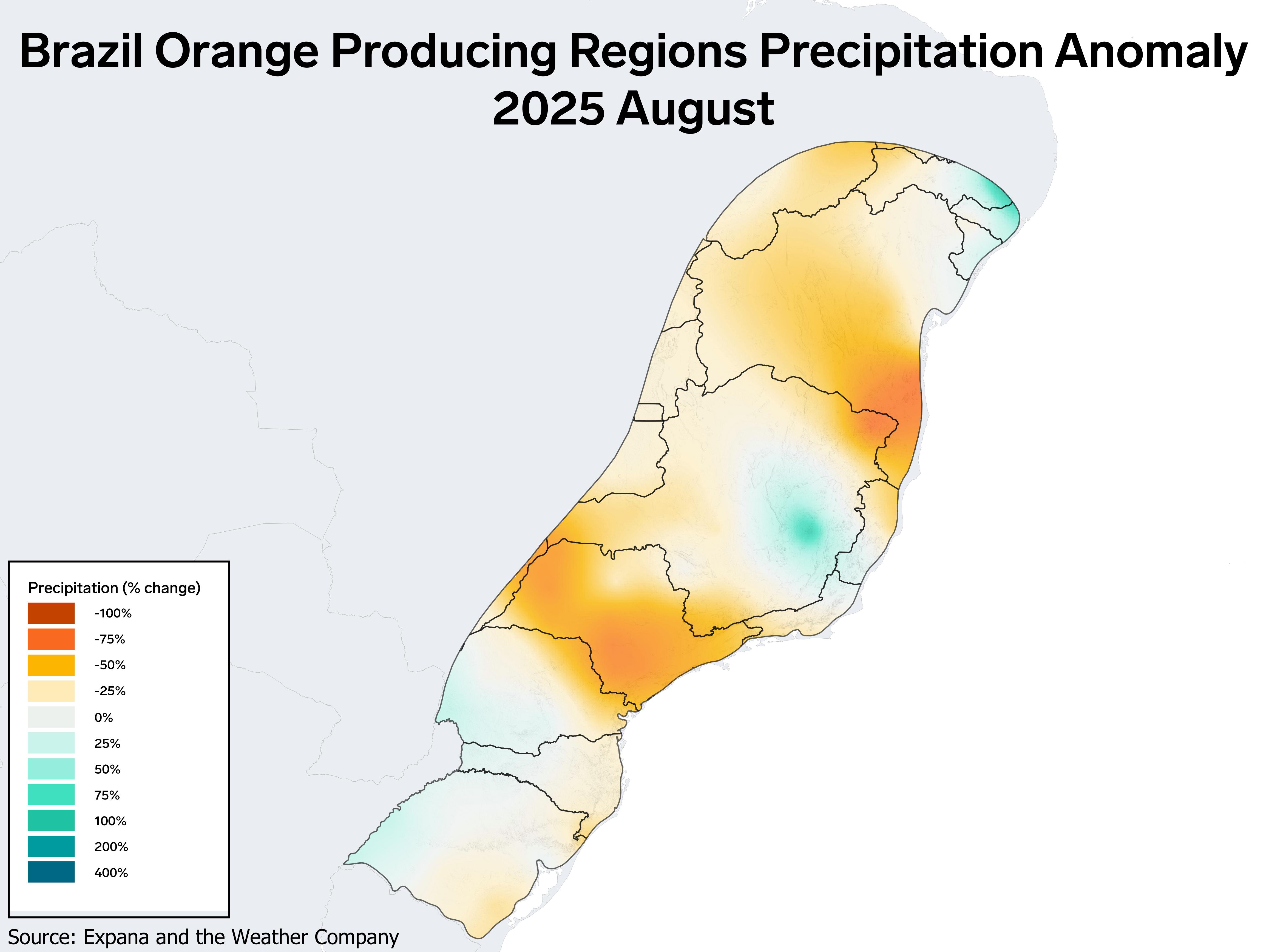

Parts of Brazil received about 70% less rainfall than expected in August, with the São Paulo region, especially impacted, leaving orchards increasingly exposed to stress as the dry spell persists. The Expana Global Weather Report – August 2025 (customer access only) provided estimates that showed that as much as 80% of Brazil’s oranges are grown in the region.

Dry conditions can dehydrate fruit, slow growth and cause the fruit to drop or split, potentially limiting yields and impacting quality just as the crop moves into the harvest phase for the coming months.

Figure 1. 2025 August precipitation percentage change compared to the 30-year average in Brazil’s primary orange-producing regions.

Craig Elliott, Market Reporter Fruit and Vegetables, Expana pointed out that on September 10, Fundecitrus, an association representing the Brazilian citrus industry, published a downward revision to its forecast for the orange harvest for Brazil’s 2025/26 season. Fundecitrus now expects total orange crop production of 306.74 million boxes in the São Paulo and Minas Gerais citrus belt, Brazil’s main producing region. This represents a 2.5% decrease compared with the association’s May forecast of 314.6 million boxes. The reduction in forecast reflects a higher anticipated incidence of greening disease and a later harvest. Moreover, Fundecitrus reports that by mid-August, only 25% of the current crop had been harvested, significantly lower than the 50% recorded a year ago.

“The later start to the harvest reflects the high concentration of fruits of the second flowering and a prioritization of harvesting at the ideal point of maturation to achieve better juice quality. This has led to a higher rate of premature fruit drop, particularly for trees affected by greening, as well as the lack of water and milder temperatures in the winter,” Elliott said.

Despite the downward revision to the forecast, this would still represent a notable year-on-year increase in output, if realized. Total orange production reached 230.9 million boxes in 2024/25, a 30-year low, owing to adverse weather conditions.

“Market sources told Expana that they are yet to see any impact on orange juice prices as a result of the revision, as demand continues to be sluggish,” Elliott said.

Brazil is the largest global producer and exporter of orange juice by a significant margin, accounting for roughly 70% of global output.

Co-authored by: Simon Duke, Managing Editor – EMEA; Craig Elliott, Market Reporter Fruit and Vegetables

Expana

Written by Demelza Knight