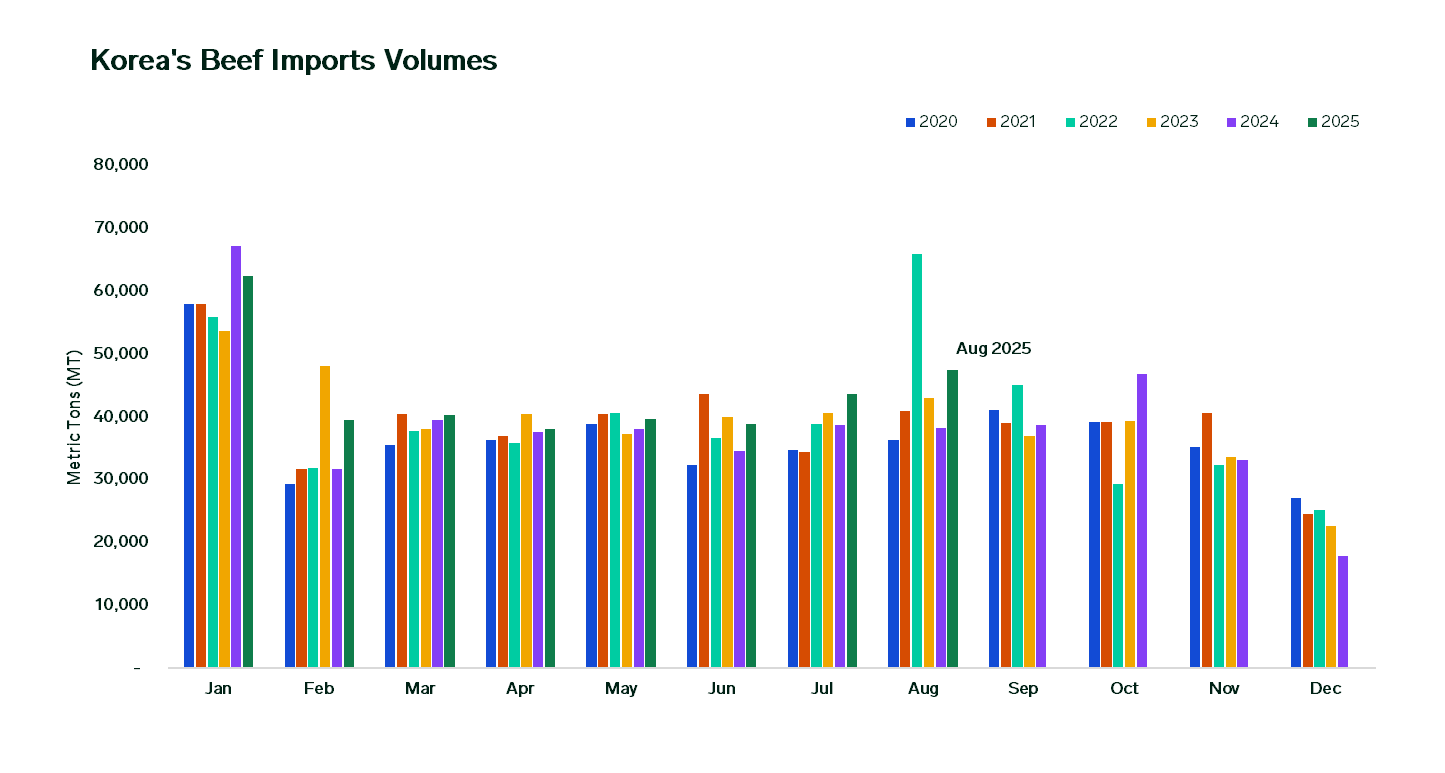

Korea’s August 2025 beef imports rose for the second consecutive month, reaching 47,475 metric tons (mt), the highest level since January 2025, data from Korea Customs Service showed.

Rising 8.8% month-on-month (MOM), imports increased by 3,841 mt, led by higher volumes from the United States (US) and Australia. Higher volumes from Canada contributed to the increase, while shipments from New Zealand were broadly stable compared with the prior month, tempering overall growth.

