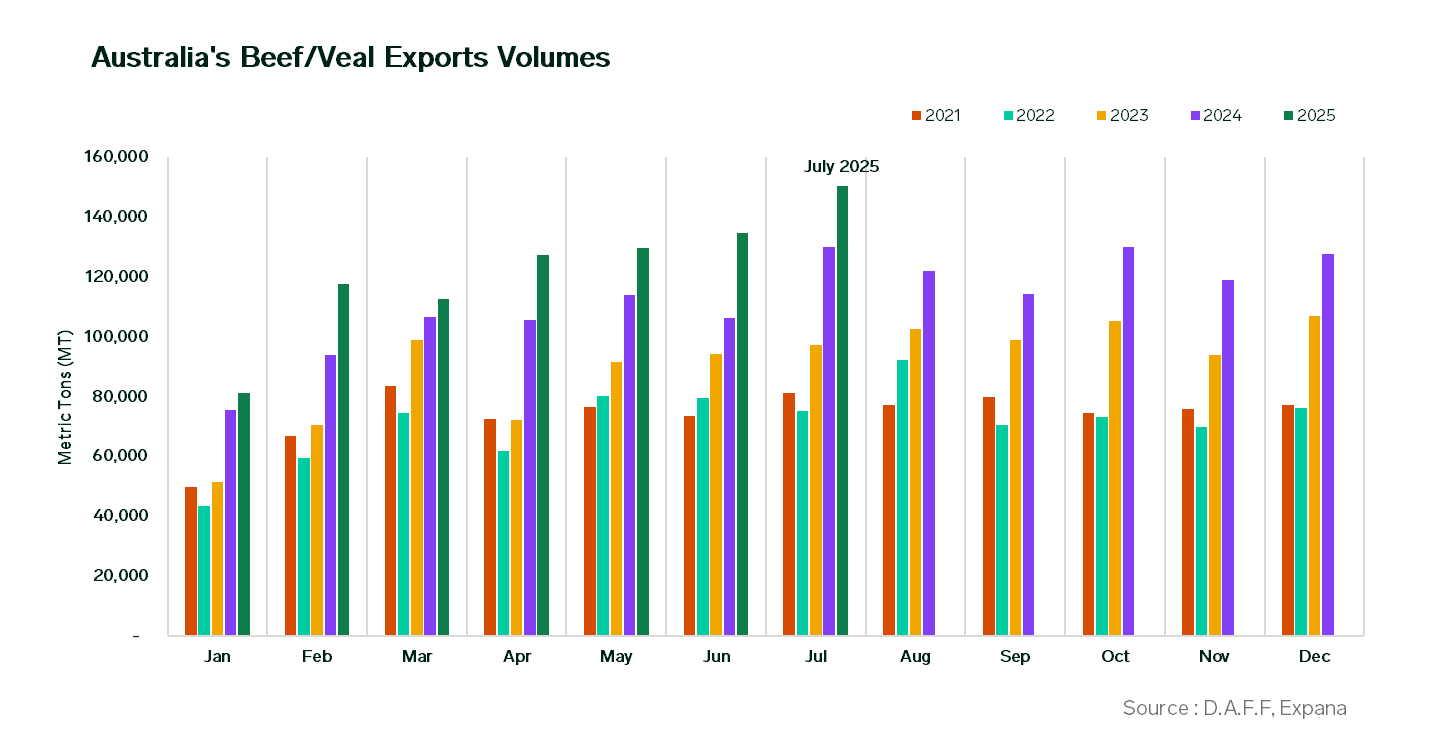

Australia’s beef exports in July 2025 soared to a fresh record high, hitting 150,435 metric tons (mt), according to data from the Department of Agriculture, Fisheries and Forestry (D.A.F.F.). The volume topped the previous peak set in June 2025 by 15,838 mt and marked a fourth straight month of growth.

