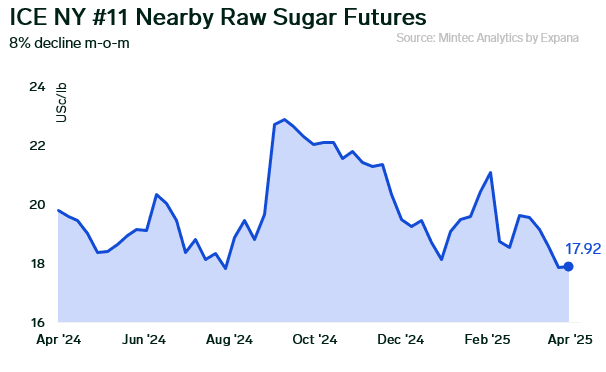

ICE NY #11 nearby raw sugar futures declined nearly 2% on the week due to limited demand. The volume of outstanding contracts in May sugar futures that expire today indicates delivery against those contracts will be substantial, according to market participants.

Additionally, the USDA’s Foreign Agricultural Service estimated that Brazil’s 2025/26 sugar production would increase slightly y-o-y, totalling 44.7 million metric tons. Meanwhile, India’s government eased restrictions on sugar exports in January, after limiting exports since 2023 to ensure sufficient domestic supplies. Also, Thailand has reported that sugar production for 2024/25 has increased 14% y-o-y. Industry players anticipate this rise in production will have a bearish impact on prices, since Thailand is the world’s third-largest sugar producer and the second-largest sugar exporter.

The International Sugar Organization (ISO) raised its 2024/25 global sugar deficit forecast from -4.88 million metric tons to -2.51 million metric tons, showing a tightening from a surplus in 2023/24. The ISO cut its 2024/25 global sugar production forecast to 175.5 million metric tons from an estimate of 179.1 million metric tons in November.

The domestic market remains under pressure based on industry feedback. Sources tell Expana that some buyers are honoring contracts and placing product in storage, but most manufacturers do not have the capacity to store sugar. Also, weak demand in the spot market is adding pressure to forward contracting. Expana Benchmark Prices for beet and cane sugar are flat on the week as a result.

Image source: Shutterstock

Written by Andraia Torsiello