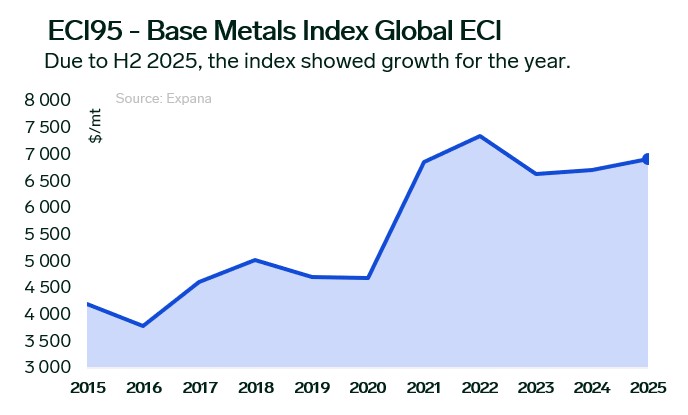

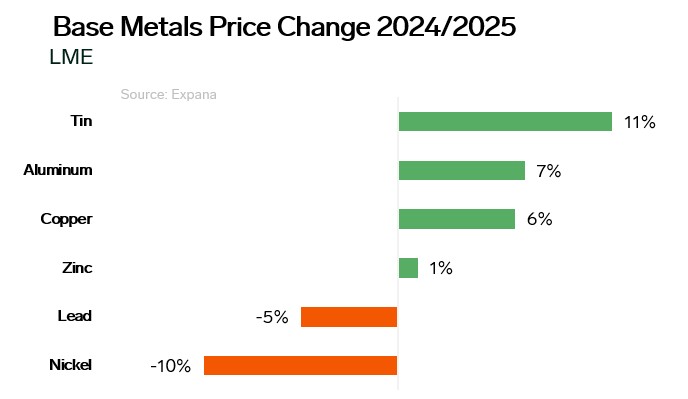

2025 was a year of price rises across base metals. The Base Metals Global Expana Category Index (ECI), based on London Metal Exchange (LME) prices, rose 3% year-on-year on average for the year (except for complete data for December 2025). The main constraining factor for the index was a 10% decline in nickel prices, continuing a trend seen since 2023 amid persistent global market surplus. Lead prices have also trended downward since 2022, and were down 5% in 2025 due to deteriorating consumption prospects, especially in automotive batteries. Zinc prices decreased marginally due to weak demand, primarily in construction. Substantial price growth was shown by metals used in electronics and energy infrastructure development. Main growth drivers were copper and aluminum, which rose 6% and 6.5% respectively in 2025, maintaining an unstable but overall rising price trend since 2017. Tin showed the highest price growth of 11% in 2025, amid strong demand for refined tin and raw material supply shortages.

Throughout the year, the market experienced steady demand growth. Primary consumption strengthened in electronics, renewable energy and electric transport. The segments continued expanding at a rapid pace, with demand once more focused on Asia.

Manufacturing PMI showed fairly weak values on average for the preliminary year results (excluding December), but nevertheless the dynamics were positive. PMI in China fluctuated around the neutral zone for most of the year, averaging only 0.3 points above the neutral line of 50 points for the year. In the US, manufacturing PMI fluctuated in a range around 48-50 points, showing an average of 49 points for the year, a figure which would represent growth from the 48 points it posted in 2024. In Europe, the index remained below 50 points for most of the year, but recovery was noted in the second half of 2025. As a result, the index exceeded 49 points on average for 2025 versus 46 points in 2024.

The macroeconomic environment also contributed to changing the balance. Periods of dollar weakness made metals more attractive for holders of other currencies, strengthening purchasing activity among traders and producers. Tentative steps toward reducing borrowing costs improved sentiment in capital-intensive sectors and supported metallurgical demand. All this formed a foundation for more sustainable consumption at year-end.

Specifics per Market

Copper

In the second half, the copper market was marked by raw material shortages reflected in price growth. China commissioned new refining capacity, but growth in concentrate mining globally was significantly slower. Important news included an accident at a mine in Indonesia in September after which production was halted temporarily. Copper treatment charges and refining charges (TC/RC) remained at multi-year lows, reflecting raw material shortages. Thus, besides high demand, rising production costs for refined copper were a significant price driver.

From a demand perspective, in September-October 2025 in China, statistical data showed declining production of copper products as well as reduced output of some household appliances, which led to deteriorating sentiment regarding demand growth in the market. Nevertheless, at Asia Copper Week at the end of November, the market received a clear signal about a growing copper deficit. Participants noted slowing raw material deliveries to China, which strengthened perceptions of structural concentrate shortage. Discussions confirmed that refining capacity is growing faster than mining and that demand from energy and electronics sectors maintains steady momentum. After the forum, the market saw accelerating purchasing activity and copper prices entered a dynamic growth phase as deficit expectations became the dominant factor.

Aluminum

Aluminum supply remained structurally constrained. China closely approached its government-imposed production limit of 45 million tons of primary aluminum per year. Capacity growth in Indonesia and Southeast Asia will reduce deficit pressure in the future, but new projects are advancing slowly. Against this backdrop, the primary aluminum market maintained a moderate deficit.

Tin

Tin received strong support from solder demand. Electronics production is growing at steady pace, while ore supplies from Myanmar were low. Permission to resume Myanmar’s export operations by Wa State authorities appeared only in July 2025, when local administration began issuing the first licenses for mining and export; moreover, actual supply volumes remained extremely low and did not correspond to normal levels. By year-end, mining in Wa State had still not resumed at full scale, as equipment required replacement, infrastructure was partially disrupted, and permits proceeded slowly. Chinese smelters sought alternative procurement routes, but they did not close the gap. Concentrate deficit became structural, supporting refined tin prices.

Nickel

The nickel market remained in deep surplus. Stainless steel production (the basis of nickel consumption) grew, but the growth rates in nickel supply, primarily from Indonesia, were significantly higher.

Zinc

Zinc experienced supply compression mid-year amid reduced mining at several major mines, leading to temporary inventory declines. However, weak construction activity, primarily in China, limited demand growth at year-end.

Trade Policy Decisions

Trade policy decisions were also felt. US tariffs and adjustments across several commodity categories redistributed flows of metals and semi-finished products, especially for aluminum and copper. US premiums at certain moments in the year rose notably above the average annual range, intensifying price differentiation between regions. This created additional volatility and required supply chain adaptation.

Year-end results show the market moved under the influence of combined factors. Demand growth and production activity in Asia, PMI volatility, soft interest rate signals, dollar weakness, structural constraints in aluminum and copper, nickel surplus, tin deficits and local zinc disruptions formed a heterogeneous picture. The main common driver for all metals remains growing demand, but doubts among market sources about further demand growth in 2026 remain.

Written by Artem Segen