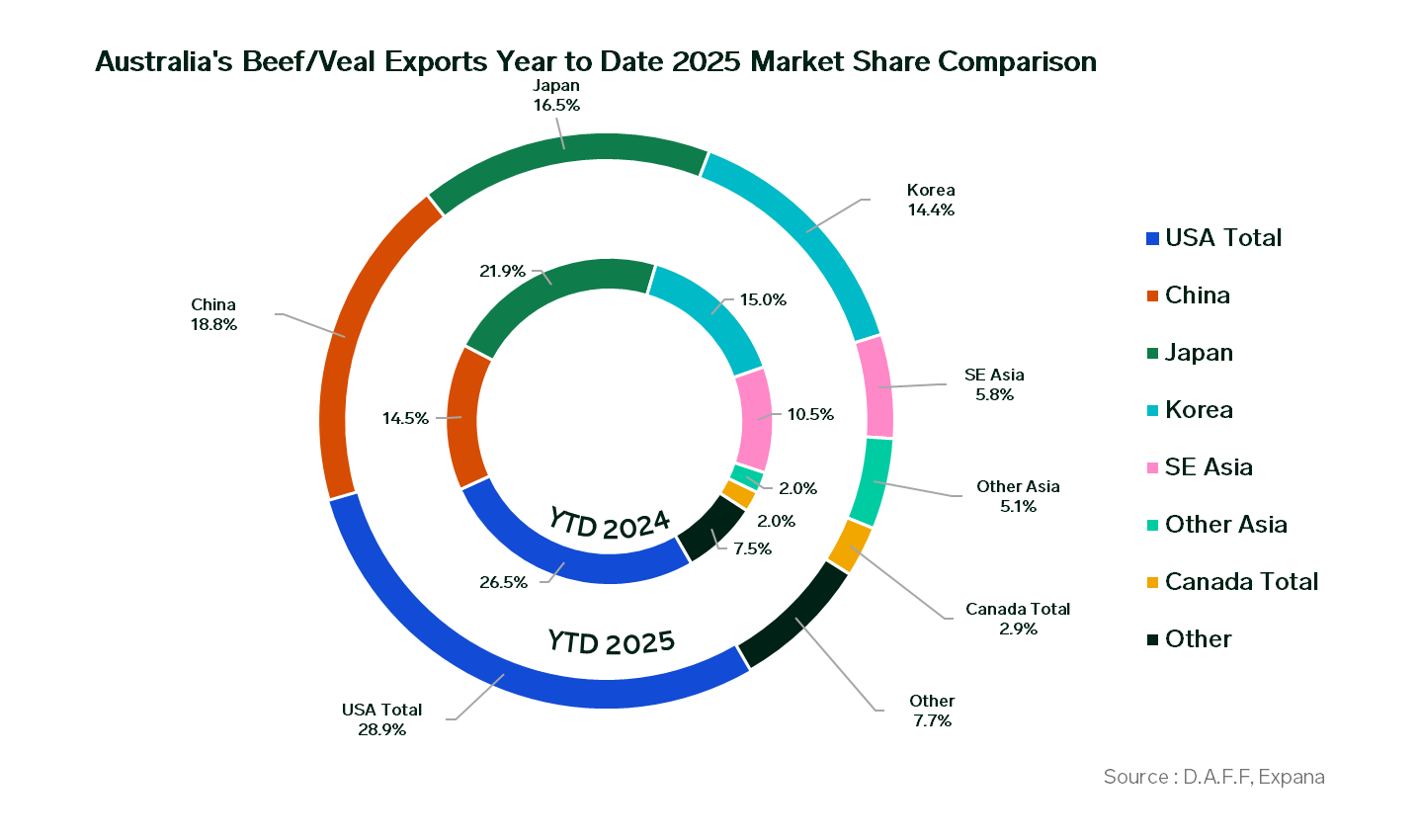

Increases in exports (customer access only) to major destinations such as the United States (US), China, Canada, Japan, and Korea supported the overall growth, potentially setting the stage for Australia’s annual volumes to hit record highs in 2025.

On a yearly basis, beef exports jumped by 15.7% compared to the previous year, rising by 20,437 mt. This increase was primarily driven by heightened demand from China in anticipation of safeguard tariffs and robust US interest in lean manufacturing beef. However, reductions in exports to Southeast Asia and Japan tempered the overall growth.

