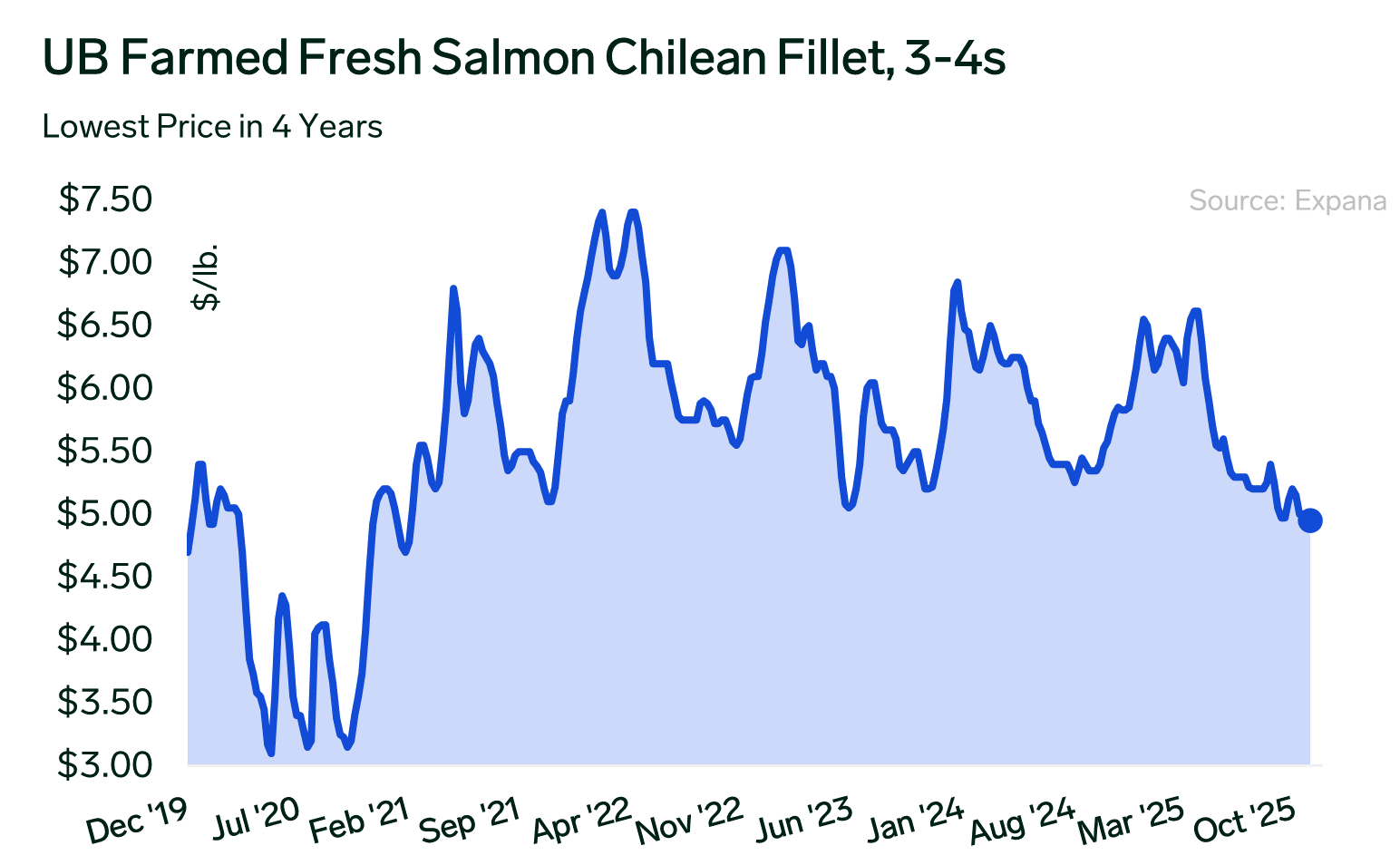

The farmed salmon fillet market has entered December at a striking benchmark – prices are at a 52-week low and, more notably, the lowest point seen in the past four years. Despite this depressed market level, retail advertising for 2025 continues to climb above 2024, maintaining a trend observed throughout the year.