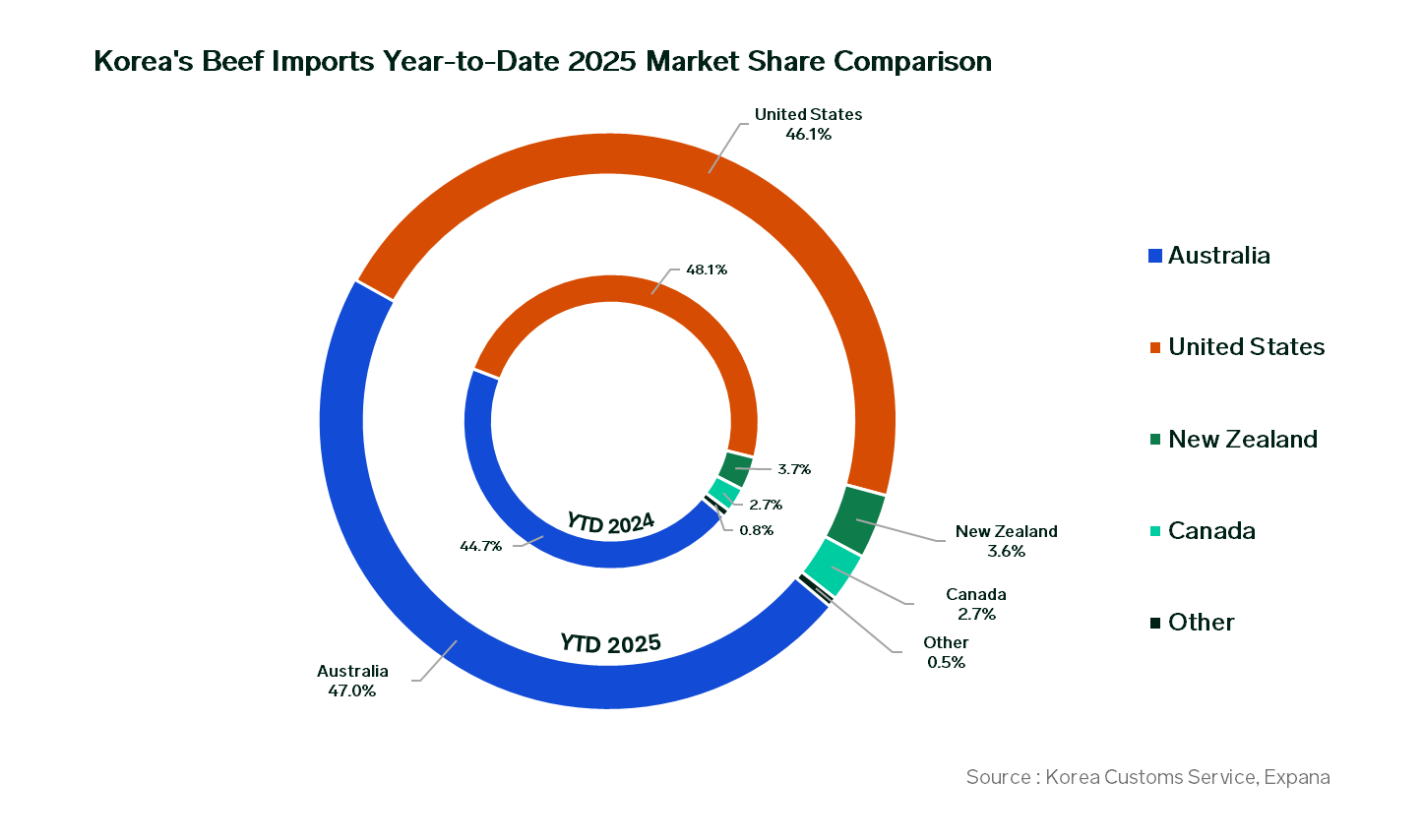

Year-on-year (YOY), imports rose 24.5% or 9,347 mt, led by Australian beef frontloading ahead of the safeguard quota. Additional US cargoes originally bound for China were redirected amid trade tensions.

Year-to-date (YTD) imports in one of Asia’s largest beef markets reached 349,539 mt, up 7.6% YOY (24,722 mt), despite the peninsula’s ongoing political turmoil. Korea’s recovery from last year’s lull, powered by firmer demand and a stronger won supported the increase.

