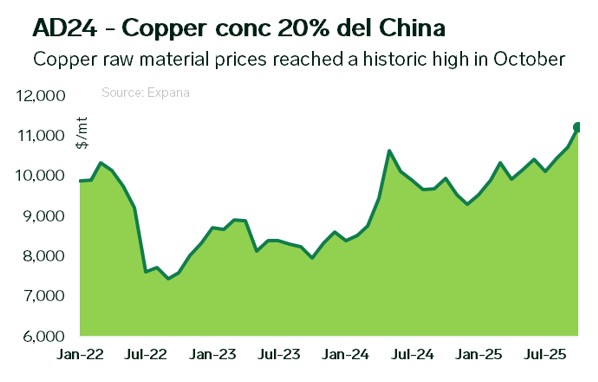

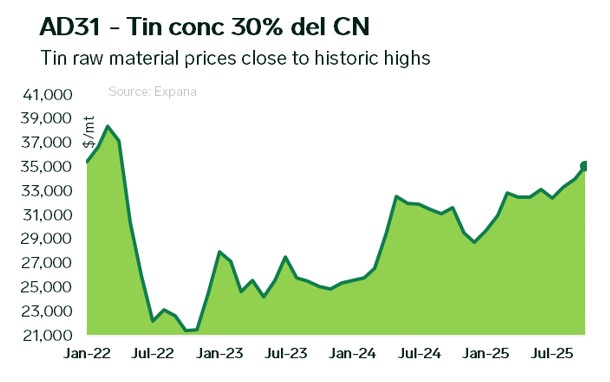

In 2025, the upward trend in the base metals market intensified. Copper and tin prices are growing faster than others. In October, copper and tin prices on the London Metal Exchange (LME) rose by 11% year-over-year (y-o-y) and 12% y-o-y, respectively, while aluminum rose by 6% y-o-y and nickel and zinc showed declines. The copper and tin markets are united by limited raw materials and high demand in related industries.

In the copper market, the expansion of refined copper production capacity in China did not lead to an increase in supply, as concentrate supplies became acted as a limiting factor. Peru and Chile, which account for more than a third of global copper production, have experienced disruptions due to lower metal content in ore. In September, an accident at the Grasberg mine in Indonesia also reduced raw material supply.

There is a continuing structural shortage of raw material in tin. After production was suspended in the state of Wa, ore supplies from Myanmar to China fell by almost half. A partial recovery began in May, but volumes remain insufficient. Indonesia, the second key supplier, has reduced exports by about a quarter because of administrative checks and licensing delays. Supply constraints remain and recycling is not compensating for the loss of production, keeping the market in chronic deficit.

Demand for both metals remains strong. Copper is used in cables, electric motors and power grid infrastructure. Tin is needed in solders, electronic components and battery systems. Growth in the production of electric vehicles and renewable energy equipment is boosting consumption and making markets sensitive to supply disruptions.

Written by Artem Segen