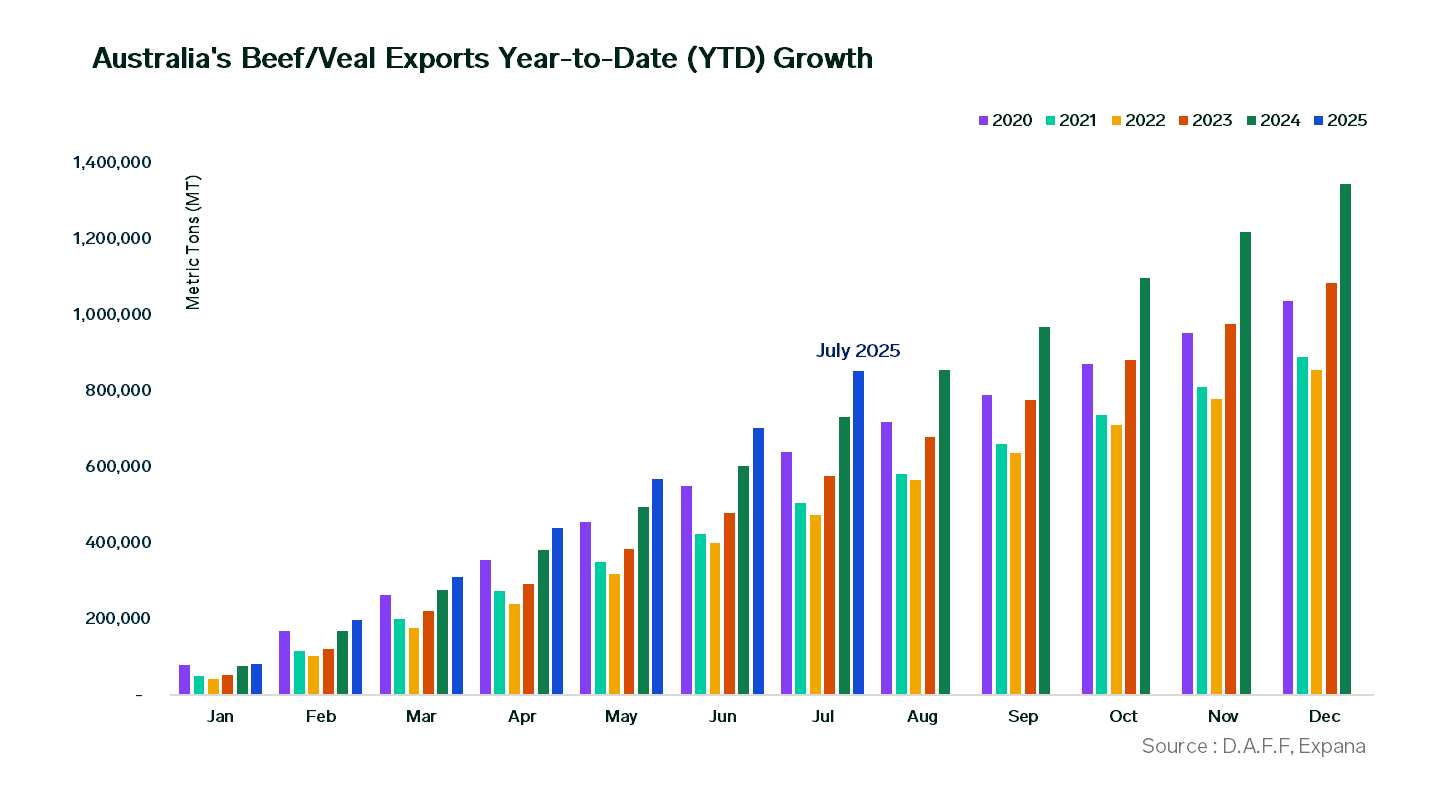

From January to July 2025, Australia’s cumulative beef exports reached 852,653 mt, up 16.6% (121,247 mt) from a year earlier, buoyed by higher slaughter rates, heavier carcass weights and robust international demand.

