As China signals a harder line on beef imports with a steep 55% tariff on shipments exceeding country-specific quotas, Brazil and Australia stand out as the suppliers most susceptible to disruption.

This latest safeguard measure, announced by the Ministry of Commerce (MOFCOM) on December 31, stands to reconfigure trade flows by curbing import volumes to China, the world’s largest beef market.

In this analysis, we examine the potential market impacts, and what to expect for global beef markets in the months ahead.

China’s Safeguard Tariff Explained

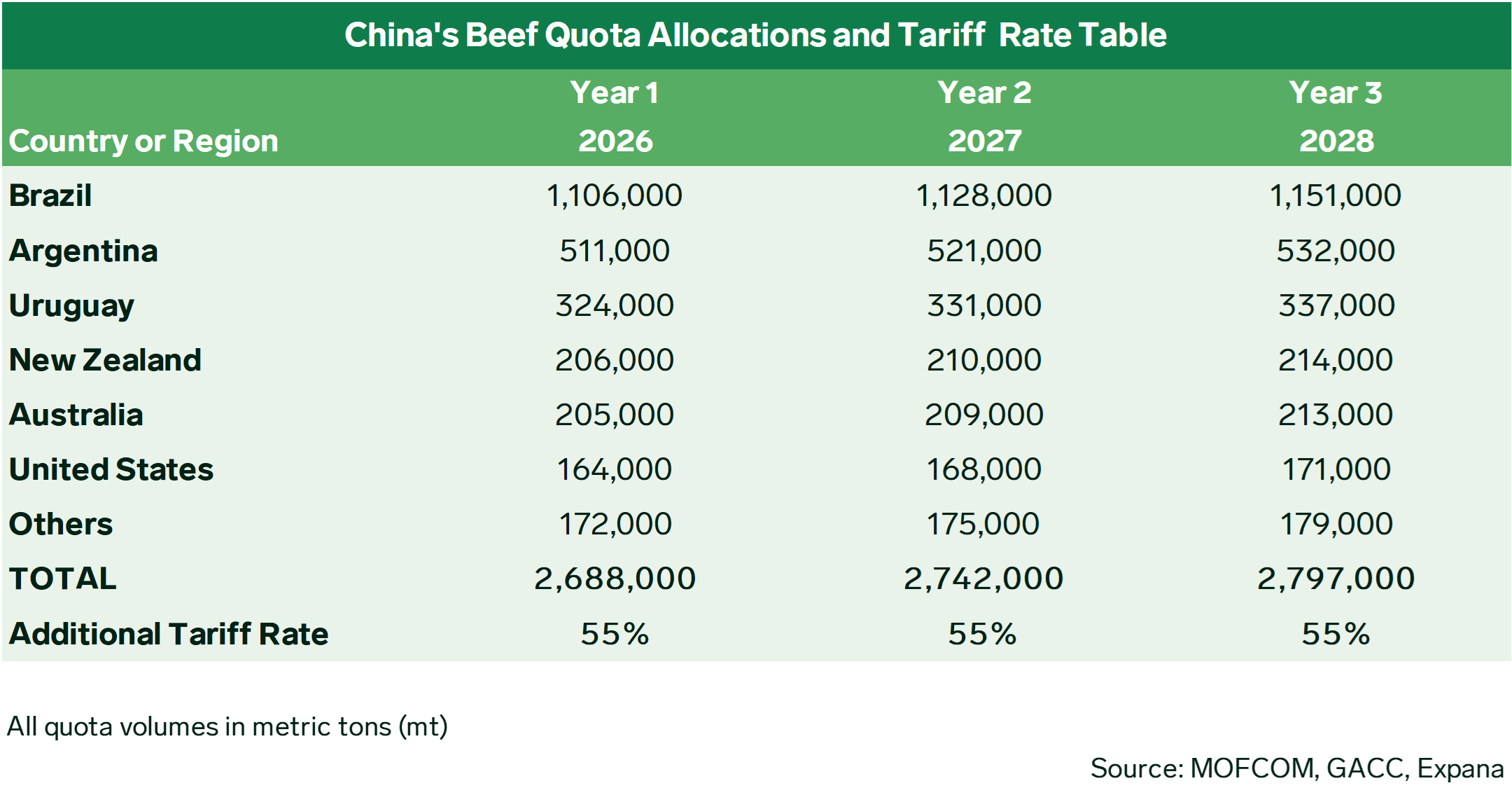

Under the new safeguard framework, Beijing has introduced a 55% tariff on beef imports from the countries listed in the table above for shipments exceeding their allocated quota, effective January 1, 2026, according to the ministry.