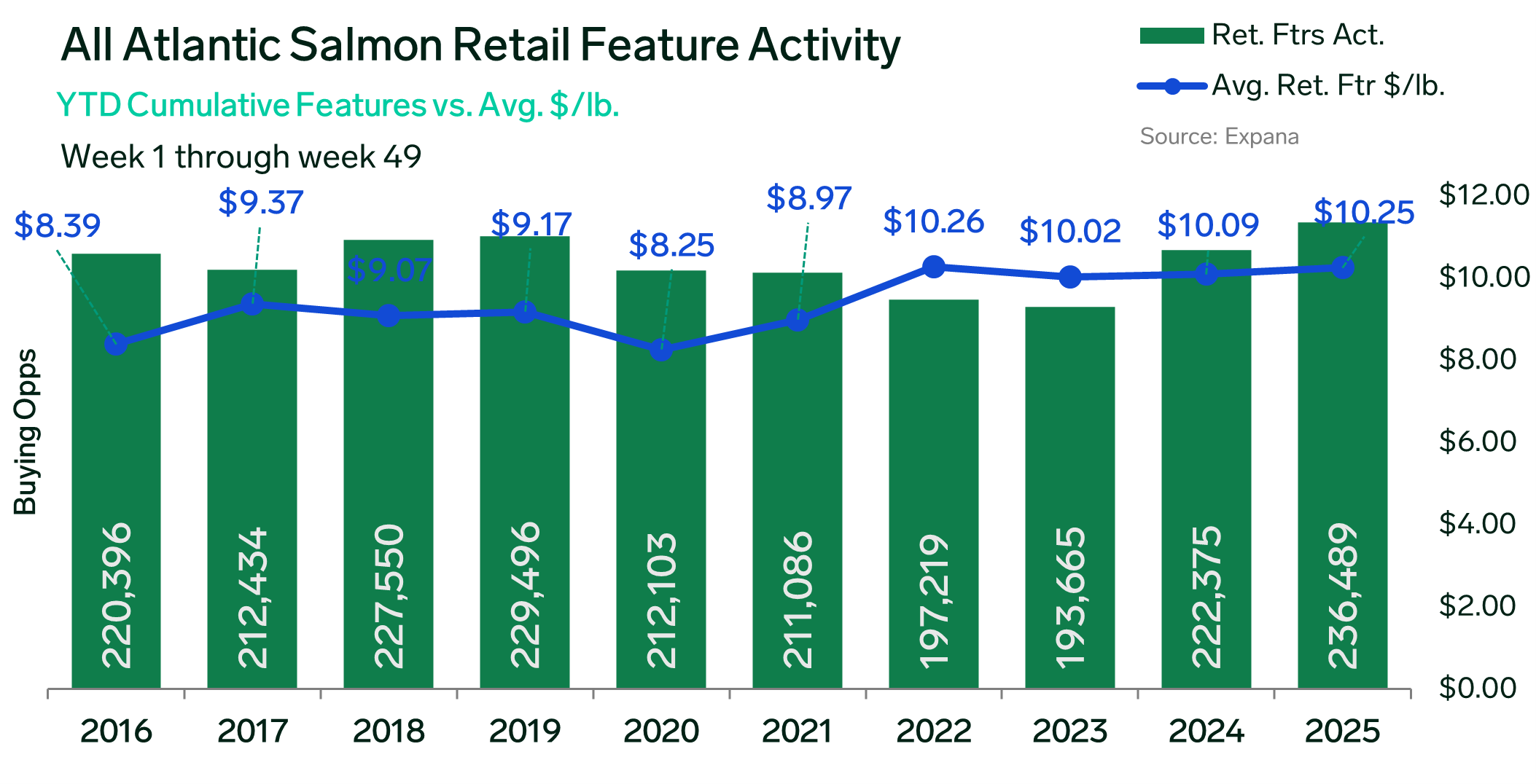

Retail Promotions at Record Highs

Buying opportunities for farmed salmon are currently 6.4 percent higher than last year, and the total number of retail ad promotions is at the highest level recorded in all years tracked since reporting began. Compared to the three-year average, retail ad opportunities are up 15.7 percent, underscoring an aggressive push from retailers to place salmon in front of consumers. This surge in promotions is being executed despite higher year-to-date pricing; 2025’s average stands at $10.25 per pound, up 1.6 percent over 2024 and marking the highest annual average price across the tracked period. For most of the year, prices have oscillated around the three-year average, indicating a relatively steady pricing environment despite broader downward pressure in the spot market.

Import Trends Show Gains from Europe, Declines from Chile

Government shutdown conditions have limited the availability of trade data, but import figures through August provide a lens on supply flows. Fresh farmed salmon fillet imports are up 3 percent year-to-date. Chile, the dominant supplier with 68 percent market share, is facing a 3.3 percent decline in volumes, while Europe has seen significant gains. Norway’s shipments are up 28.6 percent and the Netherlands, which processes Norwegian whole fish into fresh fillets, has grown 17.1 percent year-to-date. Together, Norway and the Netherlands now account for 26 percent of total market share, up 6 percentage points from 2024, while Chile’s share has fallen by 4 percentage points.

Seasonal Patterns and Current Market Sentiment

With the calendar into December, industry participants often expect a seasonal bump heading into the holiday period, when salmon typically performs well at both retail and foodservice. Thus far, the anticipated December lift has not yet materialized in the spot marketplace. This delay is not without precedent, in 2024, prices did not begin to move upward until mid-month. Currently, quotations for fresh 3-4 pound Chilean fillets are sitting below the $5.00 per pound mark on the low end, heightening a sense of uncertainty and prompting many buyers to wait for signs of seasonal strength.

Chilean fresh fillet pricing opened the week unchanged, though the undertone remains unsettled. Variations in supplier inventory positions, timing of arrivals, and immediate spot supply availability continue to produce a wide range of transaction levels. Market sentiment is mixed, with optimism for a holiday lift tempered by the reality of historically low pricing levels. Stakeholders will be watching closely in the coming weeks to see if seasonal demand materializes swiftly enough to firm up the market before year-end.

Written by Janice Schreiber