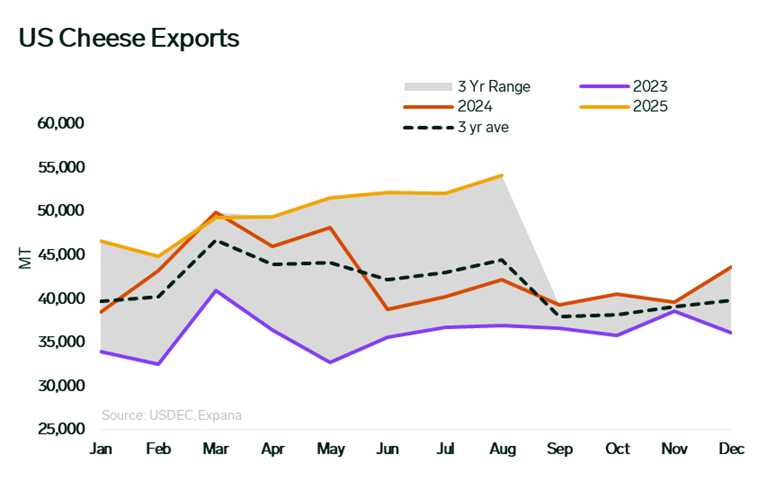

US cheese exports hit a historical milestone in August, shipping out 54,110 metric tons, the highest monthly volume ever recorded. This progressive increase reflects favorable pricing on the global market, robust production growth, and expanding processing capacity across the country. Throughout most of 2025, US cheese has held a notable price advantage over EU and Oceania offerings, leaving American suppliers well-positioned in the market and accelerating international demand.

Domestic production is the main driver behind the record-breaking numbers, with multiple new and expanding facilities ramping up production throughout the central region, which helped push May 2025 production to a new 5-year high. Production has remained elevated when compared to 2024 values, ensuring strong availability for domestic and international buyers. Cold storage data reflects the rise in exports with volumes remaining just above 2024 values but well below 2023 volumes.

Mexico continues to lead as the top destination for US cheese, while Central America, South Korea, and Japan have posted steady month-over-month gains, taking advantage of US product pricing discounts. The US Dairy Export Council shared that overall cheese exports in August were 28.1% higher year-over-year, marking the 4th consecutive month of shipments exceeding 50,000 metric tons, another notable milestone for US cheese exports.

Despite elevated export levels, the US dairy market continues to experience unseasonably strong milk flows, allowing production to run at or near capacity, adding ongoing downward price pressure to the already bearish market.

Written by Brittany Feyh