level likely to stabilize the market.

Nevertheless, market focus is now shifting squarely towards Canadian grain quality. Regular precipitation occurred in early August as the grains were maturing, any further prolonged rains would delay the harvest and could further degrade the quality of the grains.

Few Alternative Sources of Supply for High-Quality Durum Wheat

Among the global alternative sources of durum wheat supply, other exporters are not well positioned to offset a shortfall in high-quality Canadian grains. Turkey – which was a fierce competitor in the 2023/24 season due to a surprisingly abundant 2023 harvest and very competitive prices – has seen a significantly smaller production this year (estimated at 3.6 million tons compared to 4.2 million in 2023). However, Turkey’s durum this campaign is of excellent quality, with very good protein content. Therefore, the country could supply some high-quality durum to the global market, and has indeed already shipped some high-protein durum grains to Italy during the early days of the campaign, where such quality is in short supply. But Turkey can only offset a small segment of this market – with its export capacity size just 8% of Canada’s size.

Elsewhere in Europe, high quality durum is scant. Only medium quality durum is available for export from Spain, Greece and Italy. Moreover, French durum wheat is of suitably good quality for use on its domestic market, as well as for exports to other EU, and even third countries, although its total export availability remains limited this campaign.

Towards the Black Sea, Russia could once again be a source of supply for standard quality and could export to Tunisia and Algeria. Also, Kazakhstan represents a recent source of supply for the EU, and trade volumes have increased following the EU’s import restrictions on Russian grains, which have been taxed at 148 €/ton since July 1, 2024.

Although these two Black Sea countries have succeeded in developing significant local production and establishing themselves as noteworthy exporters in the global market, they have not yet managed to ensure a high-quality production comparable to that of Canada.

Finally, USA could represent an interesting alternative to Canadian grains. However, they face the same production conditions as their northern neighbors and might indeed experience the same quality degradation.

Comfortable Outlook for the 2025/26 Campaign

With a large global production for the second consecutive year, we anticipate a comfortable global balance sheet for durum wheat. Demand from the semolina and pasta industries is expected to remain strong. However, global trade is likely to contract significantly year on year due to increased production among major importers, primarily in North Africa and Europe. The high-quality durum wheat category could experience a unique situation during the season, with potential tightening in the second half, once the initial local stocks have been consumed.

Influence on International Prices

Once again, this year, high-quality Canadian grains are needed in Mediterranean markets. If quality were to fall short, in case of bad conditions during the harvest, the price for the most protein-rich durum wheat category could diverge from standard quality prices. Industry players within the durum wheat and semolina supply chain will closely monitor developments in Canada’s production, serving as a stabilizer in an increasingly climate-vulnerable market.

But overall, with higher global durum stocks expected at the end of the 2025/26 marketing year, we forecast a decrease in global durum prices compared to the 2024/25 marketing year, with the spread widening between high and standard quality durum if quality concerns materialize. For the standard quality, we expect a decrease on average prices around -17 $/t (ex La-Pallice). Durum wheat prices could then find support from the soft wheat prices, increased by a premium at around 70 $/t as an insufficient premium of durum wheat price over soft wheat discourages producers from planting the cereal, crucial for the next season’s supply chain.

Written by Séverine Omnes-Maisons