Steel demand is insufficient in most regions worldwide. The construction sector is declining or stagnating, while the automotive industry shows little overall growth. Only China demonstrates notable growth in vehicle production, but this is not enough to offset construction declines and prevent prices from falling.

European Union

Construction continues its decline. The construction confidence index in the EU fell to -5.3 points in October from -4.3 in September. After brief growth in building permits of 5% year-over-year (Y-O-Y) in July, indicators dropped again in August and September. Construction output returned to neutral dynamics in August after several months of 2-4% gains.

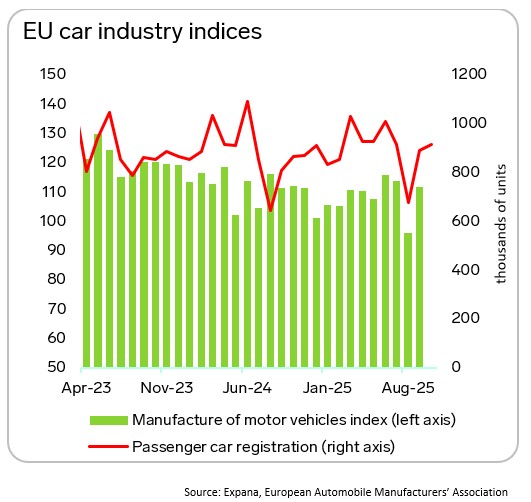

Automotive production remains weak. September showed 0.4% Y-O-Y growth, but this did not compensate for previous losses. Total output declined 3.2% Y-O-Y for the first nine months of 2025. New car registrations grew 1.3% Y-O-Y for the first nine months, reflecting rising imports. Parts suppliers report declining orders, providing no basis for rapid recovery.

United States

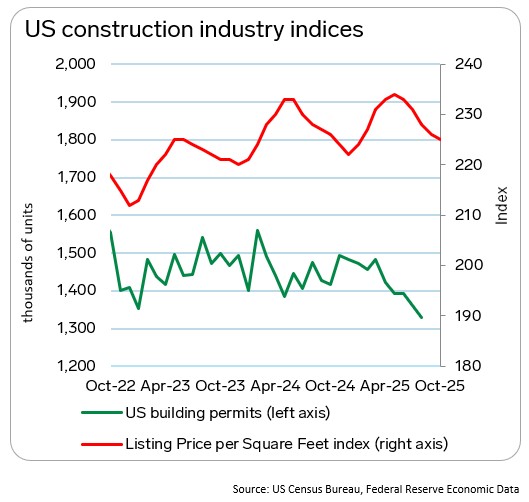

The housing market in the US shows only limited improvement. Existing home sales rose 1.5% month-over-month (M-O-M) and 4.1% Y-O-Y in September. Mortgage rates falling to 6.2% in October improved demand conditions, but activity concentrates in expensive segments. Housing inventory is growing and demand is selective, creating price pressure.

Automotive faces multiple challenges. The latest available production data for August showed a 15% Y-O-Y decline. In September and October, market sources reported that the decline continued. Fires at aluminum plants in September and November disrupted supply chains, with parts shortages forcing further output cuts.

China

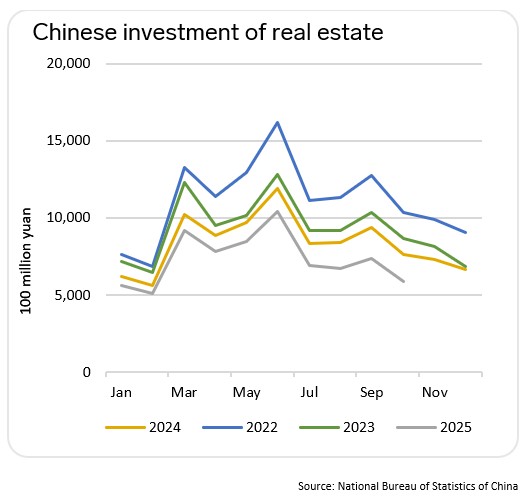

The construction sector remains in deep decline. Real estate investment fell 15% Y-O-Y for the first ten months of 2025, with October showing a 23% drop, the steepest since December 2023. Trade conflicts and policy uncertainty worsen conditions for investors, sharply reducing construction activity. Construction is a key sector for steel consumption in China, so a decline in investment is directly reflected in a drop in construction volumes and, as a result, a decline in steel consumption.

The automotive industry represents the growth point. Motor vehicle production increased 11% Y-O-Y for the first ten months, with electric vehicles adding 28% Y-O-Y. This growth helps partially support steel demand but cannot compensate for overall declines in other sectors.

Image source: Shutterstock

Written by Artem Segen