The quota will remain in place for three years, covering 2026 through 2028, with volumes and conditions set to be gradually adjusted during this period in accordance with the safeguard regulations.

Early Trade Reactions & Future Trade Shifts

While not a blanket restriction, the policy sharply raises costs on volumes above quota limits, creating a clear disincentive for late arriving cargoes and surplus shipments.

Unlike traditional tariffs, the quota-triggered structure is already starting to distort trade behavior in the first week of the 2026 calendar year.

Anticipating tighter supply, importers are aiming to front load shipments to avoid the penalty, potentially inflating near term volumes before a sharp slowdown once thresholds are reached.

“Market participants (Brazil to China) reported a surge in enquiries and price discussions were seen trending up as much as 10% this week.” South American Red Meat Analyst, Augusto Eto said.

Meanwhile, in Australia, the safeguard announcement came as many of the most affected suppliers were caught up in year-end Christmas and New Year closures.

“Australian packers are slowly responding to the market shifts, but buying interest from China have shown a clear uplift,” said Asia Pacific Red Meat Analyst, Junie Lin.

The Chinese domestic market has also responded in tandem to the safeguard measures, driving imported beef prices up strongly since last week.

Winners and Losers in the Beef Trade

Larger importers with stronger logistics control, cash reserves, and customer relationships are better positioned, while smaller players face greater exposure to tariff risk and may lack the funds to front-load shipments quickly.

Prior to the safeguard announcement, prolonged customs delays under China’s “Enhanced Supervision List” had already pushed up port and service fees, tightening cash flow and slowing logistics ahead of February’s Lunar New Year, which typically marks peak demand for red meat.

Significant volumes shipped last year are pending customs clearance and are expected to count toward the quota once released, meaning a substantial portion of the 2026 quota is already effectively taken up.

Given the high 55% tariff rate, the cost penalty for exceeding quotas is substantial, reinforcing the likelihood that China-bound volumes from all affected origins will be curtailed once quotas fill.

Import volumes are expected to surge early in the year, then taper sharply as quotas are filled, producing a lop-sided trade pattern.

A Chinese importer told Expana the import quota may be filled as early as May or June this year.