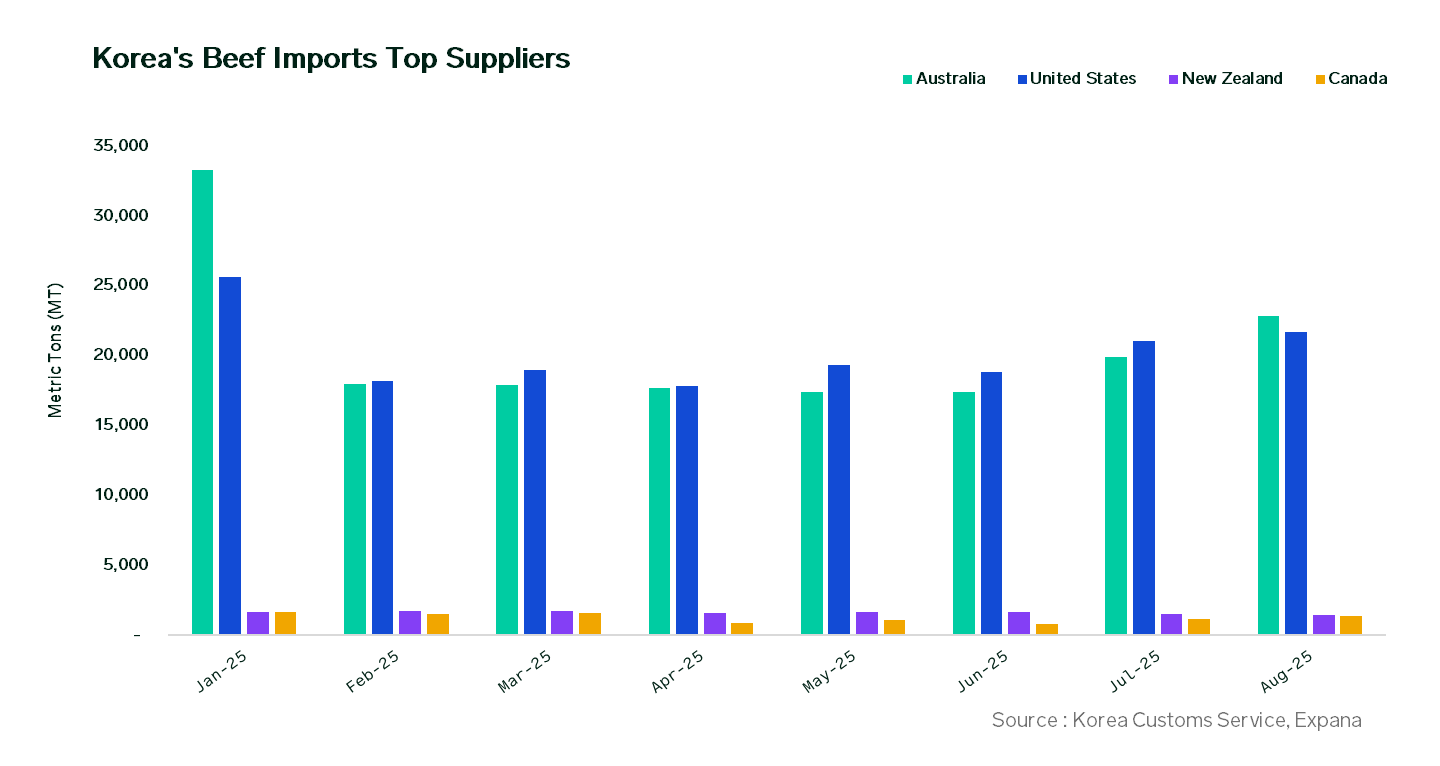

Key Supplier’s Breakdown by Volume:

