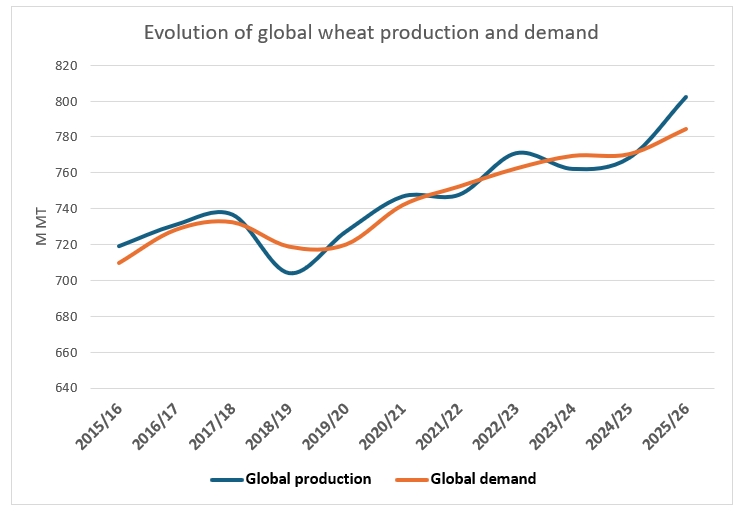

The 2025/26 season for the European Union is marked by a record high harvest, but wheat is set to be abundant globally, and demand is not rising fast enough to absorb these record supplies. With strong harvests in nearly all major exporting regions, buyers have more choice than ever.

A very competitive landscape

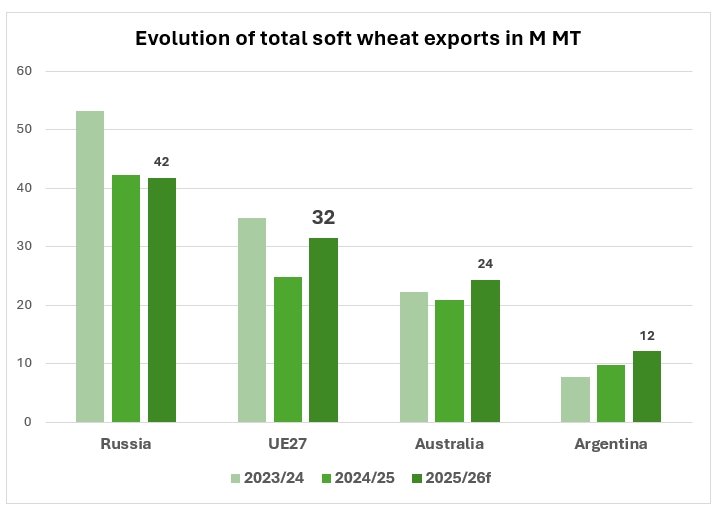

Russia remains a central player in this landscape. After a slow start to its export campaign, Russian shipments have accelerated and the country continues to operate as a major supplier to North Africa, the Middle East and Asia. However, its influence is weaker than in previous seasons because its competitors are also well supplied. The United States is another strong force this year. Despite the recent price volatility, US wheat exports have enjoyed a solid start supported by high quality grains and new trade agreements with key Asian customers, including the Philippines, Indonesia and several Southeast Asian markets. With both Russia and the US active and other exporters well positioned, global competition is broader and more balanced than in recent years, which increases the pressure on all exporters, including the European Union.

In this global environment, Europe must also deal with limited access to some of its traditionally large markets. China remains mostly absent from the international arena because domestic supply is sufficient and consumption is more are less stable. Algeria is an even more direct challenge for France. The country continues to buy large volumes but now prefers origins such as Russia, Ukraine, Romania and Bulgaria, and will likely add Argentina once new harvests reach the market. This shift reduces the opportunities for French wheat and forces exporters to look elsewhere.

EU Exporters: Competitive but Under Pressure

Even with these constraints, EU soft wheat remains well priced and attractive to buyers both overseas and domestically. France, Romania and Bulgaria are all moving wheat overseas at a solid pace. France continues to rely strongly on Morocco and Sub-Saharan Africa but is also finding new outlets such as Bangladesh and Thailand. These sales show that when French wheat is priced correctly, it can reach markets far beyond its traditional destinations.

Romania and Bulgaria are also performing well thanks to their favorable freight rates into the Middle East and North Africa, showing a good resistance to the Russian competition. Together, France, Romania and Bulgaria support most of the EU’s export momentum at this stage of the season. Meanwhile, exporters in Germany, Poland and the Baltic states have struggled to remain competitive. They have faced strong pressure from other sellers, especially in the higher-protein segment where the US has been particularly dominant this season. Recently, however, competitiveness has started to shift, and Lithuania in particular is beginning to regain some ground as US wheat loses price advantage.

Altogether, Expana forecasts EU27 soft wheat exports in 2025/26 to reach 30.1 Mt up by 7 Mt vs 2024/25, with France’s exports rebounding to 7.7 Mt to third countries. Indeed, the EU27’s soft wheat should account for 17% (14% in 2024/25) of global shipments, eroding Russia’s average share by 2%.

Strong internal demand

The EU also benefits from solid domestic demand. Maize availability is tighter this year, which encourages feed compounders in Spain, Italy and the Benelux to increase wheat use in animal rations. Household and industrial milling demand is expected to be slightly stronger than last season as consumption stabilizes. Biofuel producers continue to rely on wheat as a competitive feedstock, which adds another layer of internal support. This internal absorption helps reduce export pressure and provides the EU with some flexibility. Within the EU, French wheat is heavily favored due to its price competitiveness outpacing central and eastern European origins.

Expana forecasts French intra-EU soft wheat trade to be even stronger than in 2024/25 at 7 Mt.

Additional competition from the southern hemisphere

Nevertheless, the biggest test for Europe still looms ahead. Large crops from the Southern Hemisphere are about to enter the market, and they will intensify competition. Australia is expected to be highly competitive in Asia. Argentina, which is heading toward a potentially record harvest, will challenge French, German, and Polish wheat directly in Sub-Saharan Africa and may also disrupt French business in Morocco early next year. Once these origins enter the global market, buyers will have even more choices, and competition will become fiercer for Europe.

The outlook for EU soft wheat trade is therefore a mix of encouraging signs and clear challenges across 2025/26. Europe has shown that it can export wheat effectively even in a crowded market. France, Romania and Bulgaria remain competitive and internal demand is supportive. But the global supply situation is heavy and the arrival of Southern Hemisphere wheat will limit Europe’s room for manoeuvre.

The EU should continue to export significant volumes this season, but the balance sheet will likely remain heavy by the end of the campaign. Expana currently forecasts EU27 ending stocks at 16.8 Mt, their highest level since at least 15 years with the stocks-to-use ratio rising by 4%.

Image source: Shutterstock

Written by Amadou Sarr