(i) Brazil and Australia

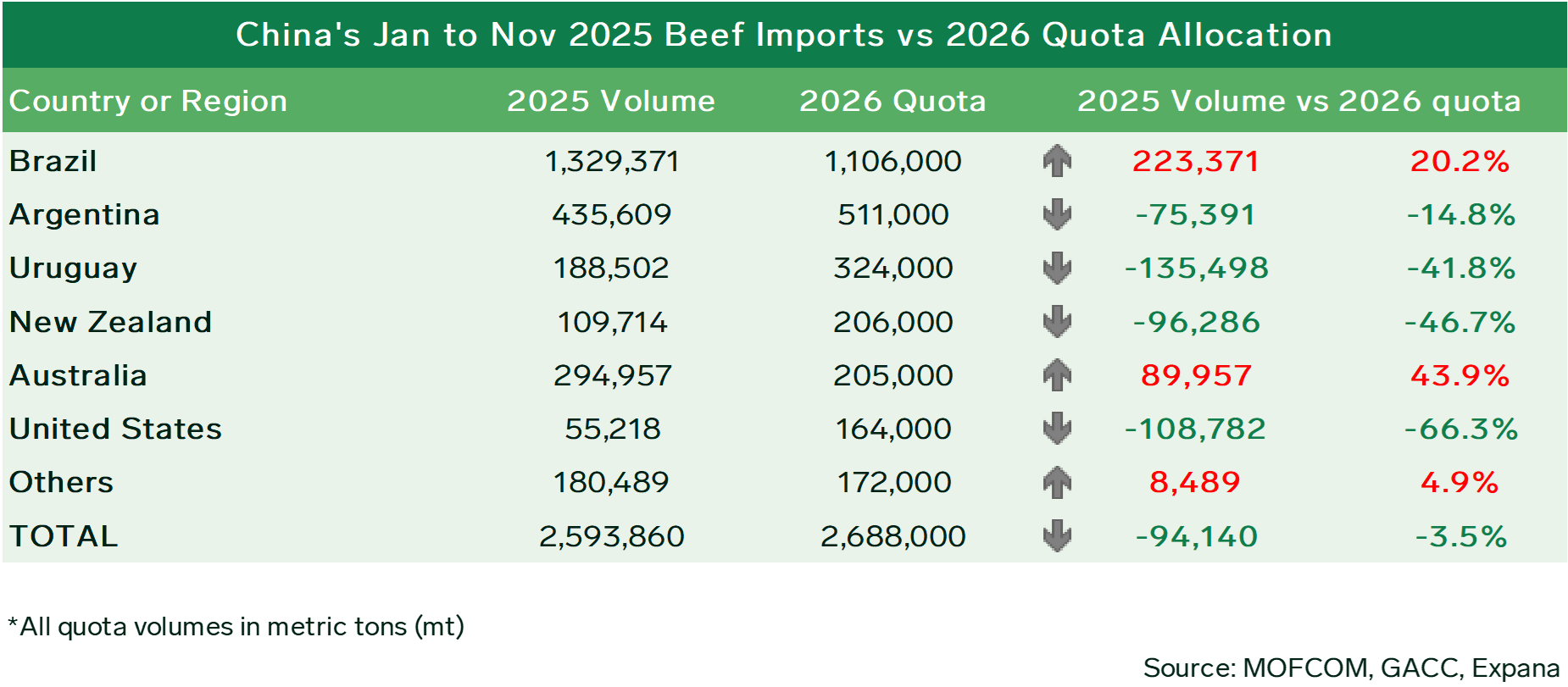

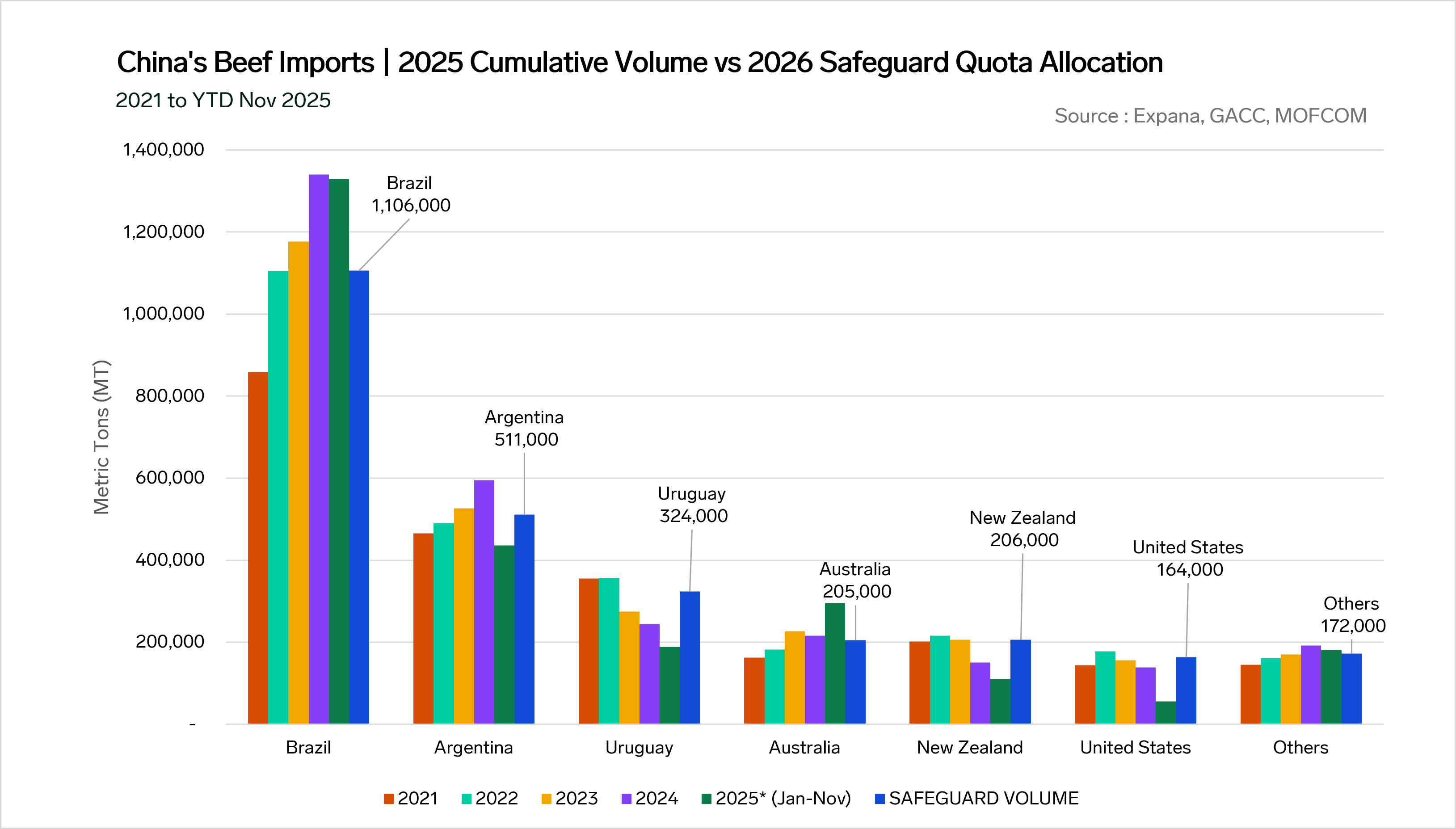

For an extrapolation standpoint, based on China’s cumulative beef imports this year through November, only Brazil and Australia would have already exceeded the quota volumes defined for 2026, with entries totaling 1,329,371 mt and 294,957 mt, respectively. Brazil would have crossed its quota threshold in October, while Australia would have done so earlier, in August.

Brazil, as China’s largest beef supplier by volume, is likely to bear the heaviest impact. Its trade is dominated by frozen beef, which is more price sensitive and less able to absorb a sudden cost increase.

For Australia, the move comes at a sensitive point in the export cycle. Its long-standing free trade agreement (FTA) initially capped the safeguard tariff at 12%, but the measure has now been applied at 55%.

China has become a fast-growing market for its grain-fed beef, helping to offset the absence of American beef, which has been largely held back since trade tensions escalated last April.

Australian beef might hold its footing slightly longer due to quality differentiation through its grain-fed beef and chilled offerings, though price resistance from Chinese buyers is expected to rise sharply as quotas tighten.

(ii) New Zealand

New Zealand is among the least affected by the imposed safeguard tariff, with year-to-date (YTD) shipments at roughly half of its allotted quota.

Once China’s top market for beef, New Zealand has ceded first place to the United State (US), where higher netbacks have made exports more attractive.

The US removal of a 15% reciprocal tariff since late November 2025 has further strengthened New Zealand’s shipments to the US over China.

New Zealand may face a difficult 1st half of 2025 as market attention centers on its key competitor Australia, but the second half could potentially bring stronger sales once other exporters fill their quotas.

(iii) The United States

US beef faces a different challenge.

With its cattle-herd at a 70-year low, constrained production has already limited its competitiveness in China, and unrenewed licenses amid the ongoing Sino-US tensions sidelined American beef throughout 2025, leaving it with just a 2.1% market share.

Conditions are unlikely to improve until political tensions thaw further.

