Egypt’s vegetable sector faces mounting logistics challenges that are reshaping market dynamics and driving price increases.

Sources within the Egyptian IQF vegetable market describe a challenging logistics environment and a period of uncertainty. With shipping carriers yet to resume service on the Red Sea trade route and the US administration’s widespread imposition of import tariffs disrupting global trade, market players contend with a volatile logistics outlook and planning challenges.

Speaking to Expana, sources stated, “From what we see on the ground, the main challenge at the moment is logistics rather than demand,” adding that the Red Sea situation is the biggest factor affecting the outlook. “It has affected sailing schedules, transit times, and freight stability, with many lines rerouting or adjusting capacity. This makes forward planning more difficult than usual”.

Egypt continues to assert itself as a key frozen vegetable exporter. In 2024 (latest data), it ranked as the world’s fourth-largest exporter, with exports valued at $74 million and accounting for 7% of global market share, according to data published by Egypt’s General Organization for Export and Import Control (GOEIC). The sector recorded annual growth in 2020-24 of about 5% in both volume and value terms.

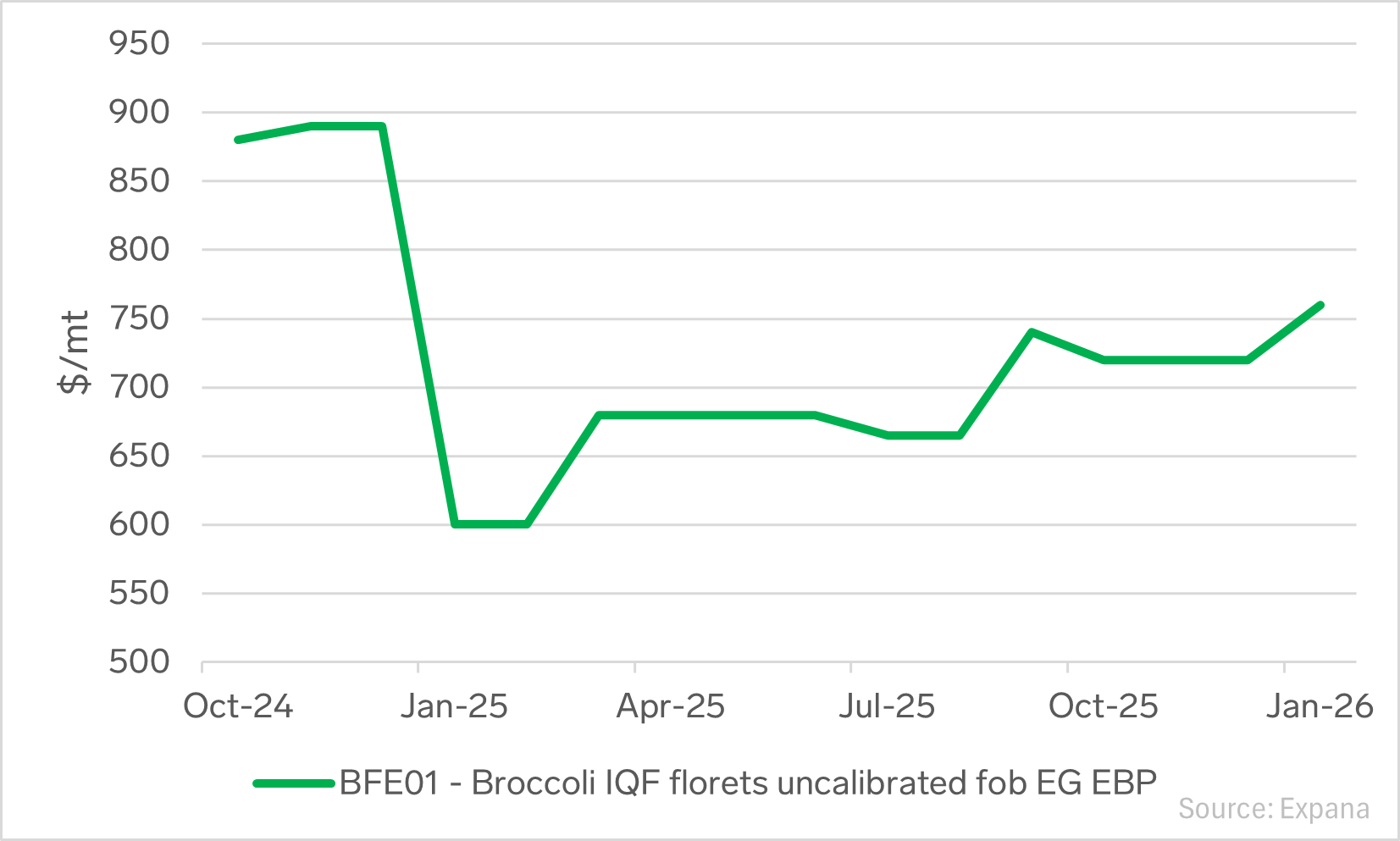

However, as a result of market volatility and challenges with input costs, including transportation, Expana Benchmark Prices (EBP) for Egyptian IQF vegetables increased month-on-month (m-o-m) on January 30. Whole green beans FOB Egypt increased by 16% m-o-m, to $650/metric ton (mt), and Broccoli IQF Florets uncalibrated FOB Egypt increased by 6% m-o-m to $760/mt.

Unrest in Iran and the resulting increase in US-Iran tensions have increased uncertainty for regional trade and are likely to further delay resumption of transit through the Red Sea, according to sources, as the Houthis threaten to resume attacks on passing vessels. In addition, the US administration has recently stated its intention to impose new import tariffs on countries trading with Iran, which sources believe could further disrupt trade flows.

Sources stated, “Shipping costs in general remain volatile, not only higher but less predictable, which is the real issue. Any port-side delays immediately increase costs and complexity. Overall, it’s more of a period of uncertainty and logistics risk management.”

Image source: Getty

Written by Craig Elliott