Australia

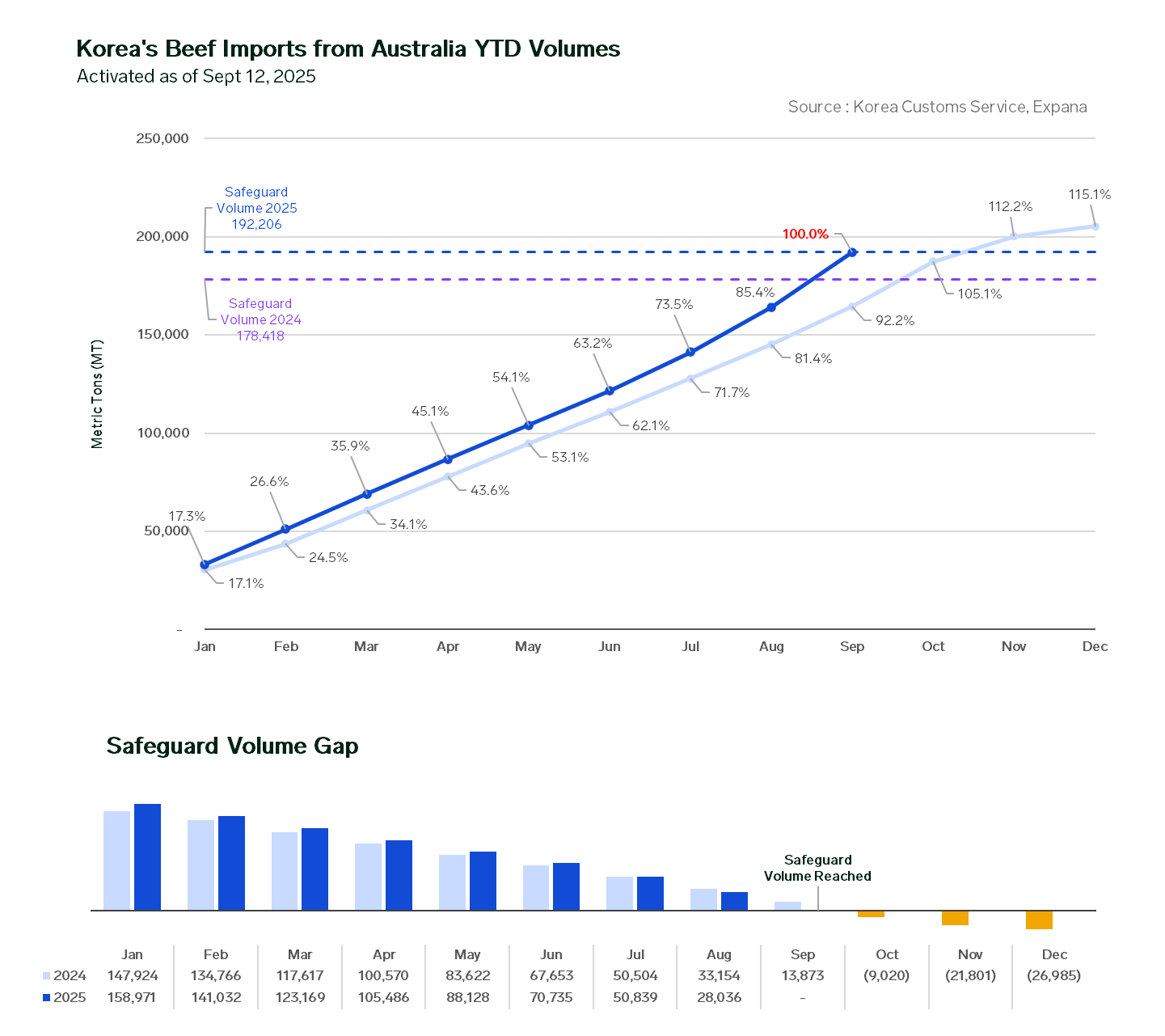

With a market share of 48.0%, Australian imports in July 2025 surpassed the US for the first time since January, reaching 22,803 mt. Volumes rose for a fourth consecutive month, up 14.6% MOM or 2,906 mt, as buyers frontloaded product ahead of Korea’s safeguard activation.

As of September 12, Australia had reached 100% of its annual Special Agricultural Safeguards (SSG) quota. Imports from Australia will now face the Most Favored Nations (MFN) duty of 24%, commonly known as the safeguard duty, through the end of the year.

Demand for Australian beef has been driven primarily by the need to fill gaps left by reduced US supply, with television and celebrity endorsements bolstering consumer interest.

The United States

With its market share at 45.6%, imports from the world’s largest beef producer, the US edged up another 3.1% MoM or 660 mt to 21,669 mt in August 2025.

Volumes climbed to their highest level since January, underpinned by winter demand and redirected cargoes from China to Korea as US suppliers sought alternative outlets amid Sino US tariffs and permit delays. Further upside was constrained by falling US production.

Other notable suppliers to Korea in August 2025 were New Zealand with 1,435 mt and Canada with 1,328 mt.

Co-authored by:

Junie Lin

Expana

[email protected]

Joe Muldowney

Expana

1-732-240-5330 ext. 244

[email protected]

Bill Smith

Expana

1-732-240-5330 ext. 265

[email protected]

Written by Junie Lin