China’s Internal Market Drivers

This safeguard policy also mirrors broader demand trends in China.

China’s falling pork prices, the staple protein for 1.41 billion people, have constrained beef consumption growth.

China’s prolonged property market slump has further eroded household wealth and confidence, restraining demand for beef.

While intended to regulate imports and support domestic producers, the safeguard policy now risks backfiring as market players rush to accelerate shipments ahead of quota limits.

Post-Quota Implications

Beyond China, the ripple effects are likely to be felt across global beef markets.

Once quotas are filled, China might effectively ease off imports and gradually rely on its inventories.

Brazil, the world’s largest beef exporter, is expected to focus on other key markets, deepen trade ties and open market access with regions less affected by China’s safeguard measures, potentially at the expense of Australia’s market foothold.

Displaced volumes are likely to be redirected to the US, Canada, Asia, the Middle East, and parts of the European Union (EU) and United Kingdom (UK), most likely in the latter part of the year.

Initial buying in these regions may be subdued, shifting toward inventory replenishment in the second half, especially in price-sensitive markets like Japan and Korea with weaker currencies.

Market Watchpoints

The coming months will test how effectively exporters can time and diversify shipments as China clamps down on import quotas.

The key variable now is also how quickly quotas are filled and whether Chinese authorities will adjust thresholds as trade evolves throughout the year.

For Brazil, one possible consideration under discussion with Chinese authorities is the opening of additional markets, including access for beef and pork offal.

Down Under, Australian packers are hoping that Canberra could lobby China to ease the new restrictions, especially during scheduled talks between the two economies later this year.

Progress in EU trade talks could also help offset the effects of China’s safeguard measures, after previous federal efforts to secure a new FTA have so far stalled.

Co-authored by:

Junie Lin

Expana

[email protected]

Joe Muldowney

Expana

1-732-240-5330 ext. 244

[email protected]

Bill Smith

Expana

732-575-1977

[email protected]

Image source: Getty

Written by Augusto Eto