Volume breakdown by country

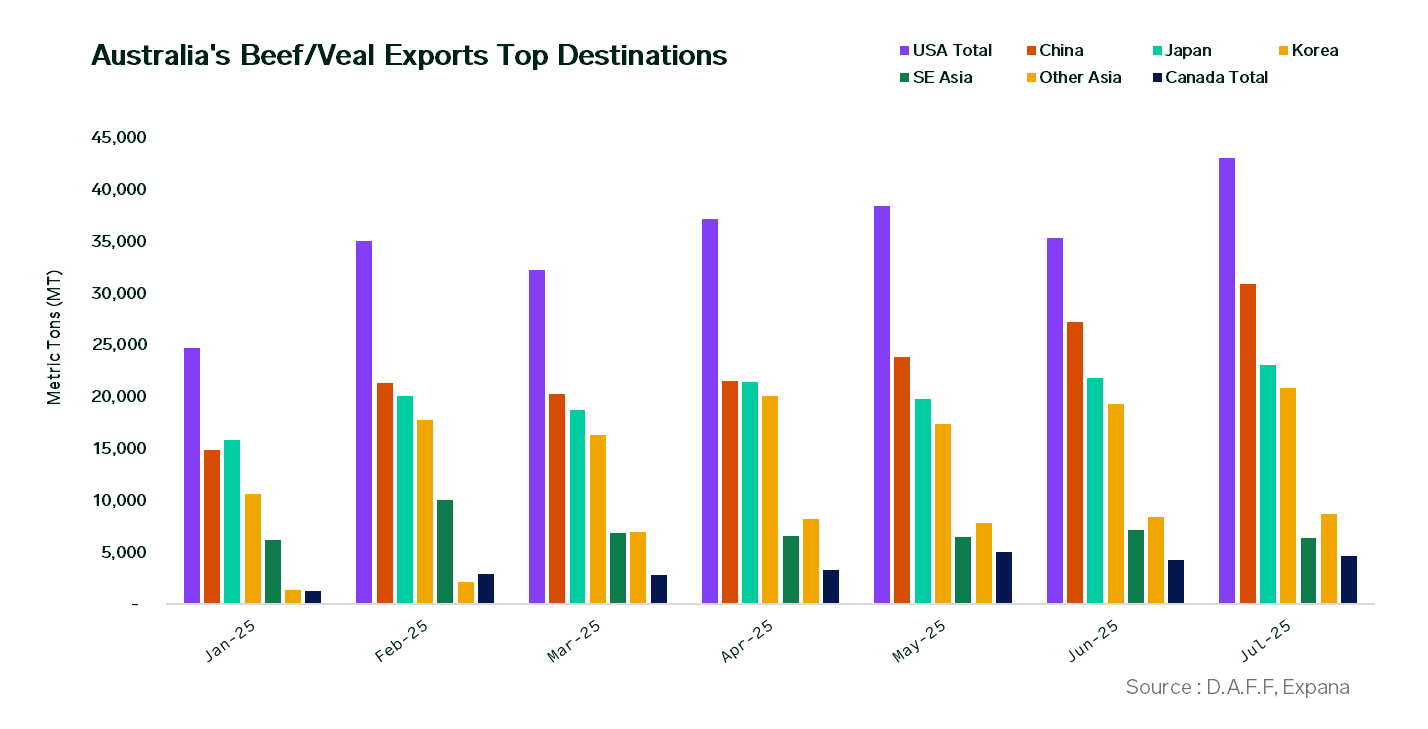

Export volumes to the US, Australia’s largest market, rebounded after a seasonal dip in June, climbing significantly by 21.8% month-on-month (MoM), which equates to an increase of 7,713 mt, reaching a total of 43,056 mt.

Australia’s efforts to front-load shipments before its 12% safeguard tariff (customer access only) drove beef exports to China to record highs. Tonnage grew for the fourth consecutive month, rising by 13.4% MoM (+3,660 mt) to 30,925 mt, while annual shipments rose a staggering 90.3% (+14,676 mt).

By July 24, Australian beef has triggered China’s 2025 Special Agricultural Safeguard (SSG) for the sixth time.

Exports to Japan rose for the second straight month, increasing by 5.4% MoM (+1,179 mt) to 23,056 mt, supported by restocking ahead of the August Obon festival. The firmer yen also contributed to this growth.

Beef exports to Korea increased by 7.9% MoM in July 2025, rising by 1,526 mt to a total of 20,869 mt. This growth was partly due to restocking efforts ahead of the week-long Chuseok holiday from October 5 to 7, as Australian material continued to offset supply shortfalls from the US.

Outbound shipments to Indonesia, an emerging market for Australia, were nearly flat at 6,516 mt, yet this still represents the highest volume since November 2024.

Shipments to Canada increased by 10.1%, reaching 4,674 mt, while exports to the European Union (EU) rose by 12.9% to 3,075 mt. Other destinations also saw monthly growth, with Taiwan receiving 3,763 mt and the Middle East at 3,425 mt.

Co-authored by:

Joe Muldowney

Expana1-732-240-5330 ext. 244,

[email protected]

Bill Smith

Expana

1-732-240-5330 ext. 265

[email protected]

Written by Junie Lin